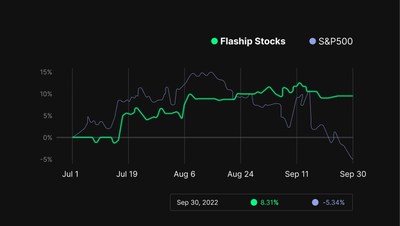

Streetbeat’s Flagship Stocks strategy up 8.3%, continuing to beat today’s market losses, with a Sharpe ratio of 3

Streetbeat surpasses 110,000 customers and $1.2million ARR just 7 months after launch and appoints Cameron Meierhoefer as COO

PALO ALTO, Calif., Oct. 7, 2022 /PRNewswire/ — Streetbeat, an investing and trading platform for stock and cryptocurrencies with a proprietary marketplace of professional investment strategies, has revealed its flagship stocks strategy was up 8.3% in Q3, and 3.4% since inception, net of fees.

Concerns with ongoing inflation, the war in Ukraine and Fed interest rate hikes have caused stocks to fall considerably over the year with the SP500 down by over 5% in Q3, and 23.6% year to date.

Streetbeat, a platform that is powered by a data-driven, patented algorithm which harnesses the power of 1 billion data points to drive investment decisions, enables effective trading strategies that react quickly to changing trends.

Graphs: Performance of Streetbeat Flagship Stocks versus S&P500

Results are based upon an “moderate” risk profile with an account value of $400 or more and are shown net of fees. Results based on price variations since inception 01/27/22 to 09/30/22 and 07/01/22 to 09/30/22. “Illustrative Benchmarks” include S&P500 Index. Flagship Stock does not mirror that of the Illustrative Benchmarks and the volatility may be materially different. Results for Flagship strategies as compared to the performance of Illustrative Benchmarks and may not reflect actual future performance.

Against this backdrop, Steetbeat’s flagship stocks have remained relatively stable. Additionally, the company also announced today that its customer base has grown to surpass 110,000 – an organic growth of 60% in the current quarter alone.

The company has also just passed the milestone of $1.2million ARR – up from just $100,000 in Q1 of 2022 – as it continues to expand, building its customer base and helping customers find growth opportunities, despite the ongoing market volatility.

Damian Scavo, Founder and CEO of Streetbeat, said: “Stubborn inflation, the ongoing war in Ukraine and elections across the globe are likely to drive this market volatility for some time to come. That’s why we believe data-driven, algo-trade strategies are so especially important in today’s market, as illustrated by the results to date of our flagships stocks strategy.

“I founded Streetbeat to disrupt the status quo by putting the financial intelligence that sits at the heart of quant hedge funds into the hands of everyday investors – giving them access to data-driven strategies that, previously, were out of reach.

“We are proud to see such strong continued growth of the Streetbeat community and the potential for even more customers and larger investments.”

Cameron Meierhoefer named Streetbeat Chief Operating Officer

Streetbeat has also today announced the appointment of Cameron Meierhoefer as Chief Operating Officer. Meierhoefer was previously Chief Operating Officer at Comscore, a global digital media data company, where he led the development of e-commerce, search and media measurement data services. He has also served as CEO of SignalFrame, an IoT data company, and Chief Product Officer at VideoAmp, a cross platform media measurement and optimization platform.

Cameron Meierhoefer, Streetbeat’s Chief Operating Officer, said: “I’m thrilled to join Damian and the Streebeat team. Individual investors deserve access to advanced trading strategies previously reserved for institutions and hedge fund clients. Streetbeat’s momentum demonstrates individuals are ready to take advantage of quantitative strategies in their portfolios.”

Streetbeat democratizes financial intelligence – including bank card transactions, social media sentiment, geolocations and corporate filings – in a machine-learning algorithm that gives real-time investment signals, helping secure returns for customers as realized in its results today. The app makes stocks, ETFs and Crypto accessible in one, easy to use platform.

Founder and CEO Damian Scavo, an Argentinian-born Italian immigrant, has over 20 years’ of experience in algotrading and data analysis. He worked in the software house that co-created the firsts electronic stock exchanges in Europe and was managing 180 hedge funds and bank customers by the age of 22, and trading over $1 billion in monthly volumes by age 26. Damian has led three exits and managed 30 patents and provisions. You can read more in a recent Forbes article here.

For more information, visit www.streetbeat.com.

About Streetbeat

Streetbeat is a fintech company focused on democratizing and demystifying investing and making it accessible to everyone. The patented Streetbeat technology was designed to allow people to benefit from algo-trading and valuable data that can be difficult to uncover and decipher, empowering them to take control of their financial futures with a smooth onboarding process. The company is based in Palo Alto and is privately held. Streetbeat, LLC (“Streetbeat”) is an SEC-registered investment adviser and a registered Money Service Business. Cryptocurrency trading and exchange services are offered by Alpaca Crypto LLC. Find Streetbeat in the Google Store or the Apple Store.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/data-driven-strategies-required-during-ongoing-market-volatility-says-streetbeat-founder-and-ceo-301643854.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/data-driven-strategies-required-during-ongoing-market-volatility-says-streetbeat-founder-and-ceo-301643854.html

SOURCE Streetbeat

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Trading Strategies – My Blog https://ift.tt/TWKxfgt

via IFTTT

No comments:

Post a Comment