As a dealer, your success will depend on your potential to establish chart patterns that may assist you to seize directional market actions. The bullish and bearish harami candlestick patterns are two such patterns that may present worthwhile perception into potential development reversals. The bullish harami, which consists of a small bullish candle that falls throughout the earlier bearish candle, can sign the tip of a downtrend and the beginning of an uptrend. The bearish harami, however, is the alternative and may sign the tip of an uptrend and the start of a downtrend. On this article, we’ll take a look at these patterns and the way you should use them to enhance your buying and selling technique.

Bullish Harami Candlestick Sample – A Reversal Sign to Watch Out For

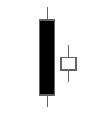

Should you’re in search of a chart sample that may sign the beginning of a reversal in a downtrend, the bullish harami may be value expecting. This minimal two-candle sample sometimes consists of a small bullish candle with a value vary that falls throughout the earlier bearish candle that closed decrease. Whereas it could seem at any level throughout a value vary, it has essentially the most significance throughout a chart’s downtrend as it could sign that the low is in and that the chart could also be able to reverse.

Understanding the Bullish Harami Candlestick Sample

The time period “harami” comes from the Japanese phrase “pregnant.” This candle sample is usually used metaphorically to explain a big bearish “mom” candle that’s “pregnant” with a smaller bullish “child” candle.

When analyzing the sample, merchants usually take a look at the second bullish candle to see if it’s a doji. In that case, it could point out that sellers couldn’t drive costs any decrease, and bullish sentiment set in, inflicting it to shut greater than the open. Moreover, volatility tends to contract throughout this sample, and the smaller buying and selling vary suggests larger settlement by merchants at these costs.

The Bullish Harami as a Reversal Sign

As talked about, the bullish harami is often seen as a reversal sign throughout a downtrend. It is because no newer low in value is about, and it exhibits a excessive chance sign for a reversal again to greater costs. The sample tends to have higher odds of working when it happens on a chart in an oversold space, reminiscent of a 30 RSI or a decrease 2nd or third deviation from the 20-day transferring common.

In conclusion, the bullish harami candlestick sample is efficacious for merchants figuring out potential reversal alerts. By understanding the mechanics of this sample and the circumstances that are inclined to make it more practical, merchants can add it to their arsenal of technical evaluation instruments and use it to make extra knowledgeable buying and selling choices.

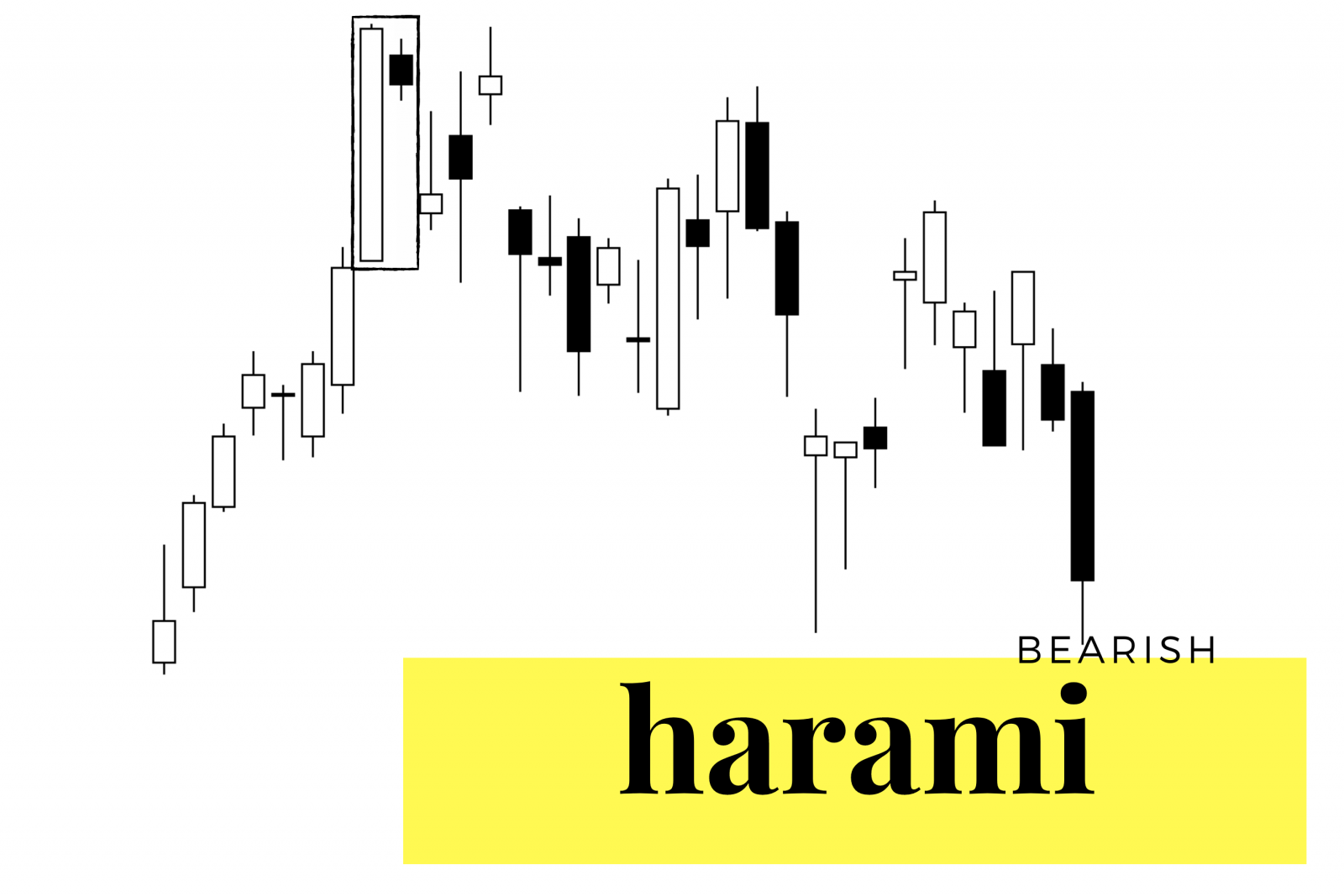

Bearish Harami Candlestick Sample: A Bearish Reversal Sign in Buying and selling

Should you’re a dealer, you understand the significance of figuring out traits and reversals out there. One device that may assist you to with that is the bearish harami candlestick sample. Let’s take a look at this sample, its traits, and use it in your buying and selling technique.

Understanding the Bearish Harami Candlestick Sample

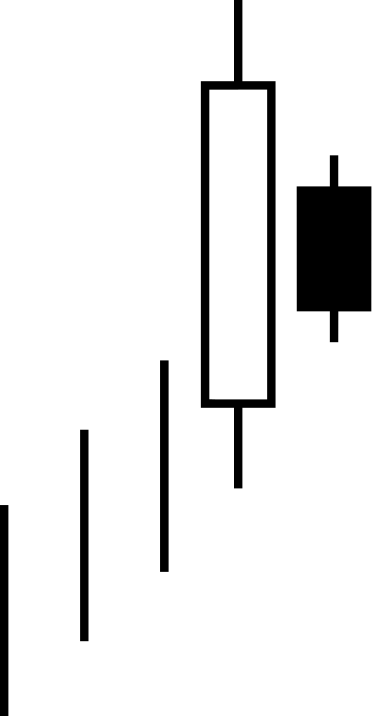

The bearish harami is a two-candlestick sample that alerts the potential for a reversal throughout an uptrend. The primary candlestick is a big bullish candle, adopted by a smaller bearish candlestick. The primary candlestick’s physique should totally engulf the opening and shutting costs of the second candlestick. This sample is bearish, suggesting that the uptrend could also be dropping steam and will reverse course.

Decoding the Dimension and Vary of the Second Bearish Candle

The dimensions and vary of the second bearish candle can present perception into the chance of a reversal. A smaller bearish candlestick signifies a better probability of a drop to decrease costs. It is because a small bearish candlestick alerts consumers are not current at greater costs, and the value has misplaced momentum.

Utilizing the Bearish Harami to Handle Your Trades

The bearish harami can lock in earnings for lengthy positions throughout uptrends, because it means that the uptrend might finish. The second bearish candle confirms that the excessive on the chart could also be in for now. A brief place commerce could be taken on the finish of the second bearish candle sign, with a cease loss on the transfer above that bearish candle. Value targets could be positioned for earlier assist ranges on the chart in value or utilizing a technical indicator just like the RSI or a transferring common.

Confirming the Bearish Harami with Different Indicators

You’ll be able to search for extra affirmation to extend the chance of a profitable commerce. A technique to do that is to search for the bearish harami close to the overbought 70 RSI on a chart or at three or extra normal deviations above the 20-day transferring common. This sample additionally confirms if the following candle after these first two can also be bearish.

Conclusion

The bearish harami candlestick sample is a worthwhile device for merchants figuring out potential reversals in an uptrend. The bullish harami candlestick sample is a useful device for merchants figuring out potential reversals in a downtrend. By understanding the traits of this sample and interpret its alerts, you’ll be able to enhance your buying and selling technique and make extra knowledgeable choices. Do not forget that no buying and selling technique is foolproof. Managing your threat by correct place sizing and utilizing cease losses to guard your capital is crucial for long-term success and, in lots of instances, simply surviving dropping streaks to get to the massive winners.

from Trading Strategies – My Blog https://ift.tt/iOYlbAX

via IFTTT

No comments:

Post a Comment