Please get pleasure from this up to date model of my weekly commentary.

The reality is that its very troublesome to gauge backside from worth motion alone. You solely have to have a look at the bottoming course of from previous bear markets to indicate how troublesome it’s to name it over. And why traders are so often pulled into “sucker’s rallies” earlier than true backside is discovered.

This brings us again round to an exploration of the long run outlook for the financial system and what meaning for share worth valuations.

As a result of falling financial system > falling earnings > falling PE ranges > MUCH LOWR inventory costs.

At this second we very a lot appear like we’ve simply entered a recession. Technically talking that occurs when you will have 2 consecutive quarters of damaging GDP.

Properly Q1 was a surprisingly dangerous -1.6% that many traders sloughed off as a result of early Q2 projections regarded fairly wholesome.

However far too most of the subsequent financial studies have been properly underneath expectations and now the GDP Now estimate from the Atlanta Fed has fallen to -1.2% for the present quarter. So barring some miracle we’re already smack dab in the midst of a recession.

That’s the image of right here and now. The hot button is what occurs transferring ahead. That’s the reason we subsequent have to consider the Fed’s uphill battle combating inflation.

Plain and easy the Fed received it unsuitable on inflation. For a very long time they talked about it being transitory and did nothing. Now they’re coming to the rescue WAY TOO LATE and thus elevating charges on the quickest tempo in fashionable historical past.

The total consciousness of this error is what received traders fearful that the Fed would gladly commerce in a recession for taming inflation. Thus, the correction that began in January, and was confirmed as a bear in mid June, was truly an excellent studying of the ominous tea leaves.

All indicators have been pointing to a worsening recession and harsher strikes by the Fed till we received a welcome signal of aid on the inflation entrance.

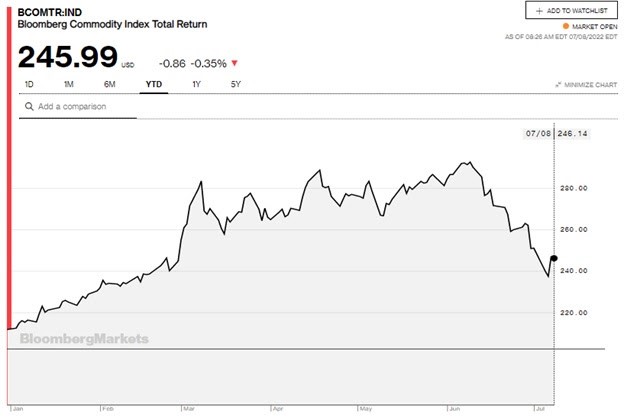

I’m speaking concerning the very well timed decline in commodity costs which is kind of evident on this yr up to now commodity worth chart under.

This easing of inflationary pressures (together with decrease costs on the fuel pump) is the #1 cause why it’s been 3 weeks since exploring the bear market lows. In truth, as we speak represents the second straight time the S&P 500 (SPY) has closed again above bear market territory (3,855), having some pondering if this bear market is certainly over.

The equation to clarify that finish of bear market logic goes as follows:

Easing of inflation > Much less Aggressive Fed > Much less Injury to Economic system > Smooth Touchdown > Shallow Bear Market > Bull Market returns second half of the yr.

Sounds good proper?

That is believable and little question everybody’s most popular end result as all of us get pleasure from bull markets over bears. Sadly, the chances of a worsening of financial circumstances makes extra sense with decrease lows on the way in which.

Contemplate this. Similar to an financial growth and bull market is a long run course of that takes time to unfold. The identical is true for a recession and bear market.

We’re solely 6 months into that course of which averages 13 months to grind its technique to backside. At this stage there may be already too many issues in movement that may trigger further damaging results. Particularly job losses.

Reity, you should be kidding. The Government Employment Report got here out as we speak and it confirmed many extra jobs added than anticipated. You should be smoking one thing humorous to see an issue right here.

As shared with you guys many occasions earlier than, employment is a lagging indicator. Sort of like a smoke alarm that goes off AFTER the home has already burned down.

Nonetheless, there are cracks displaying up within the employment basis in the event you have a look at different key studies. For instance, weekly Jobless Claims have been rolling greater practically each single week for 3 months. Any subsequent report nearer to 300,000 claims per week will likely be an actual get up name to different traders.

Subsequent is the month-to-month Challenger Job Cuts studies which exhibits motion within the # of introduced company layoffs. The June report introduced Thursday was 58.8% greater than Might with a be aware that claims:

“Employers are starting to answer monetary pressures and slowing demand by chopping prices. Whereas the labor market remains to be tight, that tightness might start to ease within the subsequent few months”

That means the wheels are in movement for employment to be the following domino to fall. And that equation goes like this:

Job loss > decrease revenue > decrease spending > deepening of recession > decrease company earnings > decrease share costs

To be clear, I’m open to the likelihood that the moderating inflation image may win the day which might result in a white flag for this bear market.

Nonetheless, given my background in economics, and 40+ years of watching its interrelationship with the inventory market (SPY), the a lot smarter cash rides on the recession grinding decrease…and the bear market mauling its approach decrease as properly.

What To Do Subsequent?

Proper now there are 6 positions in my hand picked portfolio that won’t solely shield you from a forthcoming bear market, but additionally result in ample positive factors as shares head decrease.

This technique completely suits the mission of my Reitmeister Complete Return service. That being to supply optimistic returns…even within the face of a roaring bear market.

Sure, it’s straightforward to earn a living when the bull market is in full swing. Anybody can do this.

Sadly most traders have no idea the way to generate positive factors because the market heads decrease.

So let me present you the way in which with 6 trades completely fitted to as we speak’s bear market circumstances.

After which down the street we are going to take our earnings on these positions and begin backside fishing for the very best shares to rally because the bull market makes it rightful return.

Come uncover what my 40 years of investing expertise can do you for you.

Plus get speedy entry to my full portfolio of 6 well timed trades which are primed to excel on this troublesome market surroundings.

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com

Editor, Reitmeister Total Return & POWR Value

SPY shares closed at $388.67 on Friday, down $-0.32 (-0.08%). Yr-to-date, SPY has declined -17.56%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Total Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks. More…

Extra Sources for the Shares on this Article

Most Standard Tales on StockNews.com

Stock Market Bottom? Think Again…

Figuring out bear market backside is way simpler in hindsight than doing it in actual time. That is as a result of the inventory market (SPY) affords up many spectacular bounces that give the phantasm of the worst being over…simply earlier than you drop to even decrease lows. So worth motion is a difficult technique to decide backside. Which brings us again to the elemental attributes like what is occurring with the inflation and the financial system to find out our path ahead. That will likely be on the coronary heart of our dialogue on this week’s commentary.…

Analysts Just Issued Upgrades on These 4 Buy-Rated Stocks

The blistering inflation and rising recession odds have led to low shopper sentiment. And the market volatility is predicted to stay within the close to time period. So, we expect basically stable shares Lamar Promoting (LAMR), EPR Properties (EPR), Merck & Co. (MRK), and Tenaris (TS), which analysts not too long ago upgraded, could possibly be splendid buys now. Furthermore, these shares are rated Purchase in our proprietary score system. Learn on…

Investor Alert: Prepare to Hit New Lows in July

For as brutal because the market has been up to now in 2022…it’s doubtless about to get a lot worse. Why? As a result of Q2 earnings season is about to roll out and early indications level to a worsening of outcomes that may doubtless heighten the inventory market (SPY) unload. This isn’t an issue for many who are correctly buying and selling this bear market. In case you are not sure what to do, then learn on for this very important commentary offering a well timed market outlook and bear market buying and selling plan.

Amgen is Our Growth Stock of the Week…

Biotech shares are outperforming because of engaging valuations and powerful catalysts. Amgen (AMGN) is without doubt one of the prime shares within the area because of its sturdy product portfolio, pipeline, and spectacular administration group. Learn on to seek out out why it is our inventory of the week…

Investor Alert: Prepare to Hit New Lows in July

For as brutal because the market has been up to now in 2022…it’s doubtless about to get a lot worse. Why? As a result of Q2 earnings season is about to roll out and early indications level to a worsening of outcomes that may doubtless heighten the inventory market (SPY) unload. This isn’t an issue for many who are correctly buying and selling this bear market. In case you are not sure what to do, then learn on for this very important commentary offering a well timed market outlook and bear market buying and selling plan.

Read More Stories

Extra SPDR S&P 500 ETF Belief (SPY) Information View All

| Occasion/Date | Image | Information Element | Begin Worth | Finish Worth | Change | POWR Ranking | |||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait… | |||||||||

from Stock Trading – My Blog https://ift.tt/KlLPNnA

via IFTTT

No comments:

Post a Comment