After 2022’s inflation-driven market meltdown, 2023’s bogey no 1 seems to be the concern of a worldwide recession. Nonetheless, Sharmin Mossavar-Rahmani, CIO of Goldman Sachs’ wealth-management section, doesn’t essentially suppose this can be a notably dangerous omen for the inventory market.

“We’re not arguing that at this time’s valuations totally low cost a recession, however contemplating final yr’s fairness drawdown, we do suppose a big a part of any valuation reset has already occurred,” Mossavar-Rahmani opined.

In reality, Mossavar-Rahmani thinks the S&P 500 has room to maneuver 12% larger this yr, even when a gentle recession does materialize. “Put merely,” she added, “markets backside when the information continues to be dangerous.”

In opposition to this backdrop, Mossavar-Rahmani’s analyst colleagues on the banking large have pinpointed three names that they suppose will profit from such a rally. We ran the tickers by way of TipRanks database to see what different Wall Avenue’s analysts should say about them.

Salesforce, Inc. (CRM)

The primary Goldman decide we’re taking a look at is software program large Salesforce. The corporate is a buyer relationship administration (CRM) specialist, offering software program and functions that assist its shoppers supply a greater degree of service to their very own prospects. Providers run the gamut from help to analytics and relationship intelligence to personalised customer support, gross sales, and every little thing in between. Salesforce is likely one of the greatest software program suppliers on the planet, boasting a market cap north of $148 billion.

That mentioned, like many different tech firms, latest occasions have been no simple journey, and the corporate solely just lately introduced a ten% discount to its workforce. Moreover, a number of execs have been handing their discover in over the previous few months, amongst them co-Chief Govt Bret Taylor, who mentioned he’ll go away his publish on the finish of January.

That announcement was made in tandem with the discharge of the corporate’s FQ3 outcomes (October outcomes). Salesforce delivered income of $7.84 billion, amounting to a 14.3% year-over-year uptick. Adj. EPS reached $1.40, simply trumping the Avenue’s $1.22 forecast. For the outlook, the corporate referred to as for income for the fiscal fourth quarter to be within the vary between $7.9 billion and $8.03 billion, simply lacking Wall Avenue’s name for $8.02 billion on the midpoint.

Regardless of the difficult surroundings, Goldman Sachs analyst Kash Rangan sees loads of potential for traders to seize onto.

“We see a constructive arrange for Salesforce when macro hurdles unwind and the corporate comes off a difficult interval that features administration departures, new shareholder involvement and execution missteps inside Mulesoft and Tableau… We expect revenues and margins have the potential to double within the subsequent 5-6 years, doubtlessly quadrupling earnings in regular state. To that finish, making inroads in direction of its working margin expectations of 25% by CY25 can drive a better re-rating of the inventory, as seen with firms akin to Microsoft, Adobe, Intuit and Autodesk, who’s valuations re-rated larger from important step-ups in profitability,” Rangan opined.

Accordingly, Rangan charges CRM shares a Purchase whereas his $300 worth goal suggests they are going to double in worth over the approaching yr. (To observe Rangan’s observe document, click on right here)

Rangan is the Avenue’s greatest CRM bull however loads of different analysts are backing his case; primarily based on 26 Buys vs. 9 Holds and 1 Promote, the inventory receives a Average Purchase consensus ranking. At $189.25, the typical goal makes room for 12-month beneficial properties of ~27%. (See CRM inventory forecast)

T-Cellular US, Inc. (TMUS)

From one large to a different. American wi-fi community operator T-Cellular US is the nation’s second-largest wi-fi provider and anticipated to see out 2022 with the shopper rely reaching 113.6 million. The corporate additionally prides itself with having America’s sole nationwide stand-alone 5G community, positioning it to be the 5G chief. T-Cellular’s market cap exceeds $186 billion and in sharp distinction to many different mega caps, that solely grew in 2022’s bear.

The shares posted beneficial properties of 21% over the course of the yr, boosted by sturdy earnings. Within the final reported quarter, Q3, the corporate posted EPS of $0.40, which handily beat the $0.26 consensus estimate. The corporate additionally delivered its highest ever internet additions for postpaid accounts (394,000).

The outlook was pleasing too, with postpaid internet buyer additions for the yr anticipated to be within the vary between 6.2 million and 6.4 million, above the earlier steering for six.0 million to six.3 million. In reality, initially of the month, the corporate launched preliminary outcomes for 2022, which confirmed that it’ll attain 6.4 million complete postpaid prospects, exceeding the excessive finish of that information. For This fall, the corporate delivered postpaid internet buyer additions of 1.8 million, a feat that when mixed, rivals AT&T and Verizon didn’t even handle.

That’s the type of stuff Goldman’s Brett Feldman thinks makes TMUS a ‘High Decide’ in 2023 even when taking into account final yr’s beneficial properties.

“Regardless of materials outperformance in 2022, we proceed to see TMUS as probably the most enticing massive cap development inventory in telecom and cable,” the analyst mentioned. “Key catalysts that we see in 2023 embrace sturdy postpaid cellphone internet provides (3mn vs. 3.1mn in 2022), even when sector development slows, owing to ongoing churn enchancment; sustained development in core adjusted EBITDA (10% vs. 12% in 2022E) as merger (2020’s merger with Dash) with synergies method run-rate; and a close to doubling in FCF/share as capex falls and buybacks ramp.”

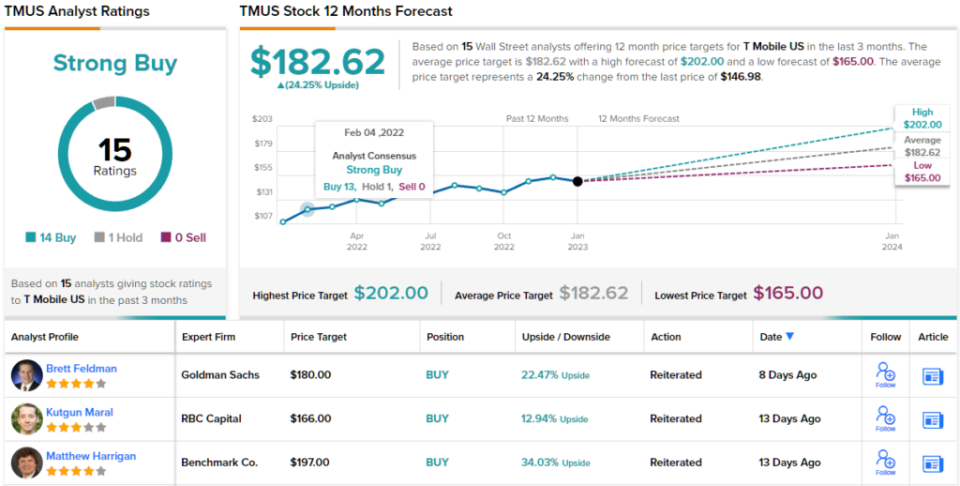

To this finish, Feldman charges TMUS shares a Purchase, together with a $180 worth goal. The implication for traders? Upside of twenty-two% from present ranges. (To observe Feldman’s observe document, click on right here)

The place do different analysts stand on TMUS? 14 Buys and 1 Maintain have been issued within the final three months. Subsequently, TMUS will get a Robust Purchase consensus ranking. Given the $182.62 common worth goal, shares may surge ~24% within the subsequent yr. (See TMUS inventory forecast)

Warner Bros. Discovery (WBD)

Onto our third Goldman advice, Warner Bros. Discovery, an organization that was shaped as a merger of Discovery and WarnerMedia, after the latter was spun off by AT&T in April final yr. The media and leisure large has an enviable portfolio spanning throughout movie and TV; Warner Bros. movie and tv studios, DC Comics, HBO, CNN, Discovery Channel, the Cartoon Community, Eurosport, and loads of different choices all fall beneath the WBD moniker with a few of the world’s most profitable franchises akin to Harry Potter, Lord of the Rings and Pals amongst its choices.

The brand new entity can be combining its streaming companies HBO Max and Discovery+, which collectively cater to virtually 100 million paid subscribers. This launch is anticipated to happen within the spring.

The preliminary interval following the merger was troublesome and mirrored within the firm’s most up-to-date earnings, for 3Q22. Income fell by 10.6% from the identical interval a yr in the past to $9.82 billion, whereas lacking the Avenue’s name by $520 million. EPS of -$0.95 fell a way wanting the -$0.45 anticipated by the analysts.

Following the readout, the shares took a beating, and total they shed 61% in 2022. Nonetheless, the inventory is off to a flying begin in 2023, having already delivered returns of ~39%.

There’s extra to come back, based on Goldman Sachs analyst Brett Feldman, who lays out the bullish case.

“We estimate that WBD is finest positioned to drive EBITDA development, ramp FCF and delever its steadiness sheet in 2023 because it pursues $3.5bn of merger synergies and relaunches its flagship streaming service,” Feldman mentioned. “As such, whereas we count on traders to proceed to debate the long-term outlook for conventional media firms, we see the danger/reward skew for WBD as most tasty vs. its peer group with key execution catalysts (merger milestones, streaming relaunch) largely inside administration’s management.”

These feedback kind the idea of Feldman’s Purchase ranking whereas his $19 worth goal implies 12-month share appreciation of ~44%.

And what about the remainder of the Avenue? Based mostly on 5 Buys and Holds, every, plus 1 Promote, the inventory claims a Average Purchase consensus ranking. Going by the $16.28 common goal, traders shall be sitting on returns of 23% a yr from now. (See WBD inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is extremely necessary to do your personal evaluation earlier than making any funding.

from Stock Market News – My Blog https://ift.tt/d3lwU6i

via IFTTT

No comments:

Post a Comment