Knowing which stock trading platform to open an account with can be a challenging process when there is often very little to separate one broker from another.

In order to make the process easier, it’s a good idea to focus on core metrics – such as those surrounding supported markets, fees, usability, account minimums, and customer service.

In this guide, we compare the 10 best stock trading platforms in the market right now so that you can make a quick and informed decision.

The 10 Best Stock Trading Platforms

The 10 best stock trading platforms in the market for 2022 can be found in the list below:

- eToro – Overall Best Stock Trading Platform in 2022

- Webull – Popular Stock Trading Platform With No Account Minimum

- Interactive Brokers – Trusted Stock Trading Platform Offering Access to Thousands of Equities

- E*TRADE – Good Stock Trading Platform for Long-Term Investments

- Schwab – $0 Commissions on US-Listed Stocks, ETFs, and Options

- Fidelity – Buy US Stocks From Just $1 Per Investment

- SoFi – User-Friendly Stock Trading Platform Offering US Equities at 0% Commission

- TD Ameritrade – Top-Rated Stock Trading Platform for Seasoned Investors

- Robinhood – Best Online Stock Trading Platform for Beginners

- Ally Invest – Great Mobile App for Trading Stocks

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

You will find full and detailed reviews of the 10 stock trading platforms listed above further down in this comparison guide.

Top Stock Trading Platforms Reviewed

Looking to buy stocks with low fees? Finding the best stock trading platform for your requirements is a process that can be cumbersome.

Not only do you need to bear in mind that there are dozens of platforms offering financial services to US clients, but you also need to cross-check a wide variety of factors.

As noted earlier, this includes the markets supported by the platform, what fees it charges, and how much you need to invest to meet the minimum requirement.

You can fast-track the decision-making process by reading our reviews of the 10 best stock trading platforms in 2022.

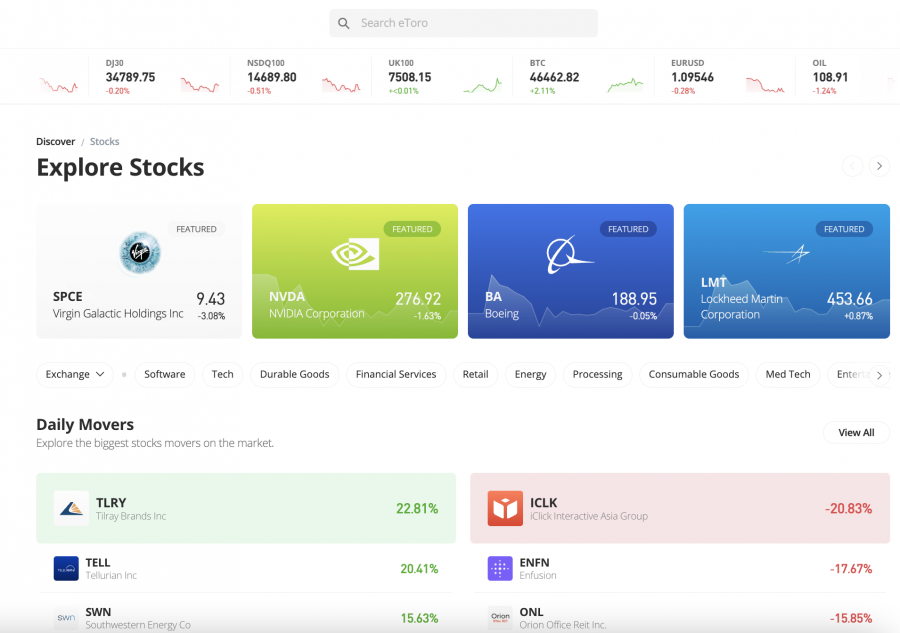

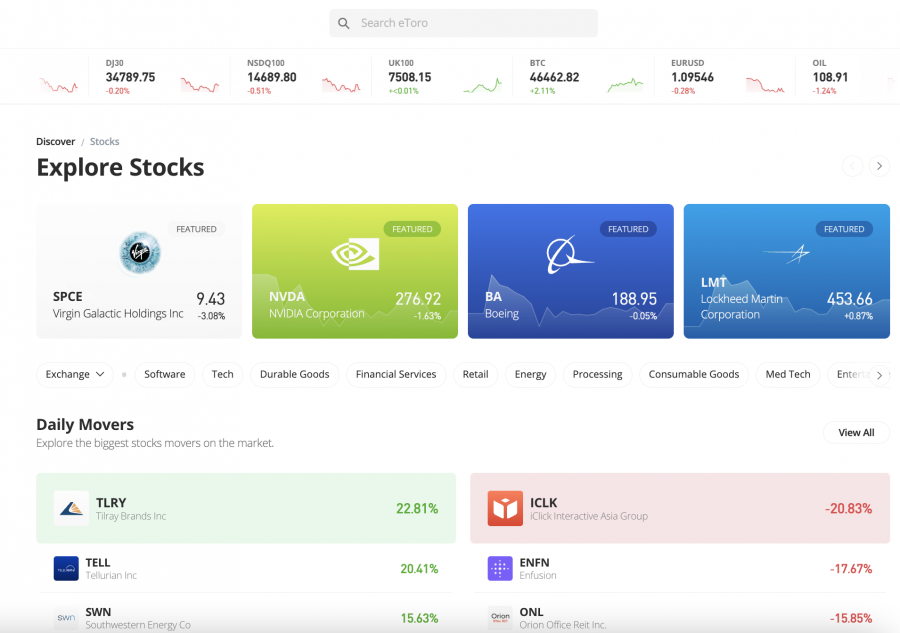

1. eToro – Cheapest Stock Trading Platform for 2022

Our comparison guide found that eToro is the overall best stock trading platform in the market right now. This popular trading platform gives you access to a wide variety of stocks from both the US and international markets. When you buy stocks on eToro you’ll be doing so on a zero-commission basis. This covers everything from the best oil stocks to the most undervalued stocks.

Our comparison guide found that eToro is the overall best stock trading platform in the market right now. This popular trading platform gives you access to a wide variety of stocks from both the US and international markets. When you buy stocks on eToro you’ll be doing so on a zero-commission basis. This covers everything from the best oil stocks to the most undervalued stocks.

While many online platforms now offer 0% commission stocks on US-listed markets, we were unable to find another broker that also offers this on foreign equities. As such, eToro is a great option if you are looking to trade stocks across multiple markets in a low-cost manner.

Moreover, eToro supports fractional ownership from just $10 per trade. This will appeal if you are looking to trade stocks like Google or Amazon, which require a minimum outlay of thousands of dollars per share. In addition to stocks, eToro also offers hundreds of commission-free ETFs. You can also buy cryptocurrency here from just $10 per trading position.

This covers nearly 60 digital currencies – including but not limited to Bitcoin, Dogecoin, Sandbox, AAVE, Ethereum, and Shiba Inu. eToro also offers social trading cryptocurrency features, which allow you to leave comments under your favorite markets. Other eToro users can then reply and even ‘Like’ your posts. You can also add eToro users to your friend list.

We also like the copy trading tool offered by this top-rated stock trading platform. This offers the opportunity to trade stocks passively, as you will be investing in a seasoned eToro investor. Anything that they trade will subsequently be mirrored in your own portfolio – at a proportionate amount.

There are thousands of traders to choose from and the minimum investment is just $200. Another popular feature that we came across when reviewing eToro is its smart portfolios. Not only does this allow you to invest in a diversified basket of stocks via a single trader, but your portfolio will be managed and rebalanced by the eToro team.

You can select a smart portfolio that aligns with your trading objectives – and each market targets a specific niche strategy. For example, there are smart portfolios that focus on everything from renewable energy and driverless cars to 5G. We also like eToro for its mobile stock trading app for iOS and Android.

In order to get started with eToro, you can open an account and deposit from just $10. No fees are charged on deposits made in US dollars, which is also the case with withdrawals. Supported deposit methods are inclusive of Paypal, Neteller, Visa, MasterCard, Maestro, ACH, and bank wires. Finally, eToro is heavily regulated and the platform holds various tier-one licenses.

| Minimum Deposit | $10 |

| Fractional Shares? | Yes – $10 minimum |

| Pricing System | 0% commission on all stocks |

| Core Features | Copy trading, smart portfolios, no fees on foreign stocks |

Pros

- Overall best stock trading platform

- Thousands of US and international stocks listed

- 0% commission on all stocks

- Minimum deposit and stock trade is just $10

- Copy trading and smart portfolios

- No fees on USD deposits

- Top-rated mobile app

- Buy stocks with a credit card and other payment methods

Cons

- Not suitable for high-frequency trading

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull – Popular Stock Trading Platform With No Account Minimum

Webull is a US-based stock trading platform that is popular with both newbies and experienced pros. Those with experience in the stock trading space will appreciate the advanced tools and features on offer – which is inclusive of technical indicators and screeners.

With that said, if you’re a complete beginner, you will like Webull for its easy-to-use platform, which requires no minimum deposit threshold to get started. Moreover, you can invest in stocks at Webull from just $5 per trade. As such, even if you only have a small amount of money to invest, Webull has you covered.

When it comes to fees, you will not be charged any commissions at Webull. Spreads can be wide on smaller-cap stocks, and ADRs are charged on a per-share basis. You will also be charged an $8 fee if you deposit funds via a domestic bank wire, albeit, ACH is free. Fees are also charged when you trade on margin – which requires a minimum deposit of $2,000.

In terms of supported markets, Webull offers thousands of stocks across the NYSE and NASDAQ. However, access to international stock exchanges is not offered. You can also invest in cryptocurrency here from just $1 per trade, and markets include Bitcoin, Ethereum, and Cardano. Webull also supports stock options and funds.

If you’re torn between our top-two brokers, you can read our eToro vs Webull review for further comparisons and in-depth analysis.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $5 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | $0 account minimum, suitable for all skillsets, good selection of retirement accounts |

Pros

- No minimum deposit

- Minimum stock investment is just $5

- Low fees when trading stocks

- Streamlined onboarding process

- User-friendly platform

Cons

- International stocks offered via ADRs only

Your capital is at risk.

3. Interactive Brokers – Trusted Stock Trading Platform Offering Access to Thousands of Equities

Interactive Brokers was historically a platform utilized only by seasoned investors and traders with a large sum of capital to inject into the financial markets. However, this highly established stock trading platform has since opened its doors to budget investors.

First and foremost, there is no minimum deposit requirement at Interactive Brokers when you open a self-directed account. This simply means that you are required to pick your own stock investments without the assistance of an advisor. Second, this popular stock trading platform allows you to invest in US-listed equities from just $1.

This is the lowest fractional share offering that you will find in the US brokerage scene. Another reason why Interactive Brokers is now attracting casual investors is that there are no commissions charged on US-listed stocks and ETFs. As such, investing in the domestic markets can be achieved on both a budget and without breaking the bank.

We also like Interactive Brokers for its commitment to asset diversity. This covers thousands of stocks and ETFs from the US and international markets, albeit, foreign-listed assets are not commission-free. Interactive Brokers is also one of the best penny stock trading platforms to consider – should you require access to the OTC markets.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $1 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | Thousands of markets, no account minimum, invest in stocks from $1 |

Pros

- Highly advanced trading platform

- Thousands of stocks on offer

- Best penny stock trading platform

Cons

- Interntional stocks are charged at a premium

- Perhaps not suitable for beginners

- Specialist accounts come with high minimum deposit requirements

4. E*TRADE – Good Stock Trading Platform for Long-Term Investments

![]()

![]()

E*TRADE is another US-based platform that has a great reputation with Americans. In particular, E*TRADE is favored for its retirement accounts – which covers a wide selection of IRAs. This will suit those of you that wish to invest in the stock markets as part of a long-term retirement plan.

Fees are also very competitive at E*TRADE, with the platform supporting 0% commission investment on all of its US-listed stocks. We should note that unlike the previously reviewed eToro, Webull, and Interactive Brokers – there is no support for fractional shares at E*TRADE.

And as such, investing in expensive stocks like Amazon will require a huge capital outlay. On the other hand, you won’t need to meet a minimum deposit when opening a standard self-directed trading plan, nor are any deposit or withdrawal fees charged. E*TRADE does, however, fall short when it comes to providing access to international stock exchanges.

| Minimum Deposit | $0 |

| Fractional Shares? | No – not supported |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | Great selection of IRAs, simple investment platform, huge selection of US-listed stocks |

Pros

- Great selection of retirement accounts

- No minimum deposit and accounts take just 10 minutes to open

Cons

- No fractional shares

- Limited number of trading tools

- Pre-built portfolios require a $500 investment

5. Schwab – $0 Commissions on US-Listed Stocks, ETFs, and Options

Schwab is an established US-based stock trading platform that gives you access to a huge variety of markets. When investing in foreign stocks here, a premium will be charged. However, Schwab allows you to invest in US-listed stocks without paying any trading commission.

Schwab is an established US-based stock trading platform that gives you access to a huge variety of markets. When investing in foreign stocks here, a premium will be charged. However, Schwab allows you to invest in US-listed stocks without paying any trading commission.

We also like that Schwab has since joined the fractional investment bandwagon – with US-listed stocks available to purchase from just $5. With that said, your chosen stock must be listed on the S&P 500 for this to apply. Another option at Schwab is to invest in a thematic stock portfolio – each of which targets a specific market.

This will be managed on your behalf, which is ideal for those of you seeking passive investment tools. Moreover, there are no added commissions to pay on thematic portfolios. When it comes to user-friendliness, Schwab seems to have created a stock trading platform that is suitable for all skillsets.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $5 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | Thematic portfolios, $5 minimum stock trade, great reputation |

Pros

- Buy fractional shares from just $5

- Top broker for creating automated portfolios

Cons

- Fractional shares only available on S&P 500 companies

- Non-US stocks come with high fees

- Platform can be overbearing for newbies

6. Fidelity – Buy US Stocks From Just $1 Per Investment

![]()

![]() Fidelity is another stock trading platform that was traditionally favored by large-scale investors. However, this top-rated platform now supports fractional share investments from just $1 per trade.

Fidelity is another stock trading platform that was traditionally favored by large-scale investors. However, this top-rated platform now supports fractional share investments from just $1 per trade.

And, on the proviso that your chosen stocks are listed on the NYSE or NASDAQ, you will not pay a single cent in trading commission. Fidelity is also known for its extensive suite of asset classes in addition to just stocks. This includes everything from fixed-rate bonds and mutual funds to ETFs. We also like that Fidelity offers a huge number of passive investment tools.

This includes managed portfolios and even access to a financial advisor. Additional fees and commissions on these products will apply. If you are opening a self-directed trading plan at Fidelity, you will not need to meet a minimum deposit. On the other hand, managed portfolios come with various minimums – so be sure to check this before opening an account. Fidelity also offers a popular trading app for iOS and Android.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $1 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | Managed portfolios and financial advice, $1 minimum stock trade, popular mobile app |

Pros

- Stocks by the Slice tool allows you to buy shares from just $1

- Thousands of financial instruments listed

Cons

- Mobile app is a bit cumbersome for beginners

- High-level research tools are best suited for experienced traders

- Financial planning accounts come with high minimums

7. SoFi – User-Friendly Stock Trading Platform Offering US Equities at 0% Commission

SoFi was founded in 2011 with the view of allowing Americans to consolidate all of their financial needs via a single platform. Not only does the platform offer stock investment services, but also digital checking accounts, loans, auto financing, and more.

SoFi was founded in 2011 with the view of allowing Americans to consolidate all of their financial needs via a single platform. Not only does the platform offer stock investment services, but also digital checking accounts, loans, auto financing, and more.

Furthermore, SoFi has since had its chartered banking application approved, which will open up the doors to even more financial services. In terms of its stock investment wing, SoFi is home to thousands of US-listed equities. There is no support for foreign exchanges, albeit, US stocks can be bought and sold without incurring any commission.

The minimum stock investment permitted at SoFi is just $5, while for digital currencies, this stands at $10. SoFi also offers access to upcoming IPOs and hundreds of ETFs. We also like SoFi for its automated portfolios, which allow you to build a pre-made basket of investments based on your risk tolerance and long-term financial goals.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $5 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | Consolidation of banking and investing, no minimum deposit, very user-friendly |

Pros

- Very user-friendly – ideal for beginners

- Offers 0% commission on US stocks

Cons

- No support for international stocks

- Too basic for seasoned investors

- IPO allocation is limited

8. TD Ameritrade – Top-Rated Stock Trading Platform for Seasoned Investors

![]()

![]()

TD Ameritrade is one of the best stock trading platforms for those that seek to invest large sums of capital and want access to advanced tools. Regarding the former, there is no support for fractional shares on this platform, which will likely be a deal-breaker for budget investors.

Nonetheless, TD Ameritrade offers a proprietary trading suite called thinkorswim, which offers everything you need to research the markets on both a technical and fundamental level. To take things to next level, TD Ameritrade offers its thinkorswim platform as downloadable software – which will particularly suit algorithmic traders.

When it comes to supported markets, TD Ameritrade offers thousands of US and international stocks, alongside mutual funds, ETFs, bonds, and more. US-based equities can be traded at 0% commission. We also like TD Ameritrade for its top-rated customer support, which includes email, telephone, and even via a US branch.

| Minimum Deposit | $0 |

| Fractional Shares? | No – not supported |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | In-branch support, high-level trading suite, ideal for algorithmic traders |

Pros

- Highly advanced thinkorswim trading suite

- Top-rated broker for seasoned investors

Cons

- No fractional shares

- Commission-free access to US-listed stocks online

- Too advanced for beginners

9. Robinhood – Best Online Stock Trading Platform for Beginners

Robinhood is one of the best-known stock market trading platforms in the US marketplace. This platform allows you to open an account without meeting a minimum deposit. Moreover, you can invest in stocks from just $1 per trading order.

Robinhood is also popular for its low fee policy. This allows you to buy and sell stocks, options, ETFs, and cryptocurrencies without paying any trading commissions. You can also deposit and withdraw funds on a fee-free basis. Robinhood does not charge any monthly fees on its standard account. However, any deposits over $1,000 will need to wait 1-3 days.

If you want to deposit a higher amount of money instantly, then you can open a gold account for just $5 per month. The gold account will also enable you to trade stocks on margin. Ultimately, Robinhood won’t be suitable for serious investors – as the platform lacks trading notable analysis and research tools.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $1 minimum |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | Great for casual traders, margin accounts offered, no commissions charged on any supported assets |

Pros

- Great option for first-time investors

- No commissions charged on US-listed stocks, options, ETFs, or cryptocurrencies

Cons

- Only offers international shares via ADRs

- Standard accounts limit instant deposits to $1,000

- No passive investment tools

10. Ally Invest – Great Mobile App for Trading Stocks

Ally Invest is one of the best stock trading platforms in the market for mobile investors. The iOS and Android app has been fully optimized for investing on the go, and opening an account rarely takes more than a few minutes.

You can deposit any amount of your choosing – as Ally Invest does not stipulate any account minimums. All of the stocks listed on the Ally Invest app can be traded commission-free. However, it did surprise us to learn that Ally Invest does not support fractional shares – especially when you consider that the app has been designed with newbies in mind.

Ally Invest also allows you to trade other asset classes – which includes ETFs, cryptocurrencies, and bonds. If you want to trade stocks on margin, this is also supported by the platform. We should also note that just like SoFi, Ally Invest offers checking accounts, loans, mortgages, and more – all via a single hub.

| Minimum Deposit | $0 |

| Fractional Shares? | No – not supported |

| Pricing System | 0% commission on US-listed stocks |

| Core Features | Financial and investing services combined, thousands of US stocks and ETFs, great user interface |

Pros

- Very user-friendly – ideal for beginners

- Offers 0% commission on US stocks

Cons

- No support for international stocks

- Too basic for seasoned investors

- IPO allocation is limited

Top Stock Trading Platforms Compared

For a comparison of the 10 best stock trading platforms reviewed on this page – check out the table below.

| Stock Brokers | Minimum Deposit | Fractional Shares? | Pricing System |

| eToro | $10 | Yes – $10 minimum | 0% on ALL stocks |

| Webull | $0 | Yes – $5 minimum |

0% commission on US-listed stocks |

| Interactive Brokers | $0 | Yes – $1 minimum |

0% commission on US-listed stocks |

| E*TRADE | $0 | No – not supported |

0% commission on US-listed stocks |

| Schwab | $0 | Yes – $5 minimum |

0% commission on US-listed stocks |

| Fidelity | $0 | Yes – $1 minimum |

0% commission on US-listed stocks |

| SoFi | $0 | Yes – $5 minimum |

0% commission on US-listed stocks |

| TD Ameritrade | $0 | No – not supported |

0% commission on US-listed stocks |

| Robinhood | $0 | Yes – $1 minimum |

0% commission on US-listed stocks |

| Ally Invest | $0 | No – not supported |

0% commission on US-listed stocks |

How we Select the Best Stock Trading Platforms?

We briefly explained earlier that there are a select number of core factors that we look for when reviewing the best stock trading platforms in the market.

If you’re still searching for the best platform for your requirements – read on:

Regulation

The first thing to check when searching for the best stock trading platform for you is the provider’s regulatory standing.

You don’t need to have any concerns if you go with one of the platforms discussed on this page – as each is approved to offer brokerage services in the US.

However, if you come across a platform that didn’t make our list of the 10 best stock brokers for 2022, be sure to check whether or not it is licensed by a body like the SEC.

Range of Stock Markets

If you have your heart set on specific stocks or exchanges – you’ll want to check whether or not the platform supports it before proceeding.

As per our reviews, platforms like eToro, Interactive Brokers, Schwab, and Fidelity not only give you access to thousands of US-based stocks but plenty of international exchanges too.

This will give you the best chance possible of diversifying across a wide number of markets.

Minimum Deposit Requirement

The minimum deposit required by your chosen stock trading platform is another factor to consider. In most cases, standard self-directed accounts require a minimum deposit of just a few dollars – or nothing at all.

However, if you’re looking to open a specialist account that gives you access to retirement products, margin trading, or managed portfolios – then higher limits will likely come into play.

Fractional Ownership

If you’re thinking about investing in expensive stocks like Amazon or Berkshire Hathaway and you’re on a budget, then you’ll want to choose a stock trading platform that offers fractional shares.

This will enable you to buy just a small fraction of one share – often for a few dollars.

Trading Fees

Top stock trading platforms that we came across allow you to deposit funds for free. Moreover, most platforms in this industry now offer 0% commissions on US-listed stocks and ETFs.

However, if you’re looking to invest in stocks that are listed overseas, the only platform we came across that offers this on a 0% commission basis is eToro. Otherwise, you will need to pay a premium to buy foreign equities.

Trading Tools and Features

When searching for the best stock trading platform for beginners, consider whether the provider offers any tools or features that can help you make better investment decisions.

For example, eToro offers a copy trading service that enables you to mirror successful investors like-for-like. The same platform also offers smart portfolios and tailor-made pricing alerts.

Demo Trading

If you are looking to trade stocks for the very first time, then consider choosing a platform that offers demo accounts. This will enable you to trade in a risk-free environment until you get more comfortable with how the stock markets function.

Mobile App

It’s also a good idea to see whether or not your chosen stock trading platform also offers a mobile app for your operating system. This will connect to your main trading account and thus – you will be able to buy and sell stocks on the move.

Payment Methods

The only stock trading platform that we came across that enables you to deposit funds via a debit/credit card or PayPal is eToro.

All of the other platforms that we discussed today will only support traditional payment methods – such as ACH, bank wires, and a check.

Customer Support

The best stock trading platforms in the market offer a great customer experience. This means offering customer support around the clock across email and live chat. Some platforms also offer a telephone support line.

How to Use a Stock Trading Platform

In reading this guide up to this point, you should now have a firm grasp of how to choose the best free stock trading platform for you.

To conclude, we will now show you the required steps to trade at eToro – which is the overall best platform for stock trading in a commission-free manner.

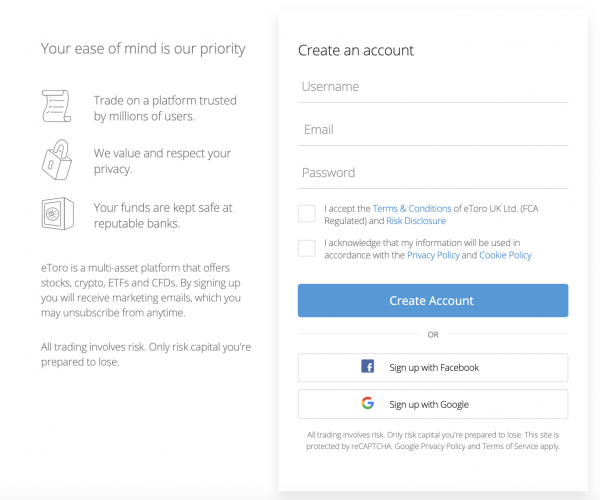

Step 1: Open an eToro Stock Broker Account

First, you will need to register a trading account on the eToro website. Click on ‘Join Now’ and follow the on-screen instructions. eToro will collect some personal information and contact details from you.

You also need to choose a username for your newly created account. Finally, confirm your cell phone number via the SMS code that eToro sends to you.

Step 2: Upload ID

All regulated stock trading platforms will ask you for a copy of your government-issued ID for verification purposes – and eToro is no different. You will also need to upload a document that proves your stated residential address – like a bank statement.

Step 3: Deposit Funds

You will now need to deposit some funds into your stock trading account. If you are based in the US you will only need to deposit $10.

USD deposits and withdrawals are fee-free here and you can choose from a debit/credit card, ACH, Neteller, PayPal, domestic bank wire, and more.

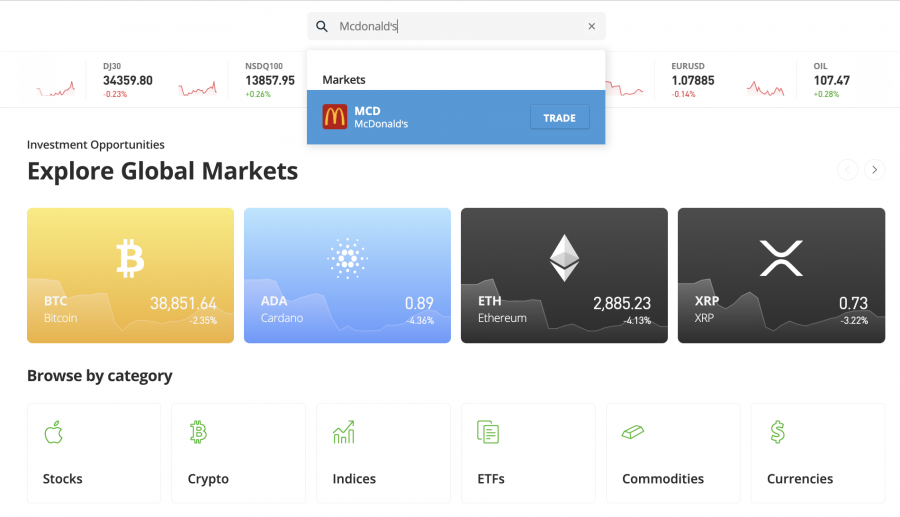

Step 4: Search for Stock to Trade

In the search bar, start typing in the name of the stock that you wish to trade. In our example below, we are searching for McDonald’s.

Click on the ‘Trade’ button to load a buy order box.

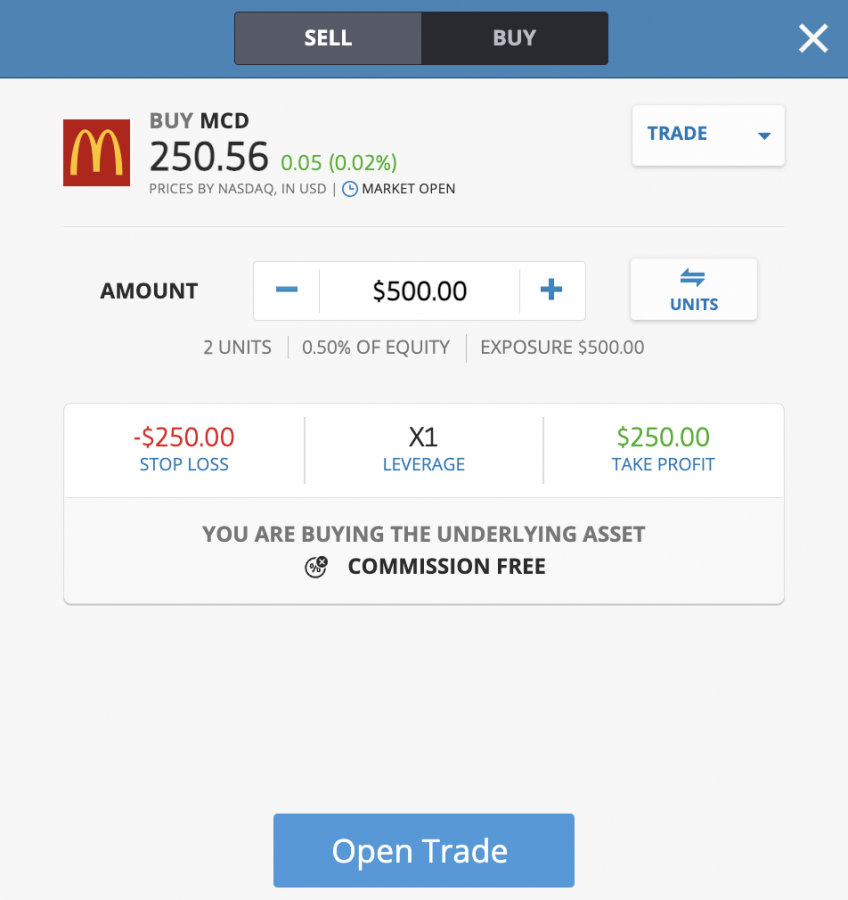

Step 5:Trade Stock

You are now just one step away from placing your first stock trading order. All that is left for you to do is enter the size of your trade-in US dollars.

In our example above, we looking to trade $500 worth of McDonald’s stocks. However, at eToro, you only need to meet a minimum requirement of $10.

After clicking on the ‘Open Trade‘ button, eToro will execute your stock trading position.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

The best stock trading platforms in the market today allow you to invest in US-listed equities at 0% commission and without needing to purchase a full share.

With that said, we found that the overall best stock trading platform for 2022 is eToro – which also offers commission-free investments in foreign share markets.

This top-rated platform requires a minimum stock investment of just $10 via its fractional trading tool and no fees are charged on USD deposits and withdrawals.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Frequently Asked Questions on Stock Trading Platforms

What is the best stock trading platform?

Which stock trading platform is the cheapest?

Are there any free stock trading platforms?

Which stock broker is best for beginners?

from Stock Trading – My Blog https://ift.tt/okrpQ5A

via IFTTT

No comments:

Post a Comment