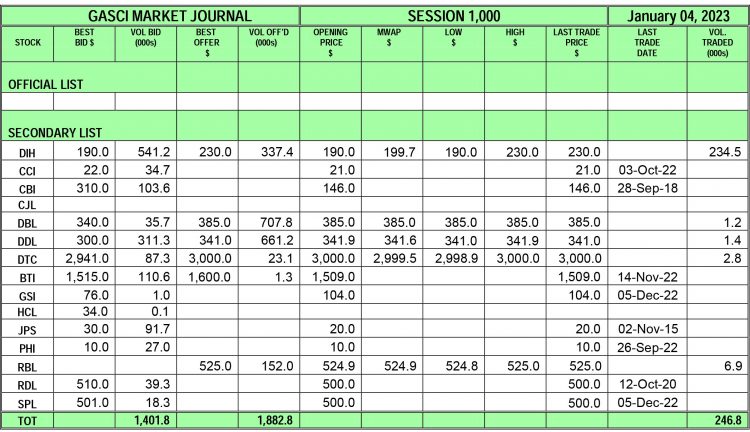

GASCI (www.gasci.com/phone Nº 223-6175/6) studies that session 1,000’s buying and selling outcomes confirmed consideration of $59,871,724 from 246,836 shares traded in 61 transactions as in comparison with session 999’s buying and selling outcomes, which confirmed consideration of $2,545,195 from 7,937 shares traded in 13 transactions. The shares energetic this week had been DIH, DBL, DDL, DTC and RBL.

GASCI (www.gasci.com/phone Nº 223-6175/6) studies that session 1,000’s buying and selling outcomes confirmed consideration of $59,871,724 from 246,836 shares traded in 61 transactions as in comparison with session 999’s buying and selling outcomes, which confirmed consideration of $2,545,195 from 7,937 shares traded in 13 transactions. The shares energetic this week had been DIH, DBL, DDL, DTC and RBL.

Banks DIH Restricted’s (DIH) 37 trades totalling 234,531 shares represented 95.01% of the entire shares traded. DIH’s shares had been traded at a Imply Weighted Common Worth (MWAP) of $199.7, which confirmed a rise of $9.7 from its earlier shut of $190.0. DIH’s trades contributed 78.22% ($46,834,755) of the entire consideration. DIH’s trades had been as follows:

from NYSE Updates – My Blog https://ift.tt/fzo6QjG

via IFTTT

No comments:

Post a Comment