Tasos Katopodis/Getty Images News

The stock market has been in turmoil for the better part of the last year as several macroeconomic challenges generated a unique negative sentiment that continues to drain liquidity out of the markets, resulting in the end of more than a decade-long bull market.

However, our analysis has shown that one particular group of people doesn’t seem to be suffering from the same problem as the rest of the investor community. It seems that members of the U.S. Congress tend to almost always find themselves in a position that allows for them to extract that couple of percentages of market alpha that manages to keep them ahead of the curve.

In today’s article, we will explain how we have leveraged the unique datasets we have collected on Congressional insider trading in order to design multiple unique trading strategies such as the “Congress Buy” and “Congress Long-Short” strategies, with both of them being successful in recreating the trading performance of our country’s policymakers.

What did Congress buy in the second quarter?

The question at the heart of the stock trading issue is whether or not members of Congress have an unfair advantage in the stock market because they are entitled to information, sometimes even on a daily basis, that is generally not available to the average investor. Some examples of this kind of information include classified briefings about national security issues, early knowledge of specific regulatory actions, as well as non-publicly available details about the legislation, appropriations, and changes in tax policies. In theory, any of this information has the capability to create a conflict of interest for a policymaker who traded shares of a company that could be affected by such information.

The question of Congressional insider trading has been one of the rare topics in US politics that has generated almost universal and bipartisan support for restricting the right of Congress members to participate in stock market trading, either directly or through spouses and other relatives.

In the meantime, we have worked hard to create transparency around the active trading being done by member of Congress, in an attempt to tip the scales in our favor. By tracking this data, and providing several interesting back-tested trading strategies, we hope to make it easier for investors to find insights from Congressional trading.

With that in mind, these are the most popular and often purchases stocks by members of both houses of the US Congress in the last quarter ending with June:

Warner Bros. Discovery (WBD)

-

QQ’s Congress Ranking: #1

-

Total Q2 Congress Purchases: 9

-

Total Q2 Individual Purchases: 16

Warner Bros Discovery YTD Performance (Seeking Alpha)

Bill Hwang, the flamboyant high-stakes investor failed to meet margin collateral obligations early last year, which ultimately led to the implosion of his family office, “Archegos Capital Management.” The family office held overleveraged positions in several media companies, including the then so-called Discovery Communications. The implosion of the family office set the entertainment company on a clear downwards spiral that it has still failed to recover from.

Even the finalization of the historic deal between the company and the telecommunications giant AT&T (T), which closed in early April of this year and lead to the creation of one of the largest pure-play entertainment entities in existence, still largely failed to put an end to the bleeding. Warner Bros Discovery generated a negative year-to-date return of 42.16%, with shares of the media and streaming giant currently trading for $14.65.

Still, David Zaclav’s brainchild managed to garner significant traction among the members of Congress, with multiple public representatives either opting in to keep the shares received from the merger or outright buying into David Zaclav’s brainchild. This includes Rep. Nancy Pelosi, Sen. Jaclyn Rosen, Rep. Michael Patrick Guest, Sen. Gary Peters, Rep. David Kustoff, Sen. Sheldon Whitehouse, as well as others.

Amazon (AMZN)

- QQ’s Congress Ranking: #2

- Total Q2 Congress Purchases: 5

- Total Q2 Individual Purchases: 21

Amazon YTD Performance (Seeking Alpha)

On the face of things, Amazon has been one of the biggest losers of the current recession-headed mindset, which rules the markets with the e-commerce giant following other popular growth stocks into achieving abysmal stock performances this year. However, underneath the hood, fundamentals remain immensely strong. The FAANG stock garnered significant attention from Congress members, with five different politicians deciding to buy the dip as it was disclosed in the 21 individual purchases during the quarter. Amazon captured the attention of Rep. Robert J. Wittman, Rep. Michael C. Burgess, Rep. Alan S. Lowenthal, Rep. Ro Khanna, and Rep. Kathy Manning.

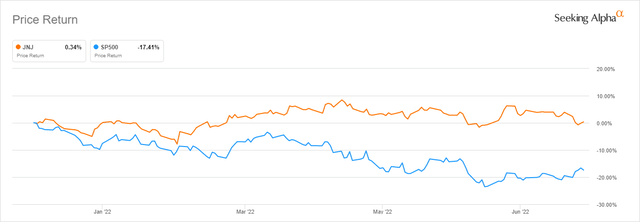

Johnson & Johnson (JNJ)

-

QQ’s Congress Ranking: #3

-

Total Q2 Congress Purchases: 5

-

Total Q2 Individual Purchases: 11

Johnson & Johnson YTD Performance (Seeking Alpha)

Johnson & Johnson has been one of the clear winners of the ongoing bear-headed market with the company fully living up to its title as one of the best defensive picks in the stock market. Five members of Congress took up a defensive-minded mentality in 11 individual trades. The company has displayed rock-solid resilience to ongoing negative macroeconomic trends and as such was successful in outperforming the market by 17.71% year-to-date, largely trading sideways since the beginning of the year. The company has been purchased by: Rep. John Curtis, Rep. Diana Harshbarger, Rep. Ro Khanna. and Rep. Lloyd Doggett.

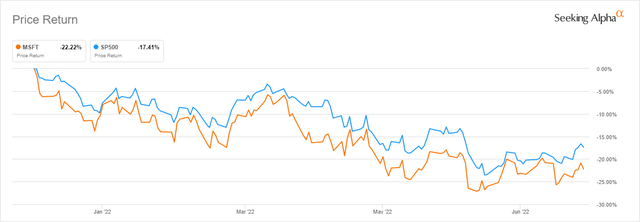

Microsoft (MSFT)

-

QQ’s Congress Ranking: 4

-

Total Q2 Congress Purchases: 4

-

Total Q2 Individual Purchases: 24

Microsoft YTD Performance (Seeking Alpha)

One of the more interesting Congressional insider purchases this quarter has been Microsoft, with the maker of Windows OS garnering interest from 4 different Congress members in 24 disclosed trades. Long gone are the days of the Steve Ballmer era, as the technology giant seems to be living a period of second youth under the reign of CEO Satya Nadella. Microsoft achieved tremendous success with Nadella at the helm, with many claiming it remains far more deserving of being considered and listed as a FAANG stock than other less impressive performers such as Netflix (NFLX).

Even though the company has been operating in the gaming industry for decades already, it has only recently doubled down on its plans to establish a more substantial presence in the expanding market with one of the most unexpected acquisitions in history. Microsoft took the tech and gaming world by surprise on January 18th when it announced its plans to acquire Activision Blizzard (ATVI) in a record-breaking $68.7 billion deal. The deal itself has been a topic of continuous debate, as many doubt it will be successful in receiving regulatory approval.

Shares of Activision are currently trading at $79, far below the planned acquisition price of $95 per share that Microsoft is willing to pay, a clear testament that many believe the deal is likely to still fall apart. However, a renewed interest by congressional insiders and most notably, a recent purchase by Nancy Pelosi herself might be telling us that the same sentiment isn’t necessarily shared on the Congress floor. Other purchases include Rep. Kevin Hern, Rep. Rohit Khanna, and Rep. Pete Sessions.

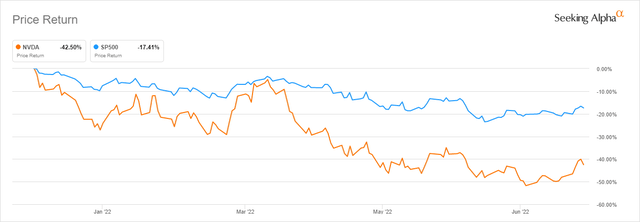

Nvidia Corporation (NVDA)

-

QQ’s Congress Ranking #5

-

Total Q2 Congress Purchases: 4

-

Total Q2 Individual Purchases: 8

Nvidia YTD Performance (Seeking Alpha)

Representing quite possibly one of the most debated congressional insider stock purchases in history, the US technology company has been the latest portfolio addition for four different members of the US Congress in the second quarter. Most of these purchases occurred in the weeks and months before Senate was scheduled to vote on the CHIPS act or the legislation brought forward with the aim of supporting semiconductor industry by providing billions of dollars in subsidies and tax credits. Much of the $52 billion bill is planned to go to chip manufacturers in order to incentivize the establishment of domestic manufacturing, in an overall effort to limit the US dependence on Asian imports.

Most notably, the company has been one of the latest additions by Nancy Pelosi, who has been one of the best-known and most controversial figures among active investors on the Congress floor. The Speaker of the House does most of her trading through her husband, Paul Pelosi, who owns and operates a San Francisco-based investment company called Financial Leasing Services. He ended up exercising 200 call options at a strike price of $100. Other purchases include Rep. Josh Gottheimer, Sen. Thomas Tuberville, and Rep. Rohit Khanna.

Other more notable purchases ranked by interest from congressional insiders that failed to make the top-five list include NextEra Energy (NEE), JP Morgan (JPM), Intel (INTC), Home Depot (HD), Goldman Sachs (GS), Apple (AAPL), Exxon Mobil (XOM), Procter & Gamble (PG), Magellan Midstream Partners (MMP), and others.

Who bought the most?

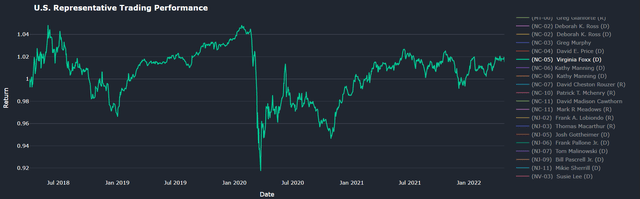

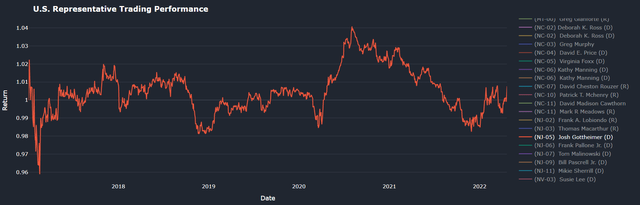

The U.S. public has not always had a chance to track the trading performance of their public representatives. Only recent reinvigorated strive for more transparency has resulted in semi-successful solutions such as the “Stock Trading on Congressional Knowledge Act,” or STOCK Act, which requires U.S. Representatives to publicly file and disclose financial transactions within 45 days of their occurrence. We download those disclosures, parse them for stock trades, fetch the stock’s performance in the time following the transaction, and calculate each Representative’s cumulative return from their trades. Here is our list of most active stock traders on the Congress floor:

1) Representative Virginia Foxx

Virginia Foxx is a 79-year-old businesswoman, educator, and politician serving as the U.S. representative for North Carolina’s 5th congressional district. She was the most active member of the U.S. Congress in the second quarter, disclosing a grand total of forty-four stock purchases for the period. Virginia is also a member of the Republican Party and currently sits on the House Committees on Education & Labor and Oversight and Reform.

In our estimates, Representative Foxx was among the top-tier spenders this quarter, disclosing roughly more than $1.04 million of purchased shares in twenty different companies, such as Green Plains Partners (GPP), British American Tobacco (BTI), Rio Tinto (RIO), Sisecam Resources (SIRE), USD Partners (USDP), Simon Property Group (SPG), and others.

Virginia Foxx (Quiver Quantitative House Trading)

2) Representative Josh Gottheimer

Josh Gottheimer is a relatively young 47-year-old attorney, writer, and politician serving as the U.S. representative for New Jersey’s 5th congressional district. He was the second most active member of the U.S. Congress in the second quarter, disclosing a total of thirty-eight stock purchases for the period. Josh is also a member of the Democratic Party and currently sits on the House Committees on Homeland Security and Financial Services. The rather ironic part of all of this is that Rep. Gottheimer has been one of the most vocal advocates of limiting lawmakers’ ability to trade stocks.

In our estimates, Representative Gottheimer had an unusually slow quarter behind him and has spent only $345 thousand purchasing shares in twenty-nine companies, such as Nvidia (NVDA), Tesla (TSLA), Eli Lilly and Co (LLY), Amgen (AMGN), ConocoPhillips (COP), Cerence Inc (CRNC), IBM (IBM), Marriott International (MAR), Starbucks (SBUX), and others.

Josh Gottheimer (Quiver Quantitative House Trading)

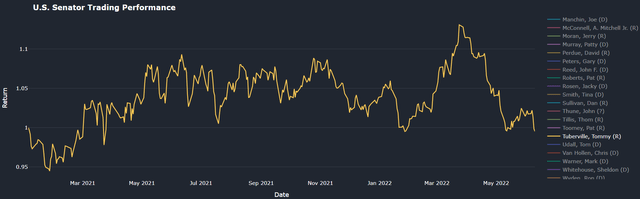

3) Sen. Tommy Tuberville

Tommy Tuberville is a 67-year-old retired college football coach and politician serving in the U.S. Senate as the representative of Alabama. He was the third most active member of the U.S. Congress in the second quarter, disclosing a total of thirty-five stock purchases for the period. Tommy is also a member of the Republican Party and currently sits on four different senate committees, most notably including the U.S. Senate Committee on Armed Services.

In our estimates, Senator Tuberville spent just shy of $2 million purchasing shares in thirty companies, such as United States Steel Corp. (X), Marsh & McLennan Companies (MMC), PayPal Holdings (PYPL), Citizens Financial (CFG), Alphabet (GOOG, GOOGL), Masimo Corporation (MASI), D.R. Horton (DHI), AbbVie (ABBV), AMETEK (AME), Merck & Co (MRK), and others.

Tommy Tuberville (Quiver Quantitative Senate Trading)

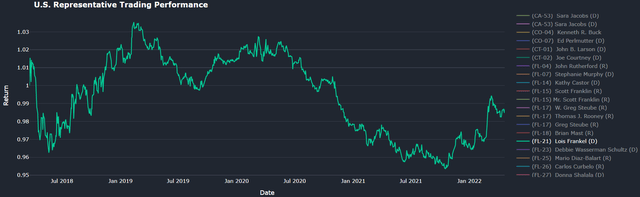

4) Rep. Lois Frankel

Lois Jane Frankel is a 74-year-old lawyer and politician serving in the U.S. House of Representatives for Florida’s 21st congressional district. She was the fourth most active member of U.S. Congress in the second quarter, disclosing a total of sixteen stock purchases for the period. Lois is also a member of the Democratic Party and currently sits on the House Committee on Appropriations as well as the House Committee on Veterans Affairs.

In our estimates, Representative Frankel spent slightly more than $117k purchasing shares in the following eleven companies: BlackRock (BLK), Americold Realty Trust (COLD), Avery Dennison (AVY), First Republic Bank (FRC), General Dynamics (GD), GXO Logistics (GXO), Johnson Controls (JCI), NXP Semiconductors (NXPI), Pioneer Natural Resources (PXD), Sherwin-Williams (SHW), and Vontier (VNT).

Lois Frankel (Quiver Quantitative House Trading)

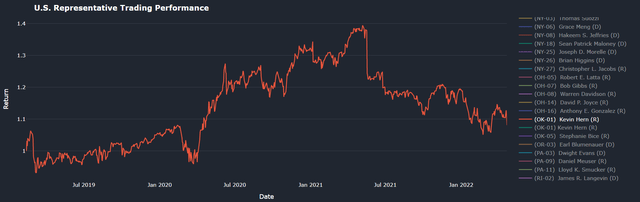

5) Rep. Kevin Hern

Kevin Ray Hern is a 60-year-old businessman and politician serving in the U.S. House of Representatives for Oklahoma’s 1st congressional district. He was the fifth most active member of the U.S. Congress in the second quarter, disclosing thirteen stock purchases this quarter. Kevin is also a member of the Republican Party and currently sits on the House Committee on Ways and Means.

In our estimates, Representative Hern spent slightly more than $960k purchasing shares of the following companies: Williams Companies Inc (WMB), UnitedHealth Group (UNH), Texas Instruments (TXN), Raytheon Technologies (RTX), ONEOK (OKE), Lockheed Martin (LMT), Devon Energy (DVN), Accenture Plc (ACN), ABB (ABB), and others.

Kevin Hern (Quiver Quantitative House Trading)

Our approach and strategies

For the purposes of attempting to benefit from the datasets collected, we have created the “Congress Buys” and “Congress Long-Short” strategies, which approach the same data in two slightly different ways.

The “Congress Buys” Strategy tracks the performance of companies that have been purchased by members of the U.S. Congress. It takes a long position in stocks that have been purchased by them or by members of their families. The current top holding representing almost 52.70% of the portfolio’s NAV is NVIDIA Corporation. The strategy is weighted based on the reported size of the disclosed purchases, with an implemented system of daily rebalancing. This strategy was successful in generating a 28.76% one-year return, with a CAGR rate of 59.84% given it has been created on the 1st of April 2020.

Congress Buys Strategy (Quiver Quantitative Strategies)

The “Congress Long-Short” Strategy tracks the performance of stocks that have been purchased or sold by members of the U.S. Congress. It takes a long position in stocks that have been purchased, and a short position in stocks that have been sold by them or by members of their families. The biggest long position in the portfolio is Nvidia, taking up 68.59% of the portfolio’s NAV. The biggest short position in the portfolio is Visa (V), which represents slightly less than 8.68% of the portfolio’s NAV. The strategy is weighted based on the reported size of the disclosed purchases, with an implemented system of daily rebalancing. This strategy was successful in generating a 27.35% one-year return, with a CAGR rate of 60.87% given it has been created on the 1st of April 2020.

Congress Long-Short Strategy (Quiver Quantitative Strategies)

Final thoughts and conclusions

With an ongoing public outcry for better regulation of the question of congressional insider trading, there seems to be growing pressure on Capitol Hill to curb lawmakers’ own ability to trade stock. As we have seen in the article, the irony is that some of those leading the charge are also the ones that lead in the charts of the most active traders in the U.S. Congress. However, the small win for the average investor came in the form of the “STOCK” act that forced U.S. lawmakers to publicly file and disclose their financial transactions within 45 days of their occurrence. While the system remains immensely flawed and leaves much to be desired, we set out to use it to our advantage.

Until better regulation comes along the way, one thing is for sure, there is value to be had in monitoring the trading activity of our country’s political leadership. This is exactly the sort of thinking process that has led us on a path of creating an investment strategy that is going to allow us to replicate trades made by U.S. Congress insiders. As far as our strategies go, both of them proved successful in generating significant alpha over the past couple of years, ultimately recreating the performance of our country’s policymakers. It remains largely unclear as to how long this opportunity will remain open, but we are committed to exploiting this in order to tip the scales to our advantage. Here at Quiver Quant, we stand firm by the belief that the average investor should remain open to the idea of utilizing alternative data during their due diligence process in order to level the playing field between himself and the institutional investor.

from Trading Strategies – My Blog https://ift.tt/3MxDKoN

via IFTTT

No comments:

Post a Comment