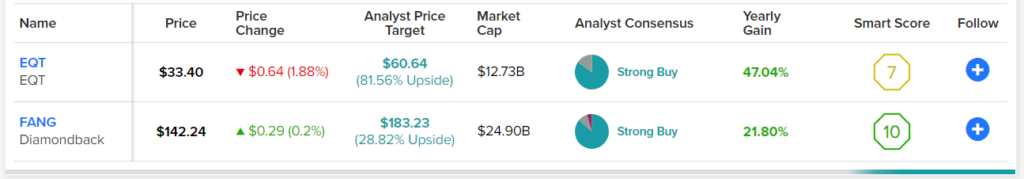

Vitality shares had been the large winners in 2022, however there’s no consensus on what to anticipate from the sector in 2023. On this piece, I in contrast two vitality shares. EQT Corp. (NYSE:EQT) and Diamondback Vitality (NASDAQ:FANG) are each up over the past 12 months, though EQT has skyrocketed by 47%, whereas Diamondback has “solely” gained 21.8%. Vitality shares had been among the many few winners in 2022, and each firms are up to this point in 2023.

Nevertheless, such a big disparity in 12-month efficiency from two firms in the identical sector bears nearer evaluation. A key distinction is that EQT is extra of a play on pure fuel, whereas Diamondback focuses extra on oil.

EQT Corp. (EQT)

EQT is the biggest pure fuel producer within the U.S. On one hand, EQT shares are hovering round oversold territory, which might sign extra upside within the close to time period. Nevertheless, warmer-than-usual temperatures within the U.S. and Europe have restrained demand for pure fuel. Thus, a impartial view appears to be like applicable for EQT, a minimum of for now.

The Vitality Info Affiliation boosted its forecast for pure fuel manufacturing within the U.S. to 100.4 bcf/d (billion cubic toes per day) in 2023, up from 99.7 bcf/d a month in the past. The group expects Henry Hub spot costs to common $6/MMBtu (metric million British thermal unit) through the first quarter, a slight improve from November’s common of about $5.50.

Nevertheless, the EIA additionally expects pure fuel costs to begin declining after January as storage ranges within the U.S. strategy their five-year common. The group cites rising pure fuel manufacturing as a key cause for falling costs. Gentle winter climate may restrain pure fuel costs if it continues.

Setting the pure fuel outlook apart, EQT has a number of issues going for it. The corporate’s new administration wasted no time attending to work by chopping prices and paying off debt. EQT has additionally made some promising acquisitions and achieved an investment-grade score for its debt, chopping its borrowing prices.

The firm’s income jumped from $6.8 billion in 2021 to $12.4 billion on a trailing-12-months foundation. EQT additionally returned to profitability, producing $1.9 billion in web revenue for the final 12 months, and it generated $2.18 billion in free money movement. That’s a exceptional turnaround from 2021, when EQT generated solely $607 million in free money movement, and 2020, when it generated $495.5 million.

EQT’s destiny hangs on pure fuel pricing. If costs bounce again, EQT might be a beautiful selection.

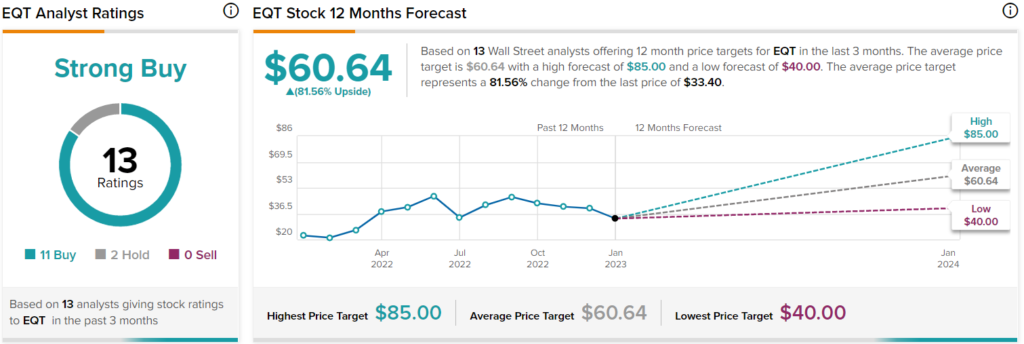

What’s the Worth Goal for EQT Inventory?

EQT Corp. has a Robust Purchase consensus score primarily based on 11 Buys, two Holds, and 0 Promote scores assigned over the past three months. At $60.64, the common value goal for EQT implies upside potential of 81.6%.

Diamondback Vitality (FANG)

Diamondback Vitality’s destiny lies extra in oil than pure fuel, which provides it a leg up versus EQT because the sleeping large China begins to reawaken. Diamondback’s fundamentals additionally look extra enticing, suggesting a bullish view could be applicable.

Because the world’s largest oil importer, China will improve international demand for oil considerably as its economic system reopens. On the one hand, China is without doubt one of the world’s few remaining importers of Russian oil, however alternatively, its reopening will probably be fairly bullish for oil demand. S&P International’s (NYSE:SPGI) base case requires $90/barrel oil in 2023 – or over $120/barrel if China reopens totally.

Oil pricing developments apart, Diamondback Vitality merely appears to be like higher than EQT essentially. Diamondback is rather more worthwhile than EQT, producing almost $4.4 billion in web revenue on $9.6 billion in income for the final 12 months. Diamondback can also be producing masses of cash: $3.2 billion in free money movement for the final 12 months.

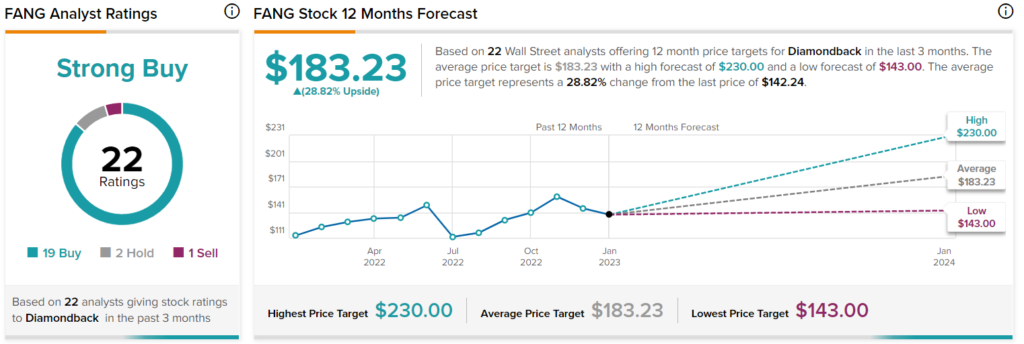

What’s the Worth Goal for FANG Inventory?

Diamondback Vitality has a Robust Purchase consensus score primarily based on 19 Buys, two Holds, and one Promote score assigned over the past three months. At $183.23, the common value goal for Diamondback Vitality implies upside potential of 28.8%.

Conclusion: Impartial on EQT, Bullish on FANG

EQT and Diamondback each appear to be enticing vitality performs, however for now, pricing developments favor oil, giving Diamondback a lift. Different tidbits add to its attraction versus EQT. For instance, hedge funds boosted their holdings in Diamond Vitality, scooping up 1.2 million further shares whereas dumping 1.8 million shares of EQT within the final quarter. Diamondback additionally has a barely higher dividend yield at 2.1% versus EQT’s yield of 1.8%.

Nevertheless, a world recession, particularly a extreme one, might weigh on each firms.

from Stock Market News – My Blog https://ift.tt/LRQjUnD

via IFTTT

No comments:

Post a Comment