Moussa81

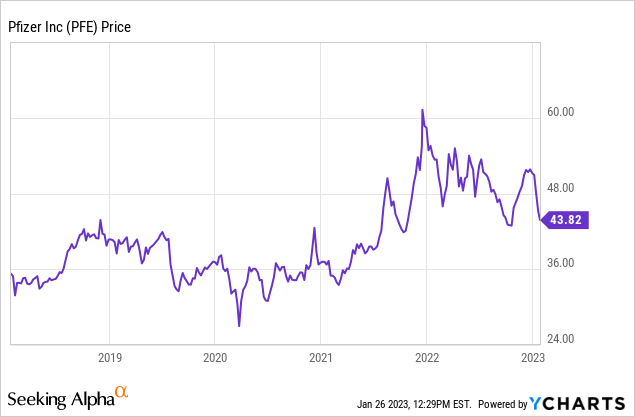

I advised Pfizer (NYSE:PFE) as a strong purchase on weak point thought within the center of December right here, when value was $51 per share. I additionally talked about the inventory as a high decide for the upcoming 12 months. My emotions have not modified with the latest downgrade-happy Wall Road analyst selloff to $44. In actual fact, that is the world I thought-about Sturdy Purchase territory only a month in the past. Why?

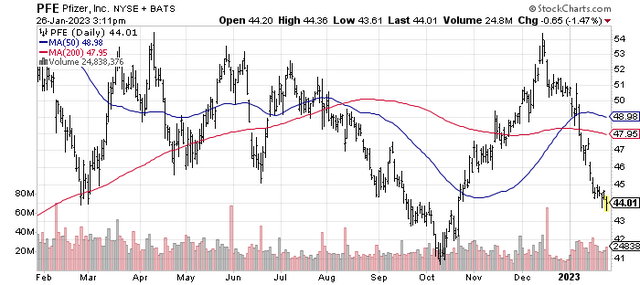

StockCharts.com – Pfizer, 1 12 months of Every day Worth & Quantity Modifications, Dividend Adjusted

For me, it is all about money holdings and free money move era vs. friends and opponents within the patented-drug discovery, manufacturing, and advertising and marketing house. The Wall Road cyclical-sentiment gotcha crowd is promoting the plain finish of the COVID-19 pandemic. In all probability we’re shifting to a yearly COVID vaccination within the fall, similar to the common flu shot really useful by docs and the CDC for higher than 20 years (whereas administered with terrific outcomes for public well being). Pfizer’s COVID shot in partnership with BioNTech SE (BNTX), and the corporate’s vastly profitable Paxlovid antiviral capsule will see declining gross sales in 2023 vs. 2021-22. I and others have been factoring in a significant decline in complete firm outcomes sooner or later for over a 12 months now.

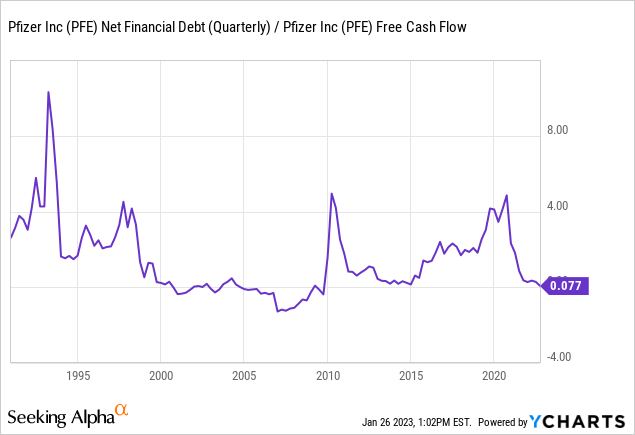

Saying Pfizer is a promote or maintain sitting at a ahead P/E of 10x with its most conservative stability sheet place since 2009 is a little bit of overkill (laughably so in case you really need my opinion). However that is solely a part of the bullish story. Beneath is a graph evaluating web monetary debt (all debt minus money held) to free money move era since 1992. At present’s low quantity means debt is a miniscule fraction of yearly {dollars} coming the door (the truth is, 1-month of free money move may pay of the online debt sum).

YCharts – Pfizer, Internet Debt to Free Money Stream, Since 1992

I’ve taken the most recent selloff in value as a present I can’t refuse in my brokerage account. Pfizer is in the present day my largest single firm holding. I’ll take the three.7% money distribution yield (and 5% web payout yield together with share buybacks), on high of no less than 9% in long-term annual free money move yield for myself (all the results of in the present day’s disregarded and ignored COVID product windfall in earnings and money move). The excellent news is administration has the pliability (money) to reinvest in Pfizer’s enterprise by way of accretive acquisitions and share buybacks that different Huge Pharma names don’t.

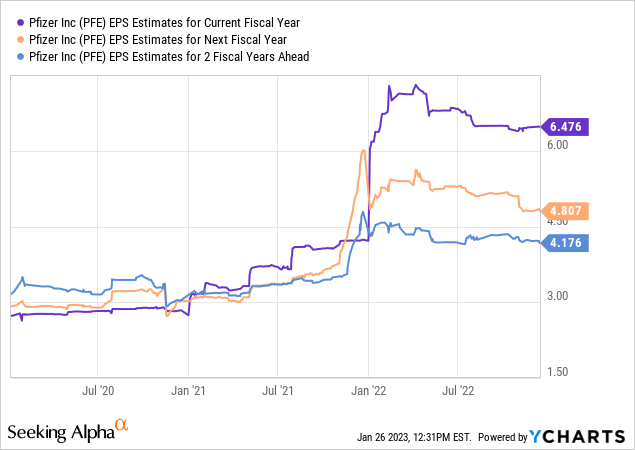

The bump in sustainable earnings from the brand new COVID money is pictured beneath. Transferring from EPS estimates round $2.70 in early 2020, $6.48 was projected for 2022 by analysts in late December, vs. $4.80 for 2023 and $4.17 for 2024.

YCharts – Pfizer, Analyst EPS Forecasts 2022-24, Operating since Jan 2020, Snapshot on Dec thirty first, 2022

Money Valuation Story Upgraded

Versus only a month in the past, the 15% decline in Pfizer’s value has opened up a really compelling valuation setup for brand spanking new share accumulation.

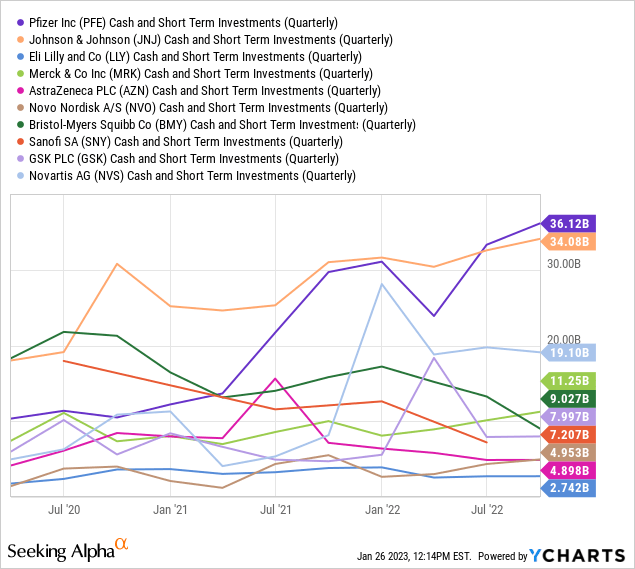

For starters, I need to concentrate on the massive and fast-growing money place. Pfizer’s money and short-term funding stash is drawn beneath vs. the most important pharmaceutical companies on the earth. It has rapidly grown into a big money stake at $36 billion in Q3 resulted in September. The type group contains Johnson & Johnson (JNJ), Eli Lilly (LLY), Merck (MRK), AstraZeneca (AZN), Novo Nordisk (NVO), Bristol-Myers Squibb (BMY), Sanofi (SNY), Glaxo Smith Klein (GSK), and Novartis (NVS).

YCharts – Huge Pharma, Complete Money Held, 3 Years

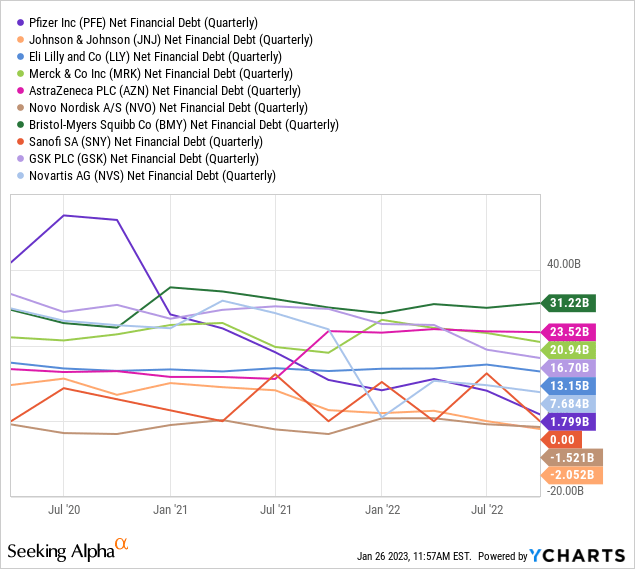

Internet monetary debt has plummeted to just about zero and should decline underneath zero when December This autumn outcomes are revealed subsequent week (which means more money than debt exists). Complete debt minus money has fallen from the best studying within the Huge Pharma group when the COVID-19 pandemic appeared to maybe the bottom in early 2023 (one other strong quarter for earnings is predicted on the finish of final 12 months).

YCharts – Huge Pharma, Internet Monetary Debt, 3 Years

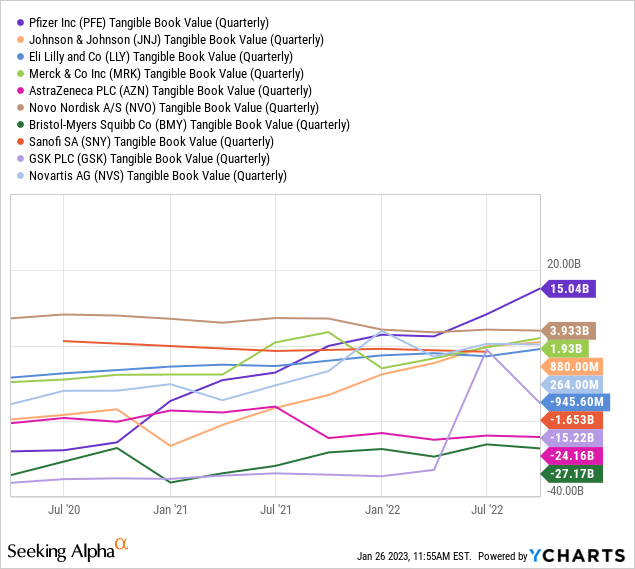

And, for the primary time since 2009, Pfizer has a “tangible” e book worth once more in early 2023, which is clearly not the case for others within the pharmaceutical business. What this implies is the corporate has extra exhausting property like stock, money, and plant & tools simply liquidated value MORE than complete liabilities and IOUs on its books. Often, Huge Pharma companies are run with patent intangibles and takeover/merger values past web exhausting property (creating goodwill accounting) to create tangible e book values in damaging territory. So, Pfizer is uniquely capable of stand up to a significant recession and reap the benefits of it with asset purchases on a budget (utilizing present money on the financial institution).

YCharts – Huge Pharma, Tangible E-book Values, 3 Years

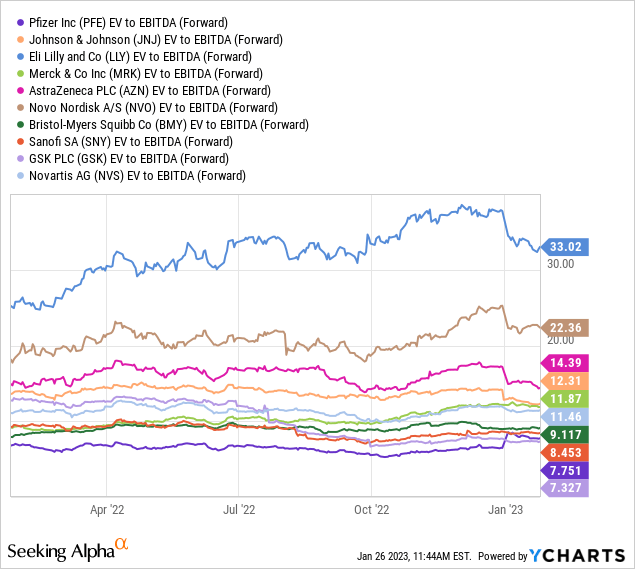

The strongest purchase arguments for Pfizer concentrate on enterprise valuations, which correctly account for its monster money holdings and little web debt. Most peer Huge Pharma performs slide as compared underneath the EV microscope, holding additional debt burdens and curiosity expense.

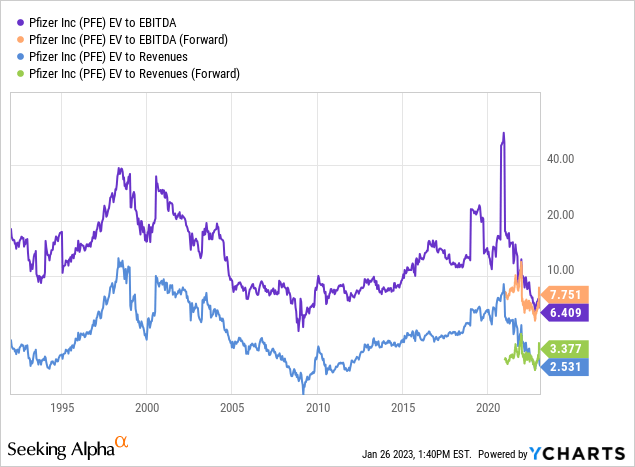

All informed, Pfizer’s EV to EBITDA and income calculations at $44 per share are hovering close to 30-year lows. In case your funding objective is to buy a high-margin enterprise, additionally a brand-name chief, at a reduced value/valuation, Pfizer could also be one of many best purchase selections on Wall Road in January 2023 (utilizing both trailing outcomes or ahead estimates).

YCharts – Pfizer, EV to EBITDA & Revenues, Since 1992

EV to “ahead” EBITDA and income estimates (which embody a drop-off in COVID gross sales) are additionally roughly the most cost effective within the Huge Pharma group.

YCharts – Huge Pharma, EV to Ahead Estimated EBITDA, 1 12 months

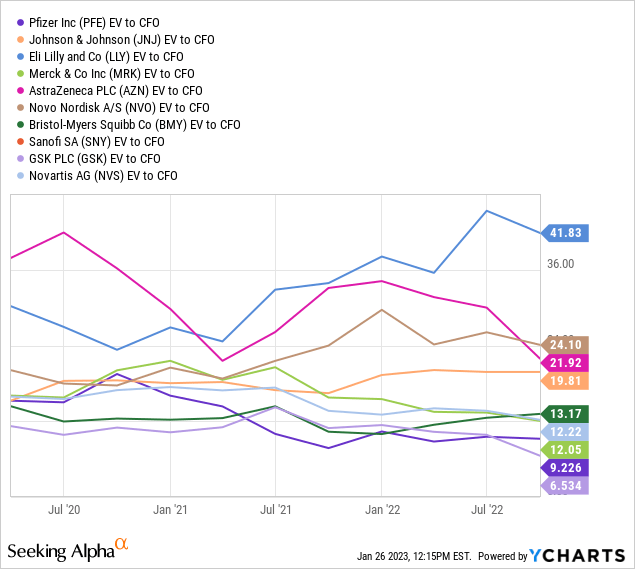

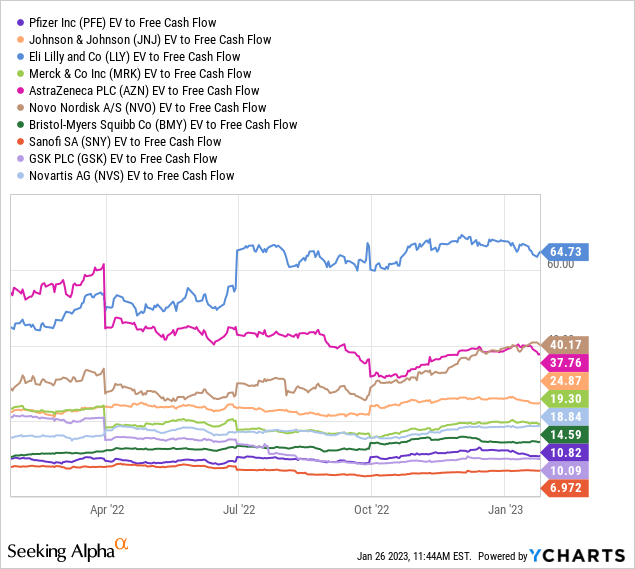

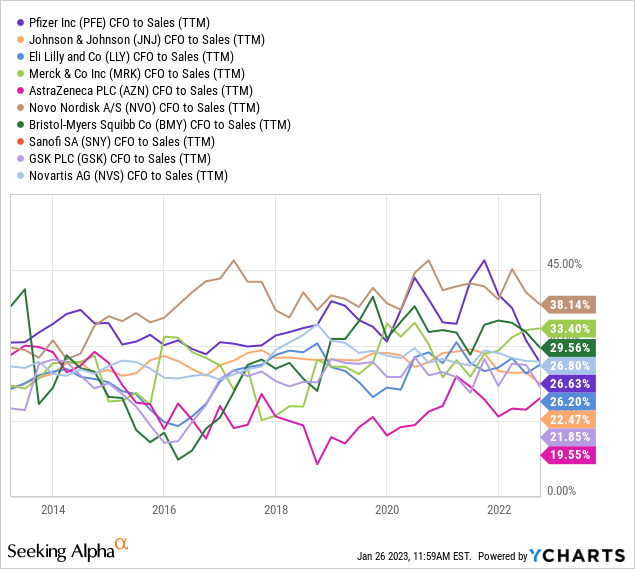

EV to “trailing” money move and free money move are additionally main the options in the present day. If you’re looking for extraordinarily optimistic ranges of money era vs. an affordable value to personal it, Pfizer is knocking the ball out of the park. As well as, money move charges on gross sales have fallen slightly in 2022, which may rebound beginning in 2023.

YCharts – Huge Pharma, EV to Fundamental Money Stream, 3 Years

YCharts – Huge Pharma, EV to Free Money Stream, 1 12 months

YCharts – Huge Pharma, Money Stream to Gross sales, 10 Years

Earnings Yield vs. Inflation Fee

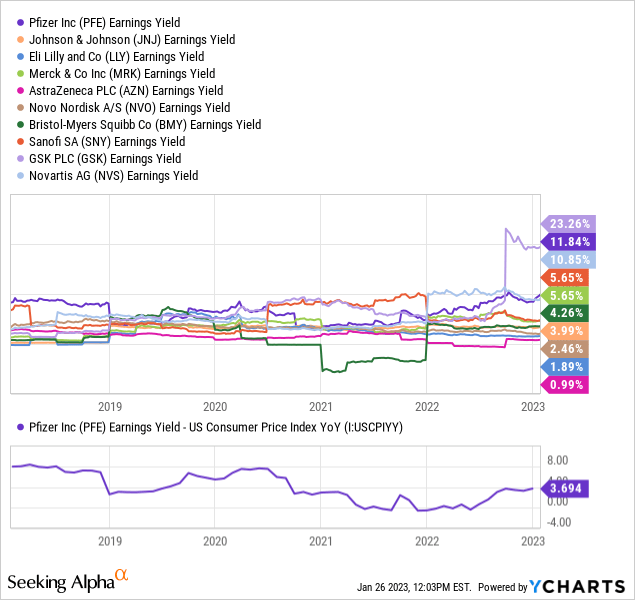

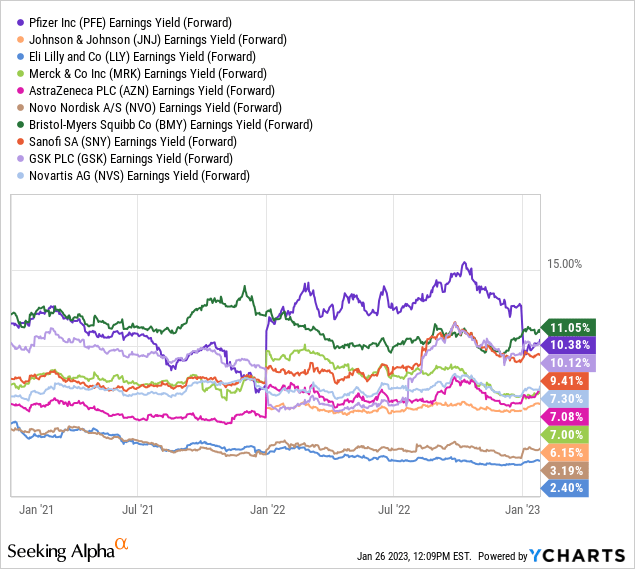

The final level I need to make revolves round Pfizer’s excessive degree of earnings yield out there to traders in 2022 and projected in 2023 vs. the present sharp rise in cost-of-living changes. I’ve harped on this challenge because the center of 2021 – rising CPI charges of inflation are sometimes thought-about the “minimal” threshold for profitable funding returns. Proudly owning an organization with a 2% earnings (or free money move) yield during times of excessive inflation is borderline suicide as a rule. That is the primary motive high-flying Huge Tech shares have crashed over the past 18 months. (And, a recession in company earnings may drive U.S. shares even decrease this 12 months). At present’s inflation charge of 6.5% requires me to solely think about shopping for equities delivering money returns above this degree. I don’t need to lose wealth upfront assured by way of a subpar earnings yield.

Effectively, Pfizer passes my inflation charge minimal with a trailing (11%) and ahead (10%) earnings yield effectively above 6.5% presently. Beneath are graphs of this evaluation vs. friends, that are struggling typically to maintain up with fundamental inflation for repeatable money returns in your funding greenback. Pfizer’s +3.7% adjusted return above the trailing inflation charge is no less than in the course of its 5-year vary (roughly 80% of U.S. equities fail to ship returns above the inflation charge in the present day, one other argument our inventory market stays overvalued!).

YCharts – Huge Pharma, Earnings Yield, 5 Years, with Pfizer vs. CPI Inflation

YCharts – Huge Pharma, Ahead Projected Earnings Yield, 2 Years

Remaining Ideas

Pfizer within the low-$40s is precisely the kind of setup free money move traders like Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) like to buy. A big, brand-name blue chip with tremendous excessive margins and buyer goodwill constructed up over many years, promoting at a ridiculously low value/valuation, after Wall Road sentiment turns bitter on the enterprise for a brief time period. I think in a number of months we are going to hear a variety of hedge funds, billionaires, and conglomerates like Berkshire have bought main positions throughout January. Why not get into the inventory at an amazing value presumably with them?

Wall Road analysts have been factoring in a slowdown in COVID associated product gross sales for over a 12 months. Now, bearish sentiment is shifting into emotional overdrive. Imagine it or not $44 for a share value is mainly the identical as late 2018’s excessive commerce, BEFORE an estimated $40 to $50 billion pandemic windfall in money arrived for the corporate (measured in opposition to the present $250 billion fairness market capitalization). Does this make sense, with Pfizer now sitting on its greatest stability sheet since 2009, flush with money, prepared for years of reinvestment and accretive acquisitions? No.

YCharts – Pfizer, Weekly Worth Modifications, 5 Years

Relying on the 2023 way forward for COVID associated gross sales, I’m nonetheless modeling a 12 months finish value of $55 to $60 per share. From $44 now, together with projected dividends, that works out to a strong +28% to +40% complete return goal from one of many high defensive names traditionally, going right into a probably critical recession.

Even when COVID variants do not make information headlines in 2023-24, excessive charges of sickness should still require new annual photographs and sturdy gross sales demand for Paxlovid. One other necessary bullish argument in favor of proudly owning Pfizer’s main COVID property is the corporate is working exhausting on new mRNA applied sciences to deal with all types of viruses from influenza and shingles to even deadlier ailments like most cancers. It’s solely doable, working outcomes previous 2024 will proceed at higher than presently forecasted charges, due to Pfizer’s profitable 2020-21 therapy innovations and offspring concepts from them.

What is the draw back threat of proudly owning the strongest stability sheet and smartest cut price valuation on money move era in Huge Pharma? My reply could be very restricted threat from $44 is the truth of in the present day’s scenario. Maybe a inventory market crash may pull Pfizer underneath $40 to as little as $35, however I doubt a critical recession would do the identical by itself. The inventory has a historical past of outperformance throughout bear markets on Wall Road and recessions on most important road. Administration may merely intervene and purchase again additional inventory with its money to stop an outsized share value decline from the low-$40s.

I’m modeling worst-case draw back potential to $35 (-17% TR) vs. best-case upside to $60 (+40% TR) over the following 12 months. Stronger working outcomes than in the present day’s low-balled, fear-induced analyst forecast, mixed with falling inflation charges and flight-to-safety shopping for by traders (on high of possible share buyback will increase) means considerably increased quotes might play out by 2024.

I can envision $4.75 in EPS for 2024 and a suitable P/E of 18x (much like present S&P 500 estimates) delivering an $85 share value in 18-24 months. Such can be good for a complete return of +100% (+40% or better compounded yearly) in your funding in the present day. The place else can you discover comparable upside from a conservatively-positioned and managed asset? I can’t discover one other.

Thanks for studying. Please think about this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is really useful earlier than making any commerce.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.

from NYSE Updates – My Blog https://ift.tt/J0z6iVE

via IFTTT

No comments:

Post a Comment