Many investors in the US will now use a top-rated stock app in conjunction with an online brokerage account. In doing so, this allows you to buy and sell stocks no matter where you are, and thus – you’ll never miss a trading opportunity again.

In this guide, we compare the 10 best stock app providers for 2022 in terms of supported markets, fees, user-friendliness, trading tools, customer service, and more.

Best Stock Trading Apps for Beginners in 2022

A list of the best stock app providers in the market right now can be found below.

- eToro – Overall Best Stock App for 2022

- Webull – Popular Stock App Offering $5 Fractional Shares

- Interactive Brokers – Advanced Stock App for Seasoned Investors

- Schwab – Buy 0% Commission Stocks via an iOS and Android App

- Fidelity – Trusted Stock App With $1 Minimum Order

- SoFi – User-Friendly Stock App Offering Commission-Free Markets

- Ally Invest – Great Stock App for Newbie Traders

- E*TRADE – Stock App Supporting Multiple IRAs

- TD Ameritrade – Top-Rated Stock App for Experienced Traders

- Robinhood – Best StockApp for Beginners

When considering where to buy stocks for your financial goals and skillset, consider reading our in-depth reviews – which you will find in the subsequent sections of this guide.

Best Stock Trading Apps Reviewed

To compile our list of the best stocks apps for 2022 – we considered a range of important factors. This includes everything from fees, commissions, and supported stock markets to user-friendliness, device compatibility, and the availability of trading tools.

Check out the 10 reviews below to choose the overall best stock app for you.

1. eToro – Overall Best Stock App for 2022

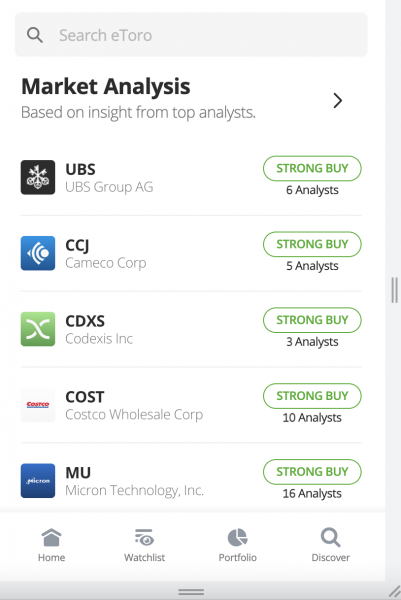

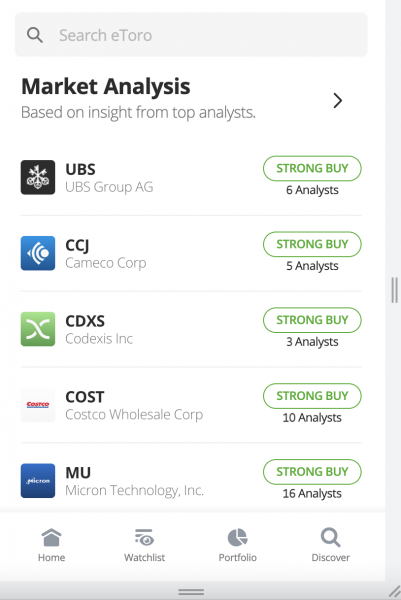

We found that eToro is a clear winner as the overall best stock app for 2022. Available to download free of charge on both iOS and Android devices, the eToro stock app gives you access to thousands of markets. Not only does this include the NYSE and NASDAQ, but more than a dozen stock exchanges based overseas.

This covers stocks listed in the UK, Canada, Germany, Hong Kong, Spain, Saudi Arabia, and more. As such, eToro is a highly suitable stock app for those wishing to buy both US and foreign-listed equities. With such an array of markets to choose from including the best blockchain stocks, best dividend stocks and the best cannabis stocks you’ll also have access to the best oil stocks in 2022 such as Exxon-Mobil and BP. In addition to stocks, the eToro app also supports cryptocurrency, ETFs, forex, commodities, indices, and more.

When it comes to fees, the eToro trading app allows you to buy stocks and ETFs on a commission-free basis. And, not only is this the case for US-listed markets but international assets, too. We also like that you only need to risk $10 when you buy stocks on the eToro app – as the brokerage firm supports fractional shares across all listed markets.

In terms of user-friendliness, the eToro app – just like the main website, is very easy to use. And, when you know which stocks you wish to buy, it’s just a case of using the search bar. You might also want to check out the copy trading feature offered by the eToro app. This allows you to copy a verified eToro investor – of which there are thousands to choose from.

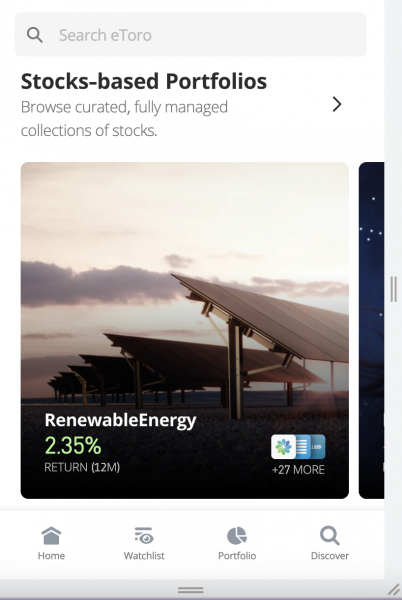

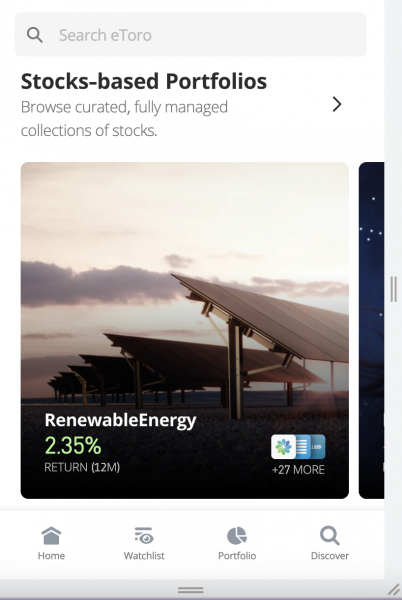

When your chosen investor places a stock trading position, the same order will be replicated in your own eToro portfolio. For passive investors, you might also like eToro smart portfolios. These are pre-bundled investment portfolios that are managed by the eToro team and they track specific markets and industries – such as tech, driverless cars, and energy.

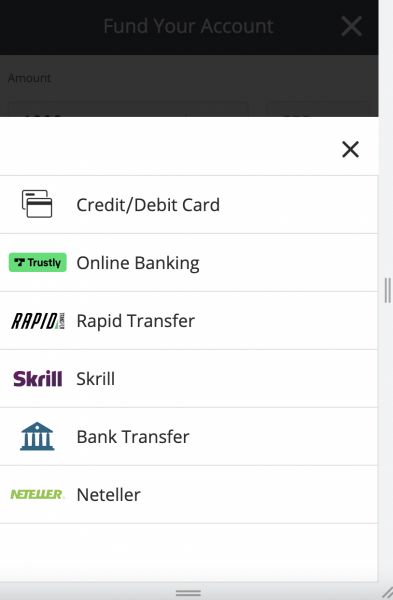

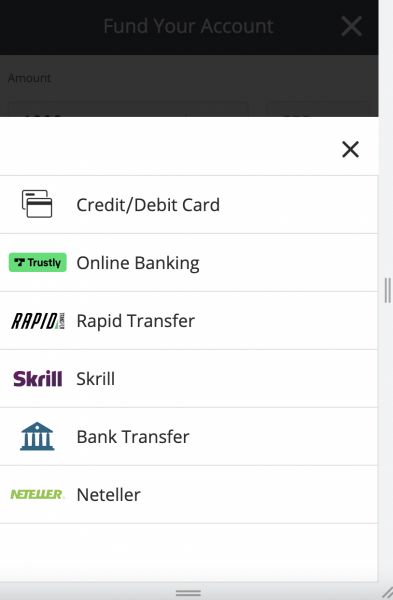

To get started with the eToro app today, you will need to register an account and make a minimum deposit of just $10. Supported payment methods include debit and credit cards, Paypal, Skrill, Neteller, ACH, and bank wires. As a US-based customer, you won’t need to pay any fees. Finally, the eToro app is heavily regulated – so safety and security are assured.

| Minimum Deposit | $10 |

| Fractional Shares? | Yes – $10 minimum |

| Pricing System | 0% commission on all stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- Available around the world including in the US and UK

- Thousands of US and international stocks listed

- 0% commission on all stocks

- Invest in the best penny stocks with low fees

- Minimum deposit and stock trade is just $10

- Copy trading and smart portfolios

- No fees on USD deposits

- Top-rated mobile app

Cons

- Not suitable for high-frequency trading

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

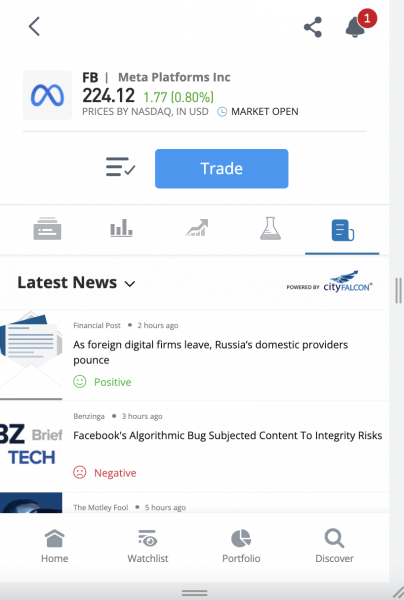

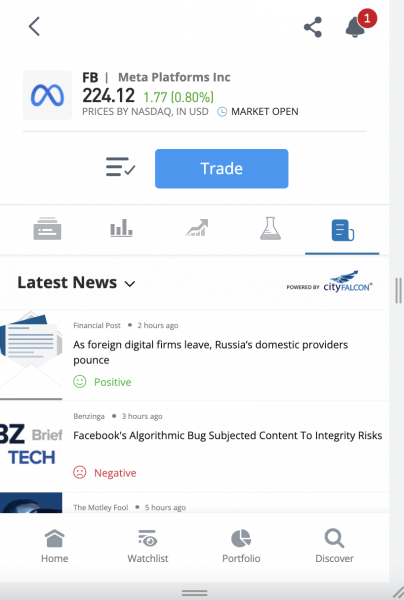

2. Webull – Popular Stock App Offering $5 Fractional Shares

Webull offers a popular stock trading app that is fully optimized for both iOS and Android smartphones. There is no fee to download the Webull app, but you first have to register an account and upload some ID before you can start trading stocks. There is no minimum deposit and you can transfer funds via ACH or domestic bank wire.

Take note, while ACH transfers are free, domestic bank wires are charged at $8 and $25 for deposits and withdrawals, respectively. Once your Webull account is set up, you will then have access to thousands of US-listed stocks. This covers virtually all equities listed on the NYSE and NASDAQ.

Moreover, you will also have access to a small number of ADRs – which gives you exposure to large-cap stocks listed overseas. When it to fees, Webull allows you to buy US-listed stocks on a commission-free basis. ADRs, however, come with additional fees. We also like that the Webull trading app allows you to buy stocks from just $5 per trade via its fractional ownership tool.

On top of stocks, the Webull app also supports ETFs, cryptocurrencies, and options. Although most traders opt for a self-directed trading plan, Webull also offers a variety of retirement accounts in the shape of IRAs. The Webull app also offers a range of charting tools – which will suit short-term day traders looking to speculate on stock options.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $5 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- No minimum deposit

- Minimum stock investment is just $5

Cons

- International stocks offered via ADRs only

- No copy trading tools

- Does not support debit/credit cards or e-wallets

Your capital is at risk.

3. Interactive Brokers – Advanced Stock App for Seasoned Investors

Interactive Brokers is one of the best stocks app providers in the market for seasoned investors. Its proprietary IBKR mobile app is compatible with both iOS and Android devices and it comes packed with advanced trading features.

This includes dozens of technical indicators, institutional-grade research tools, real-time market information, and over 50 data columns. Although the IBKR app is suited to advanced traders, it has been well designed – meaning that you won’t have any issues navigating around the platform to buy and sell stocks.

When it comes to supported markets, this is where Interactive Brokers really stands out. This is because you will have access to stocks in over 30 different countries. Moreover, in addition to stocks, Interactive Brokers supports everything from index funds, bonds, and ETFs to financial derivatives, gold, and access to upcoming IPOs.

We also like the Interactive Brokers stock trading app for its low fee policy. This is because when you buy or sell US-listed stocks, you won’t be charged any commissions. You will need to pay fees when buying non-US assets – so do check this before placing an order. Finally, Interactive Brokers does not have a minimum deposit requirement on standard self-directed accounts.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $1 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- Highly advanced trading platform

- Thousands of stocks on offer

Cons

- Interntional stocks are charged at a premium

- Perhaps not suitable for beginners

- Specialist accounts come with high minimum deposit requirements

4. Schwab – Buy 0% Commission Stocks via an iOS and Android App

Schwab is an established US-based brokerage firm that allows you to trade thousands of assets in a low-cost environment. Although accounts take several days to open, once you are set up you can download the Schwab mobile app to your iOS or Android device and start trading stocks at 0% commission.

Schwab is an established US-based brokerage firm that allows you to trade thousands of assets in a low-cost environment. Although accounts take several days to open, once you are set up you can download the Schwab mobile app to your iOS or Android device and start trading stocks at 0% commission.

This is, however, only possible if your chosen stocks are listed in the US. If you decide to buy stocks that are listed overseas, then additional fees will apply. Nonetheless, we like the Schwab stock app for its user-friendly client interface, especially when it comes to placing buy and sell orders.

Although Schwab is often preferred by seasoned investors that wish to stake large sums of capital, the brokerage firm offers fractional share trading tools. And, this enables you to buy any stock that is listed on the S&P 500 from just $5 per trade. This means that you can buy Amazon stock and other expensive equities without needing to risk thousands of dollars.

Another core feature of the Schwab mobile app is that it gives you access to diversified portfolios at the click of a button. Its thematic stock lists cover a wide range of markets – such as active lifestyle, blockchain, cyber security, social networking, caffeinated drinks, and more. Finally, there is no minimum deposit at Schwab when opening a standard account.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $5 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- Buy fractional shares from just $5

- Top broker for creating automated portfolios

Cons

- Fractional shares only available on S&P 500 companies

- Non-US stocks come with high fees

- Platform can be overbearing for newbies

5. Fidelity – Trusted Stock App With $1 Minimum Order

![]()

![]() One of the best stock app providers in the market for those on a budget is Fidelity. This is because its Stocks by the Slice tool enables you to buy and sell US-listed stocks from just $1 per trading order. Once again, this is particularly useful when it comes to buying expensive stocks like Amazon.

One of the best stock app providers in the market for those on a budget is Fidelity. This is because its Stocks by the Slice tool enables you to buy and sell US-listed stocks from just $1 per trading order. Once again, this is particularly useful when it comes to buying expensive stocks like Amazon.

In addition to stocks, the Fidelity app gives you access to dozens of other asset classes. This covers everything from bonds and ETFs to mutual funds and options. You can also access upcoming IPOs and sign up for a managed portfolio. With that said, the latter will come with higher account minimums depending on your chosen strategy.

Otherwise, there is no minimum deposit to meet when opening a standard self-directed account. We also like the Fidelity mobile app – which is available on both iOS and Android, for its retirement accounts. This covers Traditional, Rollover, and Roth IRAs. And, if you’re unsure which IRA is right for you, Fidelity offers a useful comparison tool.

The Fidelity app also gives you access to international stock exchanges, but each market comes with its own pricing structure. If you’re looking for a provider that offers high-level data and research reports, Fidelity is perhaps the best stock app for this purpose. Moreover, Fidelity also offers real-time financial news – so you can easily stay updated with core market developments.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $1 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- Stocks by the Slice tool allows you to buy shares from just $1

- Thousands of financial instruments listed

Cons

- High-level research tools are best suited for experienced traders

- Financial planning accounts come with high minimums

6. SoFi – User-Friendly Stock App Offering Commission-Free Markets

SoFi is perhaps the best stock trading app for beginners. This trading app provider offers a variety of accounts – all of which give you access to thousands of US-listed stocks. SoFi also supports cryptocurrencies like Bitcoin and Dogecoin, alongside ETFs and access to upcoming IPOs.

SoFi is perhaps the best stock trading app for beginners. This trading app provider offers a variety of accounts – all of which give you access to thousands of US-listed stocks. SoFi also supports cryptocurrencies like Bitcoin and Dogecoin, alongside ETFs and access to upcoming IPOs.

When you buy stocks on the SoFi mobile app – you won’t be charged any trading commissions. Moreover, irrespective of which US-listed stock you decide to invest in – you only need to risk $5. When setting up your account, you won’t need to meet a minimum deposit. Moreover, verified accounts can typically be opened in under 10 minutes from start to finish.

SoFi is also popular with investors that wish to combine trading and banking services via a single app. This is because SoFi offers digital checking accounts and even loans, mortgages, and auto financing. We should also note that the SoFi app is extremely user-friendly, so even newbies will be able to buy and sell stocks without needing any prior experience.

Another popular feature offered by the SoFi app is its automated investing accounts. This is a diversified investment strategy that will initially require you to state your long-term financial goals. Then, the underlying algorithm will subsequently build a portfolio based on your objectives and risk tolerance.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $5 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- One of the best stock apps for beginners

- Offers 0% commission on US stocks

Cons

- No support for international stocks

- Too basic for seasoned investors

- IPO allocation is limited

7. Ally Invest – Great Stock App for Newbie Traders

In many ways, Ally Invest is a direct competitor to SoFi. This is because the Ally Invest mobile app not only gives you access to a user-friendly investment suite – but also banking services and loans. As such, Ally Invest is a great option for those looking to consolidate all of their financial needs via a single hub.

Before we get to fees, it is important to note that Ally Invest does not support fractional shares. As such, if you’re looking to buy expensive stocks like Amazon or Tesla, then you will need to purchase a full equity. On the other hand, Ally Invest does at least support automated DRIPs, which enables you to grow your portfolio via compound interest.

Nonetheless, we do like the Ally Invest app for its 0% commission policy on all supported stocks and ETFs. Fixed-rated bonds and mutual funds are also listed on the app – but these come with additional fees. Ally Invest also offers robo portfolio services, which allow you to build a diversified portfolio based on your financial goals.

And, the robot portfolio service at Ally Invest is managed and maintained on your behalf. This means that once you have made your initial investment, you can sit back and allow your money to work for you. Finally, the Ally Invest stock app also offers margin trading facilities – which can come in handy if you’re looking to amplify your investment capital.

| Minimum Deposit | $0 |

| Fractional Shares? | No – not supported |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- Very user-friendly – ideal for beginners

- Offers 0% commission on US stocks

Cons

- No support for international stocks

- Too basic for seasoned investors

- IPO allocation is limited

8. E*TRADE – Stock App Supporting Multiple IRAs

![]()

![]()

If you’re thinking about building a long-term investment portfolio for your retirement years, then E*TRADE offers one of the best apps to invest in stocks for this purpose. Account options here include Beneficiary, Rollover, Roth, and Traditional IRAs. You can even open an IRA for your children.

With that said, E*TRADE is also a good option if you’re simply looking to open a standard self-directed brokerage account. This is because there is no minimum deposit requirement and you will have access to thousands of commission-free US-listed stocks. Unfortunately, E*TRADE does not allow you to buy fractional shares, so this should be considered before you sign up.

Nonetheless, we like the fact that E*TRADE also allows you to buy assets outside of just stocks. This includes everything from options, futures, mutual funds, ETFs, bonds, and even access to IPOs. The E*TRADE mobile app also gives you access to managed portfolios, which are ideal for those of you that don’t feel comfortable picking your own stock investments.

If you’re interested in opening a managed portfolio plan here, you will need to invest at least $500. Furthermore, you will be charged a management fee of 0.30%. Financial advice is also available at E*TRADE, but this will require a minimum capital outlay of at least $25,000. Finally, E*TRADE also offers a range of investment guides that are aimed at beginners.

| Minimum Deposit | $0 |

| Fractional Shares? | No – not supported |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- Great selection of retirement accounts

- No minimum deposit and accounts take just 10 minutes to open

Cons

- No fractional shares

- Limited number of investment tools

- Pre-built portfolios require a $500 investment

9. TD Ameritrade – Top-Rated Stock App for Experienced Traders

![]()

![]()

TD Ameritrade is perhaps the best tracking app in the market for experienced investors that seek high-level tools and features. This highly established brokerage firm is behind the popular trading platform thinkorswim – which is available through web browsers, desktop software, and a mobile app.

The latter is fully optimized for both iOS and Android devices. Once you download the TD Ameritrade app, you will have access to thousands of stocks, ETFs, and options markets. US-listed markets can be accessed on a 0% commission basis. International exchanges can also be accessed, albeit, this will be charged at a premium.

Take note – in a similar nature to Ally Invest and E*TRADE, TD Ameritrade does not support fractional trading – so you will need to purchase stocks in full increments. Nevertheless, we like the TD Ameritrade app for its in-depth market insights, third-party analyst reports, and access to key financial news.

Moreover, those of you with experience will appreciate the availability of technical indicators, chart drawing tools, and real-time pricing quotes. The TD Ameritrade app also enables you to create watchlists and receive alerts directly to your smartphone. Finally, although TD Ameritrade is aimed at seasoned traders, the app also comes with educational tools.

| Minimum Deposit | $0 |

| Fractional Shares? | No – not supported |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- Highly advanced thinkorswim trading suite

- Top-rated broker for seasoned investors

Cons

- No fractional shares

- Commission-free access to US-listed stocks online

- Too advanced for beginners

10. Robinhood – Best StockApp for Beginners

The final provider to consider from our list of the best stock broker app providers in 2022 is Robinhood. This top-rated investment app is used by millions of US-based clients for its simple interface and low-cost policy. Regarding the latter, Robinhood offers commission-free access to all supported markets.

Not only does this includes US-listed stocks, but also cryptocurrencies, options, and ETFs. Robinhood also offers a small number of ADRs, but additional fees apply. In terms of getting started, it takes just minutes to open a verified account with Robinhood. You won’t need to meet a minimum deposit and the provider allows you to trade from just $1.

As such, the Robinhood app will be of interest to those on a budget. The app – which is compatible with both Android and iOS operating systems, will limit you to $1,000 in instant deposits, with the rest being credited a few days later. With that said, at just $5 per month, the Robinhood gold account offers much higher limits.

Furthermore, the Robinhood gold account also gives you access to margin trading facilities and additional research tools. Although Robinhood is great for beginners, its mobile app is lacking when it comes to advanced trading and charting features. There is no option to engage in copy trading or managed portfolios, either.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $1 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Cost of Buying Amazon Stock | Spread only |

Pros

- Great option for first-time investors

- No commissions charged on US-listed stocks, options, ETFs, or cryptocurrencies

Cons

- Only offers international shares via ADRs

- Standard accounts limit instant deposits to $1,000

- No passive investment tools

Top Stock Apps Compared

For a complete overview of the 10 providers we reviewed above, check out our comparison table of the best stock market apps for 2022.

| Stock Broker | Minimum Deposit | Fractional Shares? | Pricing System | Fees & Charges | Features |

| eToro | $10 | Yes – $10 minimum | 0% commission on ALL real stocks | No Deposit fees, $5 withdrawal fee, $10 inactivity fee, no account management fees. |

|

| Webull | $0 | Yes – $5 minimum | 0% commission on US-listed stocks.

Regulatory Transaction Fee – Sells only. $0.0000051 * Total $ Trade Amount (Min $0.01) |

Zero deposit fees, withdrawal fees, inactivity fees and no account management fees. |

|

| Interactive Brokers | $0 | Yes – $1 minimum | 0% commission on US-listed stocks | Zero deposit fees, withdrawal fees, inactivity fees and no account management fees. |

|

| Schwab | $0 | Yes – $5 minimum | 0% commission on US-listed stocks | Zero deposit fees, withdrawal fees, inactivity fees and no account management fees. |

|

| Fidelity | $0 | Yes – $1 minimum | 0% commission on US-listed stocks | Zero deposit fees, withdrawal fees, inactivity fees and no account management fees. |

|

| SoFi | $0 | Yes – $5 minimum | 0% commission on US-listed stocks | Zero deposit fees, withdrawal fees, inactivity fees and no account management fees. |

|

| Ally Invest | $0 | No – not supported | 0% commission on US-listed stocks | Zero deposit fees, withdrawal fees, inactivity fees and no account management fees. |

|

| E*TRADE | $0 | No – not supported | 0% commission on US-listed stocks | Zero deposit fees, withdrawal fees, inactivity fees and no account management fees. |

|

| TD Ameritrade | $0 | No – not supported | 0% commission on US-listed stocks | Zero deposit fees, ACH withdrawal fees, inactivity fees and no account management fees. |

|

| Robinhood | $0 | Yes – $1 minimum | 0% commission on US-listed stocks | Zero deposit fees, withdrawal fees, inactivity fees and no account management fees. |

|

*at time of writing.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

How we Select the Best Stock App

If you’re wondering how we compiled our list of the best stock app providers for 2022 – we focused on a number of core metrics – which we discuss in more detail in the sections below.

Safety and Trust

All of the 10 stock apps that we reviewed on this page are approved to offer brokerage services to US clients.

And as such, you can choose any of these providers for your stock trading needs without needing to worry about the safety of your funds.

Supported Markets

Each and every stock investment app that we reviewed give you access to thousands of US-listed shares across the US’s two primary exchanges – the NYSE and NASDAQ.

In terms of international diversification, some of the stock investment app providers that we discussed do not give you access to foreign exchanges, while some offer ADRs.

On the other hand, we like eToro for its access to more than a dozen foreign exchanges – such as those based in Europe and Asia. Best of all, eToro enables you to buy international stocks at 0% commission – even if you’re based in the US.

Fees and Commissions

All of the stock apps discussed today allow you to open a standard self-directed account that is free to maintain. However, fees might come into play when you make a deposit.

For instance, bank wire deposits at Webull are charged at $8, so do bear this in mind if you’re looking to invest small amounts.

Another thing to note is that all the providers from our list of top stock apps for 2022 offer commission-free access to US-listed shares.

However, as noted above, all stock apps – apart from eToro, will charge you a commission when you elect to buy foreign stock.

Account Types

If you’re simply looking to buy and sell stocks in a casual manner, then you will likely be suited for a standard self-directed account. This means that you will be responsible for making your own stock picks.

- With that said, many of the stock apps that we reviewed today offer a range of alternative accounts.

- For example, at Webull, you can open a retirement account across a range of IRAs.

- This can be a great option if you’re looking to build a long-term portfolio for your retirement years.

Moreover, many stock app providers also offer managed portfolios. For example, at eToro, the app gives you access to dozens of smart portfolios that are internally managed.

This means that eToro will regularly rebalance and reweight your smart portfolio to ensure that it aligns with the investment strategy that you chose.

Fractional Shares

The best stock trading apps for 2022 allow you to buy and sell fractional shares. Put simply, this means that you can purchase just a small fraction of one stock – which is particularly useful if you are on a budget.

For example, as of writing, Alphabet stocks are trading at just under $3,000 per share. However, if you were to use eToro for your stock trading requirements, you would only need to invest $10 into Alphabet.

Other brokers – such as Robinhood and Fidelity, have reduced the minimum share investment to just $1. However, this is only available on US stocks, while at eToro, its fractional tool can also be used on foreign-listed equities.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Alternative Assets

Seasoned traders will often look to hedge their stock investments with other asset classes.

As such, the best stock investing apps in the market also gives you access to index funds, ETFs, mutual funds, bonds, commodities, and more.

Just be sure to check what fees apply on non-stock and ETF investments, as brokers will often charge a premium for alternative assets.

Mobile Experience

Across the board, we found that the 10 providers from our list of the best online stock trading apps each offer a great mobile experience across both iOS and Android.

However, we did find that some stock apps are better suited for beginners, while others are aimed at those with prior trading experience.

For example, the likes of eToro, Robinhood, and Webull are most definitely suited for first-time investors, as their respective apps are super easy to use. Moreover, to buy a stock, it’s just a case of searching for the company and entering your total investment stake.

You then have stock apps like Interactive Brokers and TD Ameritrade – both of which are preferred by seasoned investors that need access to high-level data and analysis tools.

Ultimately, just make sure that you choose the best app to invest in stocks for your experience level and skillset.

Copy Trading

Another core feature that we came across when reviewing the best stock apps for 2022 is copy trading. In a nutshell, the eToro app allows you to mirror the trades of a verified and proven stock trader.

For instance:

- Let’s say that you invest $500 into a stock trader on the eToro app

- The trader utilizes 30% of their available equity on Tesla stocks

- This means that automatically, $150 of your balance is allocated to Tesla ($500 x 30%)

- The trader sells their Tesla stocks a few months later at a profit of 50%

- Your Tesla shares are automatically sold and you also make 50% – or $75 ($150 x 50%)

Crucially, not only is the copy trading tool on the eToro app suitable for inexperienced investors – but also for those without the required time to regularly research the markets.

Margin Facilities

Many of the stock apps that we discussed on this page give you access to margin trading facilities. This means that you can trade with more capital than you have in your brokerage account.

Take note, as per SEC rules, you need to maintain a balance of at least $2,000 to access margin.

Trading Tools

Trading tools allow you to scan the stock markets with the view of predicting future price action. The best stock analysis apps that we came across offer everything from technical indicators and chart drawing tools to stock screeners and market insights.

We also like it when stock apps offer in-house research facilities – such as earnings reports and third-party news. This will give you the best chance possible of making informed investment decisions.

Minimum Deposit

We mentioned earlier that the best stock apps allow you to buy fractional shares with just a few dollars. With that said, you also need to check whether or not your chosen trading app requires a minimum deposit.

In most cases, you should find that standard self-directed accounts allow you to do get started with any amount of your choosing. However, if you decide to open a retirement account or invest in a managed portfolio – this will likely require a higher minimum.

Demo Account

Many free stock apps in the market will enable you to trade risk-free via a dedicated demo account. This typically mirrors live market conditions, meaning that you can practice trading strategies without needing to invest any money.

Demo accounts are suited for both beginners and experienced traders alike – so this is definitely something to look for when choosing the best stock app for you.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Take note, some demo accounts experience after a certain number of days from when you register with the stock app. At eToro, however, you can access demo trading facilities for as long as you wish without even needing to have an account balance.

Onboarding Times

Make no mistake about it – there is often a huge disparity in the number of days that you need to wait before you can start trading with a new brokerage account.

This is because of the onboarding process – which requires the stock app provider to verify your identity for anti-money laundering purposes.

For example, when registering with the likes of Interactive Brokers or TD Ameritrade, it can take several days for your account to be verified.

However, when using a new-age stock app provider like eToro or Webull, your ID documents will typically get verified in less than five minutes. This is because the onboard process is automated.

Payment Methods

All of the free stock trading apps that we discussed today enable you to deposit and withdraw funds via ACH or a domestic bank wire. Some providers also support third-party transfers and checks.

With that said, we like that the eToro trading app also supports real-time deposits via debit/credit cards and even e-wallets like Paypal. This means that you don’t need to wait several days for the funds to arrive – as you do with traditional bank transfers.

Customer Service

Consider whether or not your chosen stock app offers a sufficient level of customer service. For instance, be sure to check what hours the support team works and what options you have when it comes to making contact.

The best stock investment apps offer 24/7 customer support via live chat. This means that you can speak with a human advisor simply by logging into your stock app.

How to Buy Use a Stock App – eToro Tutorial

If you’ve never previously used a trading app to buy and sell stocks – you might be somewhat intimidated by the process.

The good news is that when using a user-friendly app provider like eToro – it takes just five minutes to set up an account and start trading – even if you have no prior experience.

To start trading stocks right now on a commission-free basis via the eToro app – follow the step-by-step tutorial below.

Step 1: Open an Account

Load up the eToro website on your desktop or mobile web browser to begin the account opening process.

Some of the information that eToro needs from you include your full name, social security number, home address, nationality, and date of birth.

Next, you will need to go through a quick KYC verification process. This will require you to upload a copy of your government-issued ID.

You can also use your smartphone camera to take a photo of your identity document – which can be a state ID card, passport, or driver’s license.

Step 2: Download eToro App

Once you have registered an account with eToro via your mobile or web browser, you can then download the provider’s app. In clicking on the Google Play or App Store logo, you will be redirected to the official download link.

Once you have downloaded the eToro app to your phone, log in with the username and password that you chose in the previous step.

Step 3: Deposit Funds

You can easily deposit funds into your eToro account without needing to leave the app. To do this instantly, use a debit or credit card. You can also use Paypal, Neteller, and a number of other e-wallet providers.

Bank transfers are supported too – but you will need to transfer the funds into your eToro account manually. Moreover, this can delay the process by 1-3 working days.

The minimum deposit requirement for US clients is just $10. No deposit or withdrawal fees are charged by the eToro app when the payment is executed in US dollars.

Step 4: Search for Stocks

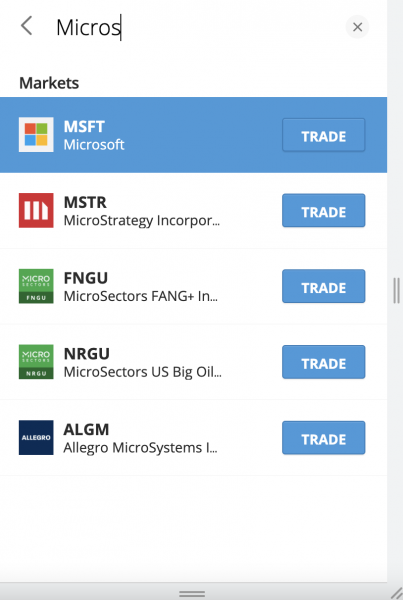

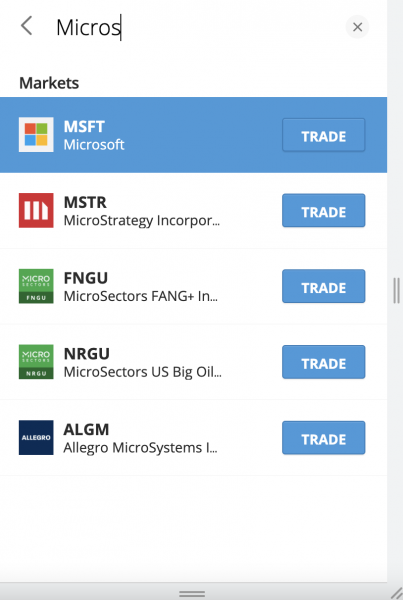

When it comes to choosing stocks to invest in, the eToro app gives you two options. First, if you know which stock you wish to buy, you can start typing the name of the company into the search bar.

As you can see from our example above, we are searching for Microsoft stock. The other option is to use the filter buttons offered by the eToro app – which allow you to break your stock screening process down by the industry or exchange.

You can also choose suitable companies by exploring lists that track top market movers and trending stocks.

Step 5: Buy Stocks

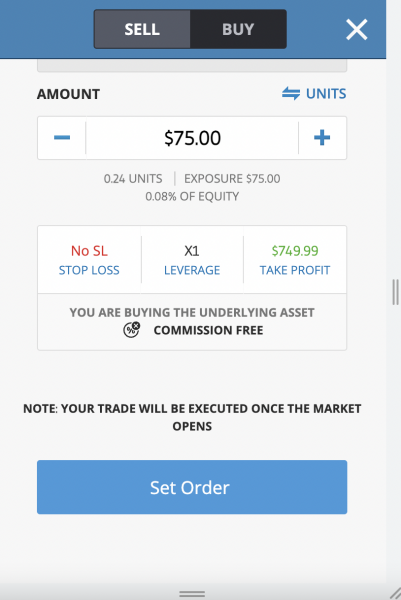

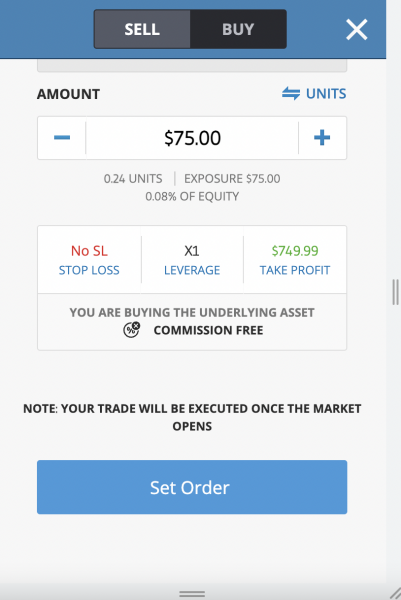

Once you have found a suitable stock to invest in you can click on the ‘Trade’ button. This will then take you to the screen that allows you to place a buy order.

As you can see in the image above, in the ‘Amount’ box we are looking to invest $75 into Microsoft. With that said, eToro allows you to invest any amount from just $10.

Once you confirm your stock trading order, eToro will add the shares to your portfolio.

Conclusion

Choosing the best stock app for your skillset and the markets that you wish to access to crucial. As discussed throughout this guide, the best trading apps for 2022 offer low fees, plenty of trading tools, and support for fractional shares.

The overall best stock app in the market today – as per our review findings, is offered by eToro. Once you download the eToro app – you can buy and sell thousands of US and foreign stocks at 0% commission from just $10 per trade.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Frequently Asked Questions on Stock Apps

What stock apps are legal in the US?

Which investment app is best for beginners?

What is the best app for buying stocks?

from Stock Trading – My Blog https://ift.tt/n3AFkCB

via IFTTT

No comments:

Post a Comment