“The Large Brief” investor Michael Burry advised the S&P 500 might plunge under 1,900 factors.

The Scion Asset Administration chief based mostly his prediction on how previous crashes have performed out.

Burry mentioned transient rallies had been probably, and joked about his penchant for untimely predictions.

Michael Burry, the hedge fund supervisor of “The Large Brief” fame, rang the alarm on the “best speculative bubble of all time in all issues” in the summertime of 2021. He warned the retail traders shopping for up meme shares and cryptocurrencies that they had been headed in direction of the “mom of all crashes.”

The Scion Asset Administration chief’s grim prediction could also be coming true, because the S&P 500 and Nasdaq indexes tumbled by 19% and 33% respectively in 2022. In tweets posted in Could 2022 then subsequently deleted, Burry took credit score for calling the sell-off, defined why he expects additional declines, and cautioned in opposition to shopping for into aid rallies.

Here is a roundup of Burry’s greatest tweets concerning the stock-market stoop:

The pandemic crash was simply the beginning

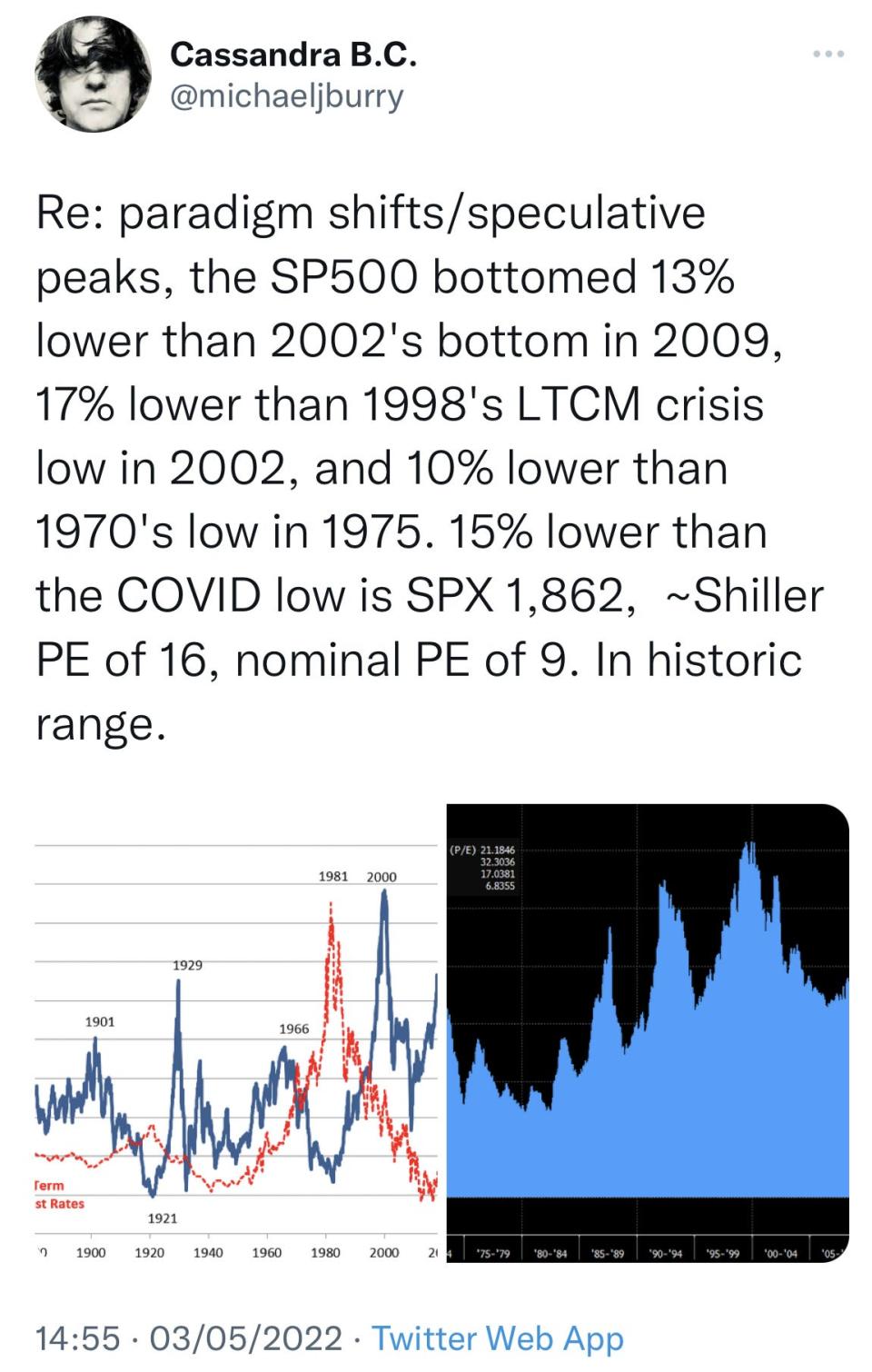

The S&P 500 index has rebounded strongly from the pandemic crash within the spring of 2020, rising from a low of two,192 factors to round 3,800 factors at the moment. Nevertheless, it might halve in worth to under 1,900 factors over the following few years, Burry tweeted on Could 3, 2022.

When the S&P 500 has crashed previously, it has traded decrease a number of years later, Burry famous. He pointed to the index bottoming 13% decrease in 2009 than it did in 2002, 17% decrease in 2002 than it did throughout the Lengthy-Time period Capital Administration fiasco in 1998, and 10% decrease in 1975 than in 1970.

If the benchmark index follows that historic sample, it might commerce 15% decrease than its degree within the spring of 2020, Burry mentioned.

There could also be epic however short-lived rallies

A “useless cat bounce” refers to a short lived rebound in inventory costs after a major fall, actually because speculators purchase shares to cowl their positions.

They usually happen throughout main declines within the inventory market, Burry mentioned in a Could 4 tweet. The implication is that traders should not get their hopes up about any rallies within the coming months, as they’re prone to be transient respites that will not lead to a market restoration.

Burry famous that 12 of the 20 largest one-day rallies within the Nasdaq index happened because the dot-com bubble burst, whereas 9 of the S&P 500’s 20 greatest one-day rallies occurred within the aftermath of the Nice Crash in 1929.

Do not be fooled by shares rebounding

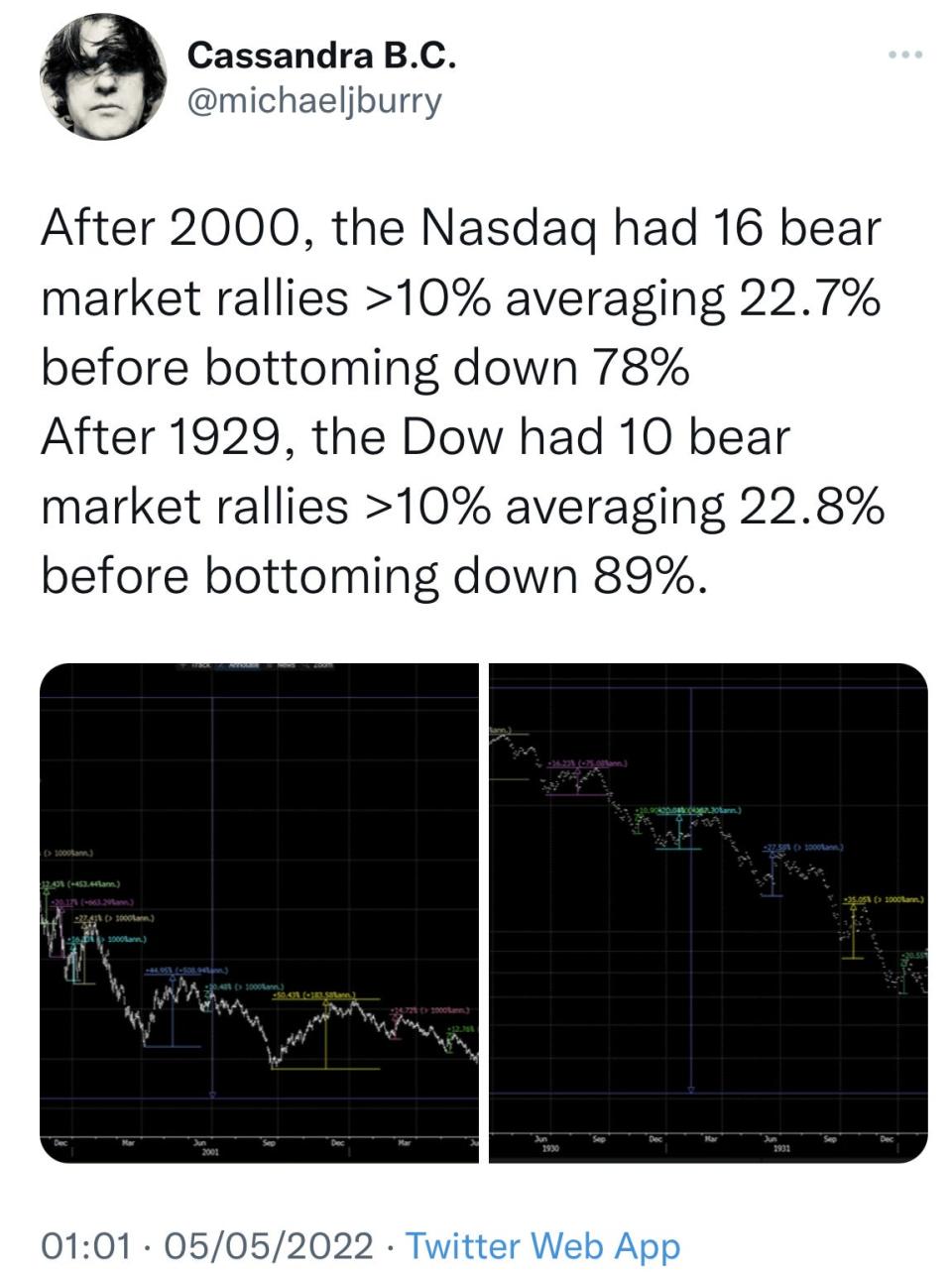

Shares might stage a number of rallies earlier than the crash is over, Burry warned in a Could 5 tweet.

He famous that after the dot-com bubble burst, the Nasdaq rallied 16 occasions by greater than 10% — gaining on common 23% every time — on its method to a 78% decline at its nadir.

Burry additionally emphasised that after the Nice Crash of 1929, the Dow Jones index rallied 10 occasions by greater than 10%, rising by a mean of 23% every time, earlier than bottoming at a 89% decline.

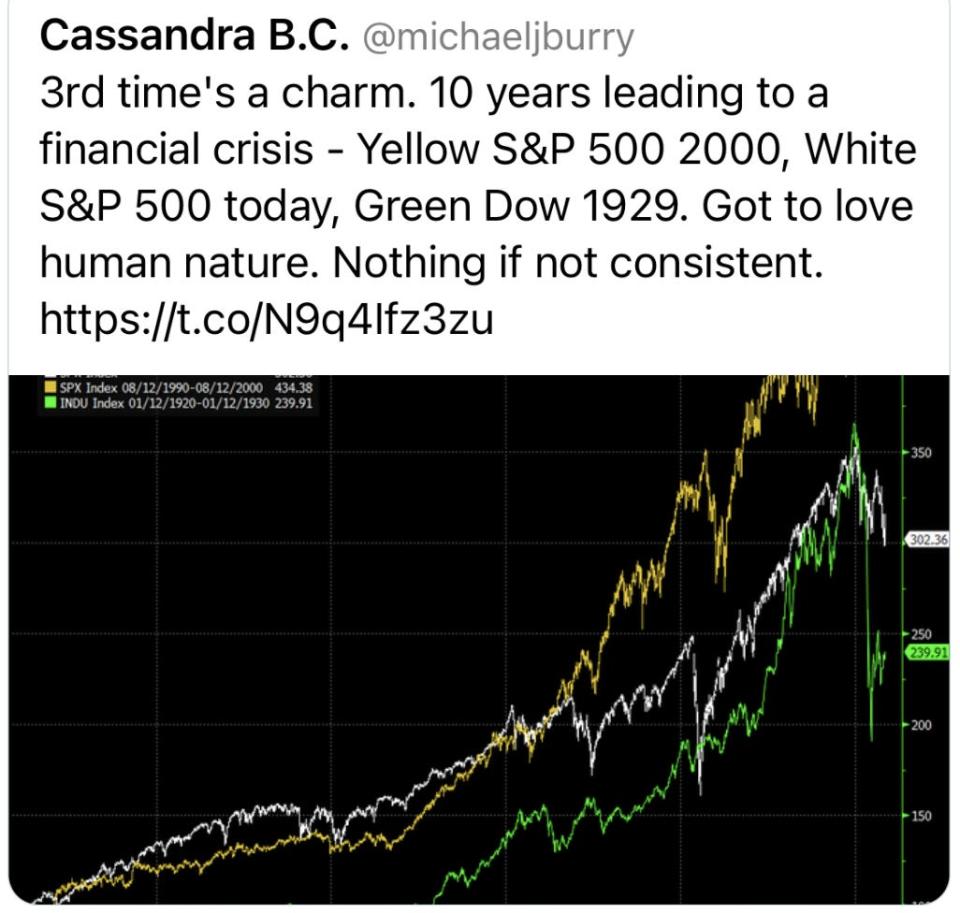

Shares are on a harmful trajectory

The US inventory market seems to be following the sample of earlier bubbles, leaving it poised for a monumental crash, Burry famous in a Could 8 tweet.

The Scion chief pointed to the S&P 500’s trajectory over the previous 10 years, noting it was strikingly just like the index’s chart for the last decade main as much as the dot-com crash, and the Dow’s chart for the ten years earlier than the Nice Crash of 1929.

Burry advised that human nature was behind the constantly decade-long buildups, and implied that historical past is repeating itself.

Burry predicts appropriately, however early

Burry appeared to take a victory lap in a Could 10 tweet, suggesting he believes the stock-market crash that he is been warning about has lastly arrived.

The Scion boss joked he was early along with his prediction, simply as he was throughout the mid-2000s US housing bubble.

Burry additionally nodded to Elon Musk calling him a “damaged clock” final yr, after the Scion chief wager in opposition to Tesla inventory, predicted it will collapse in worth, and questioned Musk’s motives for promoting his firm’s shares.

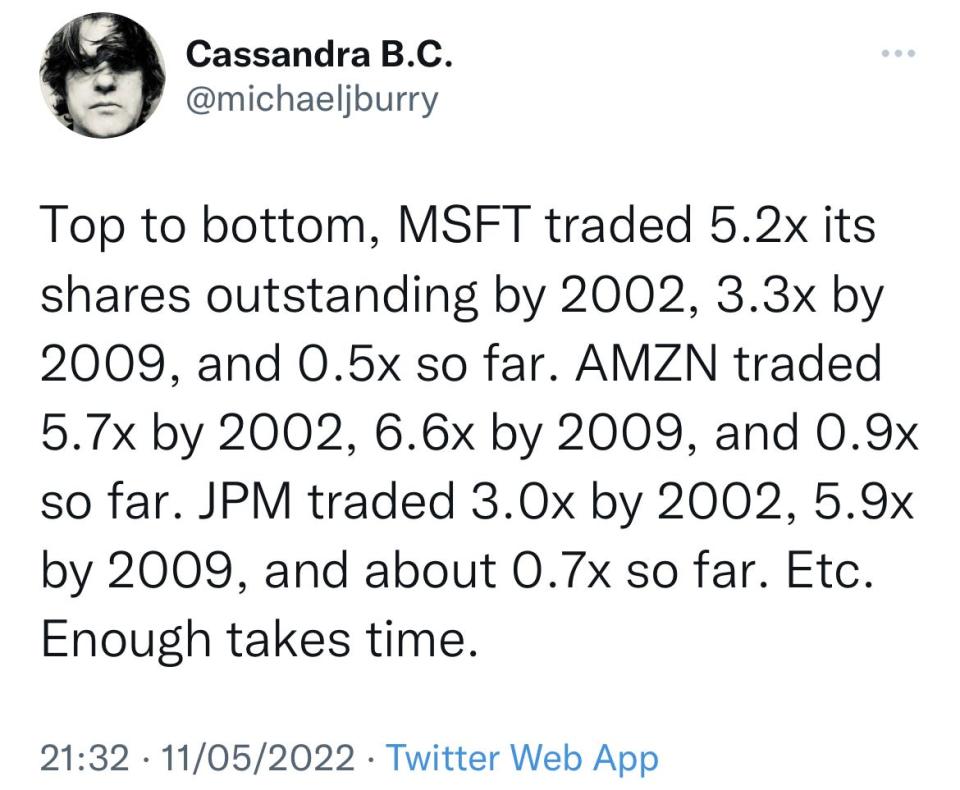

Shares are set to tumble so much additional

Buyers can anticipate shares to fall so much additional, Burry warned in a Could 11 tweet.

The investor famous that 5.2 occasions Microsoft’s excellent shares had been traded between the software program inventory’s peak throughout the dot-com bubble and its backside in 2002. That determine was 3.3 occasions throughout the monetary disaster, however had solely reached 0.5 occasions on the time of his tweet.

Burry famous it was the same story with Amazon and JPMorgan, indicating it could possibly be some time earlier than these shares and others backside out.

Learn the unique article on Enterprise Insider

No comments:

Post a Comment