STEEX

Inflation and the Federal Reserve are the two things that are dominating the stock market these days.

And how, specifically, are inflation and the Federal Reserve affecting the stock market?

Well, for one, they are generating a major swing in volatility.

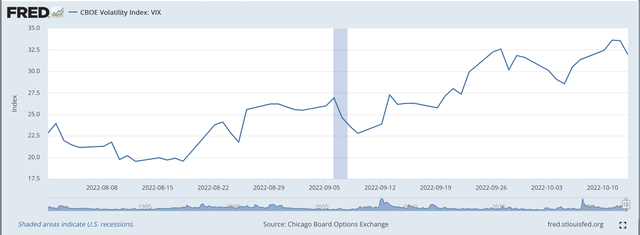

Since August 1, 2022, the CBOE’s VIX volatility index has shown a strong upward swing.

CBOE Volatility Index VIX (Federal Reserve)

In early August, the VIX Index was leaning around 20.0.

New information was coming out that the rate of inflation was staying strong and was not going to immediately drop off, as quite a few investors believed.

If inflation showed signs of lessening, many investors believed that the Federal Reserve would pivot from the “strong” stance it had been promoting.

If the Fed pivoted, stock prices should rise, right?

And, so the market began showing greater swings as the stock prices would move up on any information indicating that inflation might be tapering off, meaning that the Fed could “back off” from its quantitative tightening.

But, as soon as Federal Reserve officials stepped up and said that the Fed was not going to “back off,” stock prices moved strongly downward again.

Any other information only played a minor role in the stock market’s volatility because this information was only looked at as adding to the investor focus on whether the Fed would “pivot” or not.

Latest Inflation News

The last round of market volatility came about this past week.

The news that set the movement off was that the Consumer Price Index (CPI) for August came in, year-over-year, at 8.2 percent.

This was down from 8.3 percent the month before, but the expectation was for a drop off in the index to 8.1 percent.

The Core rate of inflation rose, year-over-year, by 6.6 percent in August. This was a forty-year high.

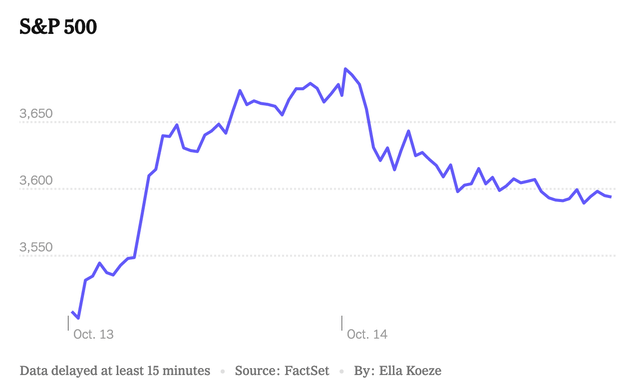

Funny thing. The stock market initially rose.

S&P 500 Stock Index (New York Times)

Isabella Simonetti and Joe Rennison, comment on this in the New York Times:

“In a whipsaw move that mirrored Thursday’s sharp turn from a loss to a gain, the S&P 500 fell 2.4 percent on Friday, after being up over 1 percent in the morning. The abrupt shift left the index 1.5 percent lower for the week, erasing last week’s gain. The benchmark index is down more than 25 percent since January.”

But, the bottom line established at the end of the week:

The probability had increased that the Federal Reserve will raise its policy rate of interest by another 75 basis points when the Federal Open Market Committee meets on November 1 and 2.

By-the-way, Simonetti and Rennison make no notice of the fact that the early earnings report from the biggest banks in the country showed lower profits.

Guess this bit of information was not that important.

The Federal Reserve Is On Track

But, the Federal Reserve is continuing its path of quantitative tightening, as I reported in my last Federal Reserve Watch post.

Since March 16, the Federal Reserve has reduced the amount of securities on its balance sheet by about $190.0 billion. Its plan is to continue to reduce the amount of securities bought outright by about $95.0 billion every month until sometime in 2024.

For the time being, the latest inflation numbers released last week will support the Fed officials that are speaking out about continuing the quantitative tightening program.

Consequently, the underlying trend for stock prices should continue to be downward.

But, the higher level of volatility will not go away.

There are so many uncertainties in the world today that there will still be plenty of investors on both sides of the market. So, we will get the volatility.

And, I don’t see the radical uncertainty that exists today leaving any time soon.

So, the forecast: stock prices will continue to decline within an environment that is highly volatile.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Stock Market News – My Blog https://ift.tt/VTXi37s

via IFTTT

No comments:

Post a Comment