Effectively that was actually a shock!

Heading into earnings Wednesday night, analysts polled by The Fly had predicted that Meta Platforms (NASDSAQ:META) — the artist previously referred to as Fb — would earn $2.22 per share on gross sales of $31.5 billion. Because it turned out, Meta missed the earnings estimate, at the least, by a metric mile, reporting income of solely $1.76 per share — a $1 billion-wide earnings miss.

On the plus aspect, gross sales got here in at a powerful $32.2 billion, and Meta hit a “milestone,” reporting that for the primary time ever it has reached 2 billion day by day energetic customers.

Traders broke out in applause. Regardless of the earnings miss, in after hours buying and selling, Meta inventory soared 20%, erasing greater than six months of losses from the inventory, and returning Meta shares to costs final seen in June 2022.

And no surprise. In response to Mark Zuckerberg, 2023 goes to be the “Yr of Effectivity” at Fb — sorry, “Meta.”

Regardless of reporting a 4% 12 months over 12 months decline in income in This autumn (complete revenues dropped only one% for the 12 months), a 22% enhance in prices (23% for the 12 months), and a staggering 52% decline in per-share income (38% for the 12 months), Meta undeniably beat earnings estimates with a stick. What’s extra, administration predicted it’ll beat income expectations in Q1 2023, delivering gross sales in a variety from $26 billion to $28.5 billion. And over the course of this 12 months, administration promised to rain in capital spending by as a lot as 19% (under earlier expectations), and to chop complete prices by as a lot as 11%.

All of because of this, after lacking earnings in This autumn 2022, Meta is most definitely going to outperform earnings expectations all via 2023.

Commenting on the outcomes, Baird analyst Colin Sebastian declared unqualifiedly that “Meta [is] getting its mojo again,” “rising expense self-discipline,” and “making enhancements with each customers and advertisers.” After praising Meta’s efficiency in This autumn 2022 and predicting nice issues for 2023, Sebastian proceeded to reiterate an “outperform” score on Meta inventory.

But, Meta Platforms inventory isn’t out of the woods simply but. As a result of guarantees of effectivity however, the easy reality is that as of This autumn 2022, at the least, Meta remains to be on a downtrend. Gross sales for the quarter, keep in mind, have been worse than for 2022 as an entire — down 4%. Earnings for This autumn (down 52%) have been additionally worse than full-year earnings (down 38%). And whereas Meta’s steering for Q1 holds out the potential for a return to gross sales development if administration maxes out its prediction of $28.5 billion, if gross sales fall in the direction of the decrease finish of the steering vary ($26 billion), properly, that may be a decline of seven%.

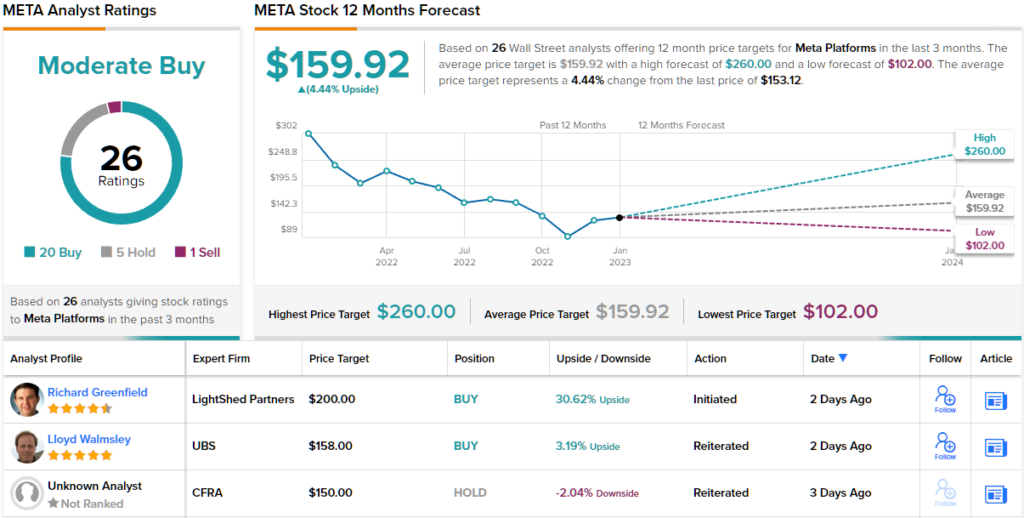

Wanting on the consensus breakdown, the vast majority of analysts are bullish on Meta’s prospects; 20 Buys, 5 Holds, and 1 Promote add as much as a Average Purchase consensus score. (See Meta inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your individual evaluation earlier than making any funding.

from Stock Market News – My Blog https://ift.tt/ZEoVLhc

via IFTTT

No comments:

Post a Comment