What Is a Taking pictures Star?

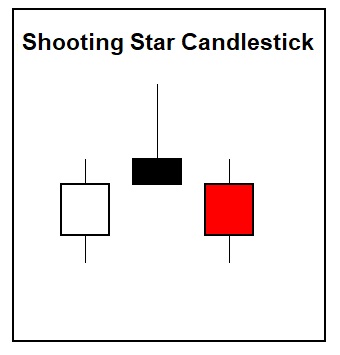

A taking pictures star candle or pin bar reversal is a bearish candlestick sample showing throughout an uptrend on a chart. A taking pictures star tends to have lengthy higher wicks and virtually no decrease wicks, together with a candle physique that’s often small. A taking pictures star often occurs when a value opens after which goes a lot greater intra-day however reverses and closes decrease close to the opening value or decrease. The bigger the higher wick is in relation to the candle physique, the extra bearish it’s, because it has created new overhead resistance and exhibits a rejection by consumers at greater costs.

- A taking pictures star is a bearish sign and will point out the tip of an uptrend and the elevated chance of a downtrend starting.

- It’s bearish as a result of it exhibits the rejection of upper costs and the start of promoting stress.

- If the subsequent candle after the taking pictures star has a decrease excessive and decrease low, it will increase the chance of the tip of the uptrend.

- Worth closing again over the excessive of the day of a taking pictures star invalidates the bearish sign.

- Taking pictures star candles are finest utilized in confluence with different indicators like overbought readings, key transferring averages, or resistance zones to place the sample contained in the context of the general chart.

What Does the Taking pictures Star Inform You?

The taking pictures star candlestick sample tells a dealer or investor that there’s a excessive chance that value motion has reached the highest of the chart, at the least within the quick time period. This indicators that the percentages have shifted to disclose consumers have turn out to be exhausted at greater costs, and sellers overwhelmed them to take value motion again to the place it began or decrease. Whereas consumers and sellers are at all times even in every transaction, the value motion reveals the precise provide and demand metrics at completely different ranges. The taking pictures star exhibits an amazing provide at greater costs and an absence of demand by consumers to maintain pushing a chart greater. The taking pictures star exhibits you bearish sentiment has set in on a chart beforehand in an uptrend.

What Makes A Taking pictures Star Bearish?

- A failure of the chart to carry new excessive costs.

- A reversal again to the opening of the candle.

- A big higher wick.

- The candle is often black or crimson, displaying a decrease shut than the open.

Instance of The right way to Use the Taking pictures Star

A taking pictures star candlestick sample can be utilized as a short-sell sign on a chart you might be bearish on. It confirms that the chart might have began a reversal because it didn’t go greater in value and reversed decrease. A brief-sell has good odds of success on entry on the subsequent bearish candle after the taking pictures star candle for affirmation that value is following by means of to decrease costs. A cease loss could be set on an in depth above the taking pictures star, with a revenue goal set at earlier assist or resistance ranges on the chart or the 50 RSI. A trailing cease might be moved to every earlier candle excessive as an end-of-candle cease to lock in earnings if there’s a sizable reversal to the upside.

How To Spot Resistance With Taking pictures Star Patterns

The taking pictures star candlestick sample is finest utilized in confluence with different indicators like overbought readings, key transferring averages, or resistance zones. They’re most significant and correct after they happen at overbought areas just like the 70 RSI or the third deviation from the 20-day transferring common. A taking pictures star that kinds at an overhead Fibonacci degree or key transferring common may also present a bearish confluence. A taking pictures star that happens at greater costs whereas the RSI is at a decrease degree than the earlier excessive can present a bearish divergence between the value and the indicator.

Utilizing The Taking pictures Star To Spot Promote Indicators

A taking pictures star can sign extremely precisely that it’s time to lock in earnings on any lengthy positions throughout a robust uptrend. The chance/reward ratio is now not favorable when a chart reverses strongly after an prolonged uptrend. The taking pictures star could be each a brief sign for brand new positions or an exit sign for present lengthy positions.

Limitations of the Taking pictures Star

The taking pictures star candlestick sample isn’t predictive. It simply exhibits there are better odds of 1 factor occurring than one other sooner or later primarily based on the present value motion conduct on the chart. It will probably create an edge by displaying goal bearish value motion and never only a subjective opinion about what ought to occur subsequent. It’s a momentum reversal sign, not a assured revenue. Cease losses should nonetheless be used on all trades to restrict threat publicity.

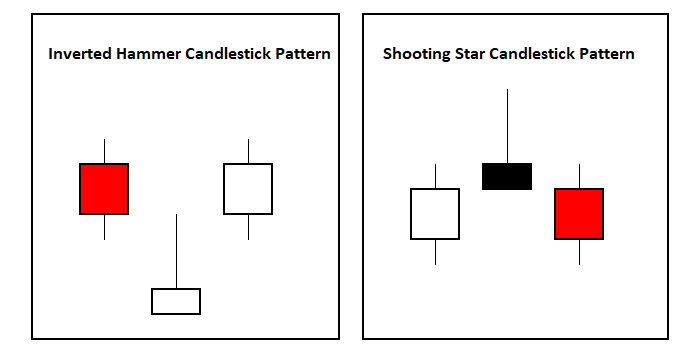

The Distinction Between the Taking pictures Star and the Inverted Hammer

A taking pictures star appears like an inverted hammer, but it surely’s bearish within the context of an uptrend. The taking pictures star candle has a decrease shut than the open and is often a crimson or black candle.

If an inverted hammer happens close to the lows on a chart, it may well sign a bullish reversal. A bullish inverted hammer exhibits consumers bid up value motion after rejecting new decrease lows. The inverted hammer exhibits dip consumers current in a downtrend and that they held costs up till the shut greater than the candle lows. This can be a stealthy sign of demand inside a downtrend. The lengthy wick of the inverted candle usually pierces contained in the earlier candle vary on the chart. If the subsequent candle on the chart after the inverted candle is bullish, it confirms the bullish sign displaying that at the least a short-term low in costs may be in, and better costs forward turn out to be the brand new chance.

Key takeaways

The taking pictures star candlestick is without doubt one of the strongest bearish candlestick indicators in technical evaluation displaying merchants a excessive chance that it’s time to lock in earnings in lengthy positions and that it might even be a very good time to go quick on the chart the place it happens.

from Trading Strategies – My Blog https://ift.tt/vTOYaql

via IFTTT

No comments:

Post a Comment