Fourth quarter (Q4) 2022 outlook: Summary

The forward paths of inflation and rates are highly uncertain. Global central banks are attempting to quell price pressures with aggressive monetary policy, and regime shifts like the one we are currently experiencing are typically accompanied by major price dislocations. As a result, we prioritize capital preservation until inflation and rates stabilize and, in the meantime, prefer managers that can capture alpha in rapidly shifting environments with nimble portfolios.

Strategy highlights

- Discretionary global macro: Macro policy is likely to remain a key factor driving markets for the foreseeable future. Discretionary macro managers should face a compelling opportunity set for implementing directional and relative value themes as well as tactical trading in this environment.

- Commodities: Persistent global inflation has led to continued investor interest in commodities. Volatility remains elevated, which should provide a rich potential opportunity set across both relative value and directional trading strategies.

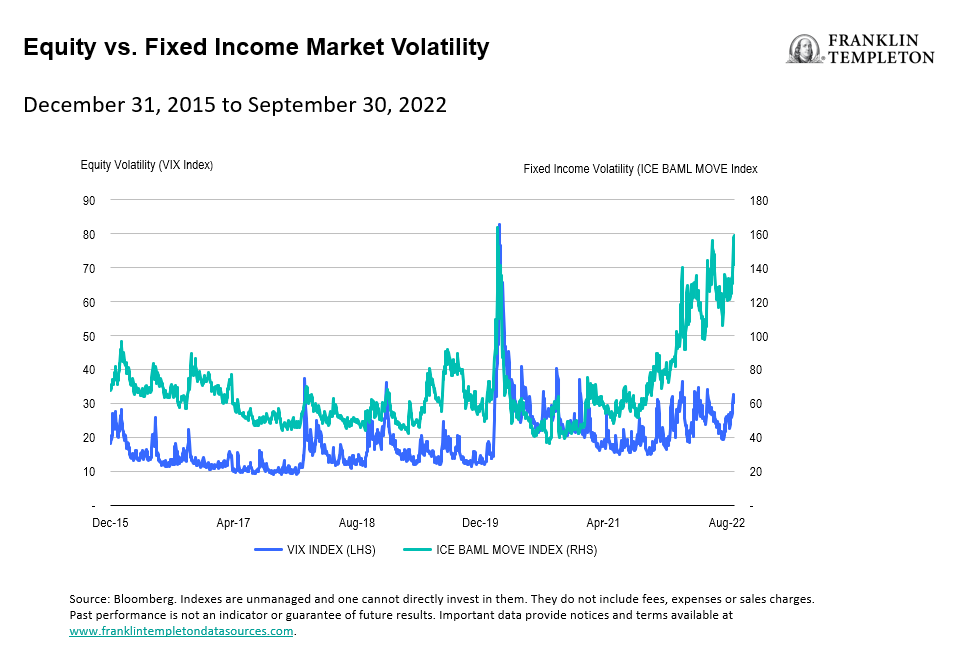

- Relative value: Elevated volatility (particularly in the fixed income markets) is presenting a more attractive trading environment for active and relative value trading strategies.

Macro themes we are discussing

The forward direction for various stock, bond, commodity and currency markets during the fourth quarter (and beyond) seems to center around the future level and path of global inflation. The elements causing inflation to be at multi-decade highs are well known. The tricky bit is figuring out the catalysts that will bring price pressures down without causing extensive economic harm.

A quick recap. The first quarter 2020 COVID-19 pandemic led to global lockdowns, which led to fears of a massive global economic slowdown. Central bankers injected massive amounts of liquidity and kept interest rates low in order to limit the economic drawdown. Politicians passed massive stimulus and other emergency programs to help citizens and businesses weather the health crisis. The lack of available labor impeded the “just in time” production and global supply chain mechanisms. Shutdowns further limited the supply of parts, food and finished goods. Families moving from cities to less dense neighborhoods pushed up the cost of housing (and related assets). These events all put upward pressure on the prices of goods and services around the world. In the first-quarter 2022, there were signs of improvement in the COVID case count, and the hope was that the worst was behind us, and things would begin to normalize.

Then Russia invaded Ukraine, and China adopted a “Zero-COVID” policy. Energy and food prices spiked. The availability of parts and finished goods remained limited. Housing costs continued to rise due to cheap financing and employee resistance to return to offices. Other living expenses rose as companies and service providers passed through increased labor and raw material costs. The inflationary cycle had begun.

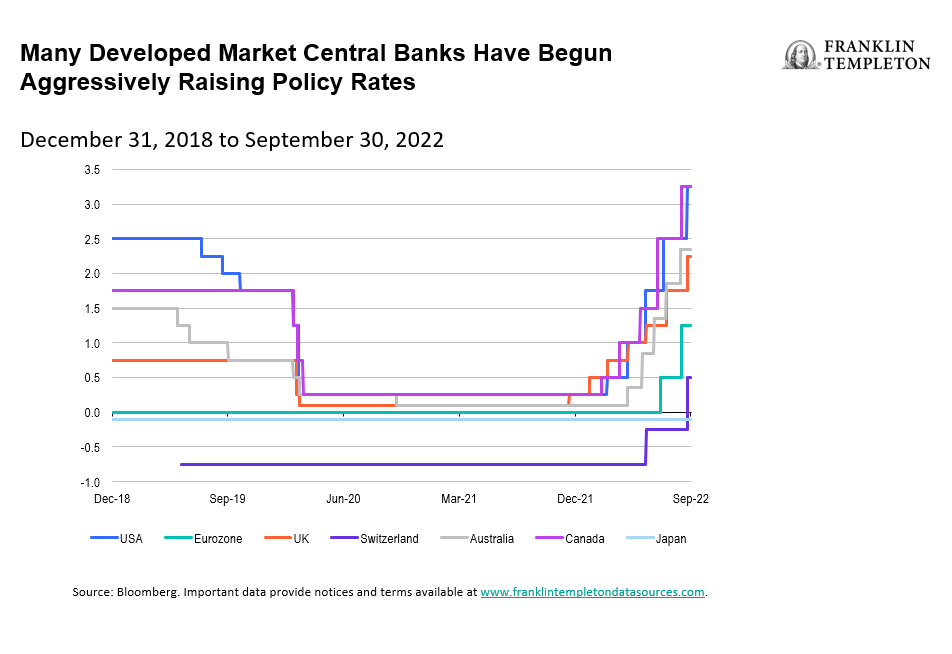

In response, central bankers around the world decided interest rates were too low and money supply growth was fueling inflation. Accordingly, they began raising interest rates in a fast and furious fashion. Time will tell how long these aggressive policy tightening measures will take to dampen inflation. It is widely thought that monetary policy shifts can take up to 18 months to fully turn an economic an inflationary battleship around. This cycle may take less time given the speed of changes. Until progress on inflation is evident, risk assets and financing costs will remain in adjustment mode.

From an investment standpoint, aggressive regime shifts like the current one often creates price dislocations as allocators restructure their portfolios. Volatility is typically above average and nimble, active managers can capture performance in both up and down markets. That said, capital preservation is paramount and downside protection hedges can reduce portfolio stress until the regime shift has stabilized.

So, what are the macro elements we are monitoring for signs that corrections in stocks and bonds are over?

- Talk of policy hike pauses. Central bankers have indicated there are more interest-rate hikes on the horizon. Bond markets have been anticipating this, and equity market valuations are adjusting accordingly. Until there is a clear sense that implied central bank interest rates are at a terminal point, investor uncertainty will remain. Note that a cut in interest rates is not needed. Rather, an indication that the target level is near should be enough to calm markets and confirm central bankers are comfortable with the outlook for inflation.

- China macroeconomic improvement. The upcoming political planning sessions in China may well offer more clarity on an easing of the zero-COVID policy, signs of support for the impaired real estate participants, or a less aggressive geopolitical stance regarding Taiwan. Any of these or other positive headlines would help improve investor’s risk appetite.

- Stable or lower energy prices. While energy prices have declined recently, a continuation of this trend would add to the desired disinflation outlook, relieve economic pressure on Europe, and reduce consumers cost of living concerns.

- Pause or reversal in the strong dollar trend. Given the US dollar’s safe-haven status, any stalling or reversal in the appreciation cycle seen during the past 16 months might indicate that the US Federal Reserve is approaching the latter stages of their hiking cycle, geopolitical concerns are easing, inflation outlooks are improving, or non-US assets offer stronger relative investment opportunities.

While many of the above catalysts are not evident today, we remain vigilant as to how the macro elements might change and what opportunities will be created on both long and short/hedge investments.

Q4 2022 outlook: Strategy highlights

Discretionary global macro

Active central banks may create attractive opportunities for discretionary macro managers who can take advantage of higher volatility, higher rates and dynamic policy changes. As policymakers have begun to react aggressively to persistent inflation headwinds, many managers have taken advantage of directional interest rate moves, changing yield curve shapes, currency trends and movements across other financial markets. With policymakers having already stated their commitment to fighting inflation, the environment can remain attractive for discretionary macro managers focused on thematic trends or tactical trading opportunities in the months ahead.

Commodities

The Russia-Ukraine conflict remains a large overhang across almost the entire commodity complex. With news of Russian mobilization, it appears Russia has no near-term intentions to end the conflict despite recent reports of Ukraine reclaiming territories Russia has held since the outset of its campaign. Gas saving measures will be crucial to help stretch inventories to the end of winter even with dwindling Russian supply. Reduced consumption would give the European Union some breathing room as it tries to prevent shortages and blockages. Tensions heightened recently after blasts at the Nord Stream pipelines that European politicians are calling sabotage. The Nord Stream leaks appear to end hopes of a near-term recovery of Russian flows. Russian gas is still flowing to Europe through Ukraine, but concerns about stoppages will remain as long as the war continues. A big question remains about Europe’s ability to replenish storage sites next year in the absence of usual volumes of Russian gas. Reserves are about 88% full but will likely be eroded over the coming colder months.

Relative value

Volatility across many asset classes remains elevated. This is most pronounced in fixed income markets where one common measure of volatility (the ICE BAML MOVE Index) is trading at levels last seen during the COVID-19 market crash. Equity market volatility appears tame by comparison. While volatility is typically a challenge for traditional long-only investors, it can be a boon for relative value strategies since it presents greater dispersion and more attractive opportunities for active trading.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss or principal. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at September 30, 2022, and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Trading Strategies – My Blog https://ift.tt/ZuXF3eM

via IFTTT

No comments:

Post a Comment