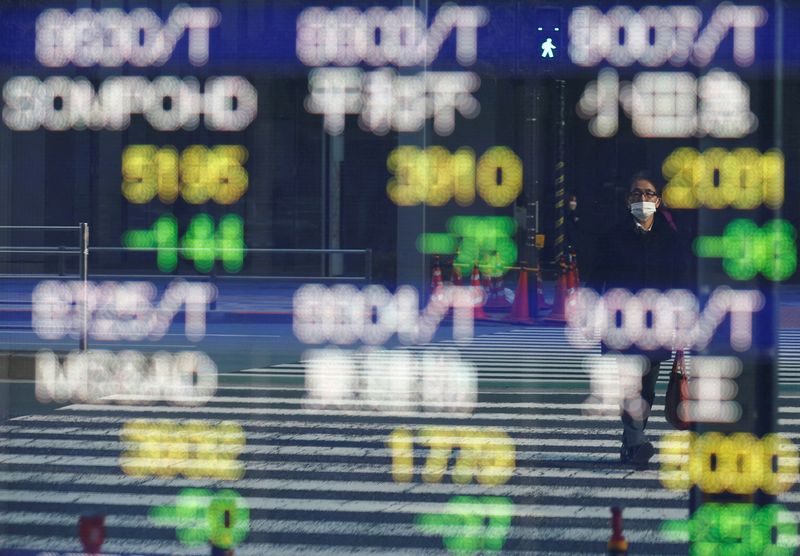

© Reuters. FILE PHOTO: A person is mirrored on an digital board displaying numerous corporations’ inventory costs exterior a brokerage in Tokyo, Japan, February 22, 2022. REUTERS/Kim Kyung-Hoon/File Photograph

By Wayne Cole

SYDNEY, (Reuters) – Asian shares adopted U.S. inventory futures greater on Monday on hopes authorities have been working to ring fence stress within the international banking system, whilst the price of insuring towards default neared harmful ranges.

Serving to nerves have been studies First Residents BancShares Inc was in superior talks to amass Silicon Valley Financial institution from the Federal Deposit Insurance coverage Corp.

firmed 0.5% in early commerce whereas Nasdaq futures added 0.4%.

MSCI’s broadest index of Asia-Pacific shares exterior Japan edged up 0.1%, with buying and selling cautious. gained 0.1% and South Korea 0.2%.

The temper remained jittery after shares in Deutsche Financial institution (ETR:) fell 8.5% on Friday and the price of insuring its bonds towards the danger of default jumped sharply, together with the credit score default swaps (CDS) of many different banks.

“The present stage of credit score default swaps for European banks is just a bit decrease than it was throughout the top of the European monetary disaster in 2013,” famous Naeem Aslam Chief Funding Officer at Zaye Capital Markets.

“If these CDS don’t normalise, it’s extremely probably inventory market might proceed to endure for a lot of days.”

Over in the US, depositors have been fleeing smaller banks for his or her bigger cousins or to cash market funds. Flows to cash market funds have risen by greater than $300 billion prior to now month to a document atop $5.1 trillion.

Minneapolis Fed President Neel Kashkari on Sunday mentioned officers have been watching “very, very intently” to see if the banking stress led to a credit score crunch that threatened to tip the financial system into recession.

That, in flip, meant the Fed was nearer to a peak in charges, he added. Markets are effectively forward of the central financial institution in pricing round an 80% likelihood charges have already peaked, whereas a primary fee reduce is seen as early as July.

Fed Governor Philip Jefferson speaks in a while Monday, whereas Fed Vice Chair for Supervision Michael Barr testifies on “Financial institution Oversight” earlier than the Senate on Tuesday.

Yields on two-year Treasuries have fallen an astonishing 102 foundation factors thus far this month to face at 3.77%, whereas your complete yields curve out to 30 years is under the 4.85% efficient funds fee.

That dive has generally been a drag on the greenback, a minimum of towards the safe-haven Japanese yen the place it stands at 130.85 yen, having touched a seven-week low of 129.65 final week.

The euro suffered its personal reversal on Friday amid the concerns over Deutsche, and it was final at $1.0767 and effectively off final week’s $1.0930 prime.

The drop in yields has mixed with the run from danger to burnish gold, which was buying and selling at $1,975 an oz after reaching a excessive above $2,009 final week. [GOL/]

Oil costs have been steadier early Monday, however are nonetheless nursing losses of just about 10% for the month as worries about international progress undermine commodities usually. [O/R]

added 43 cents to $75.42 a barrel, whereas rose 47 cents to $69.73 per barrel.

from NYSE Updates – My Blog https://ift.tt/kMSpaCB

via IFTTT

No comments:

Post a Comment