The SPY is coming off every week the place it gained practically 2% as markets look to rally off a 3-week dropping streak.

With every week of heavy financial knowledge arising, I’d wish to share with you my single favourite indicator I take advantage of when day buying and selling the SPY throughout unstable market circumstances.

Apart from utilizing this ONE indicator to assist me with my entry and exits on the SPY, I additionally love how I can see market knowledge arising after which put together my trades round that. It’s one of many distinctive elements of buying and selling the SPY or S&P500 that inventory merchants don’t essentially have. Having the ability to see the pitch coming a day or two upfront can actually assist give me an edge on my buying and selling.

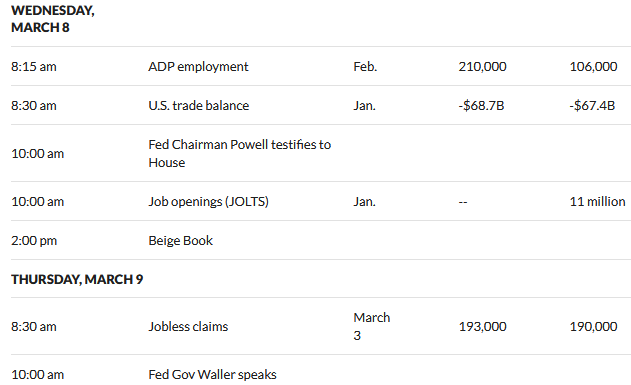

For instance, I see that Wednesday and Thursday have some actually excessive impactful items of market knowledge. ADP employment (or the change in personal employment) is arising earlier than markets open Wednesday. Fed Powell speaks that very same day at 10AM, adopted by Job openings after which Jobless claims on Thursday.

How can we not overlook about Fed Waller on Thursday??? His final reside occasion ended “prematurely” when he supposedly received hacked and began to stream porn (or one thing alongside these traces!)…

Both method, seeing these softballs being lobbed forward of time permits me time to arrange for the subsequent day or two. This would possibly maintain me from taking in a single day swing trades in hopes of defending my capital the place some merchants would possibly maintain blind and get up to a complete market mess.

That being stated, I LOVE volatility. I imply isn’t that what most merchants need? I believe it’s secure to say most of us don’t commerce speculative shares with the aim of holding them for 1 12 months and looking for a return of two% – boring to me, no less than!

So, as soon as I spot a commerce setup I like, what’s my #1 indicator to assist information me in my entries and exits?

Bollinger Bands.

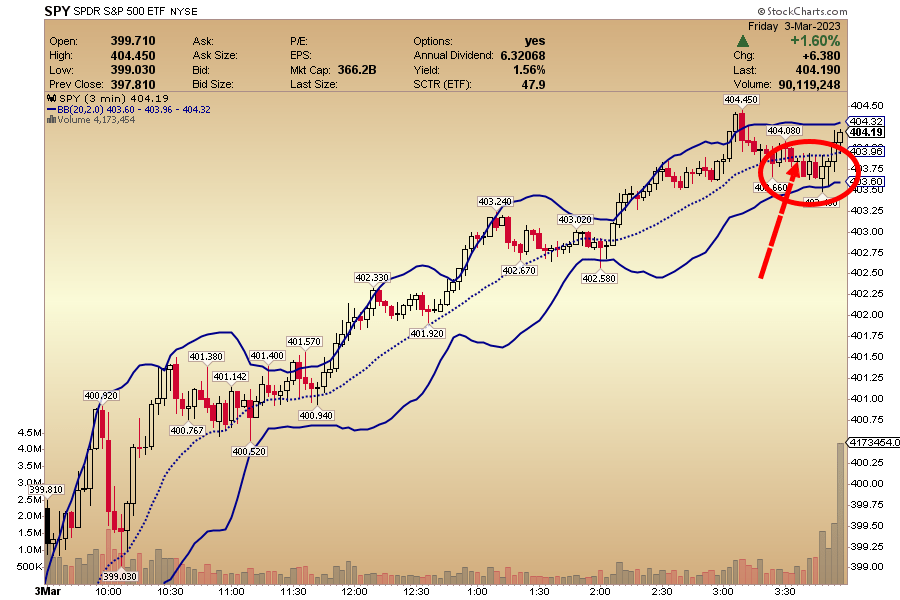

Check out this chart from final Friday the third of March. You see the thick stable blue traces on prime and backside of value motion (seem like clouds) and the dotted center line operating up the center? These are the bollinger bands. They basically symbolize volatility.

Right here is how I take advantage of them. When the value motion is above the dotted center blue line (which is solely the 20 SMA) I like to purchase calls on SPY. If value motion is under the dotted center blue line then I like to purchase places.

Assuming the value motion stays above the center dotted blue line, I would look to remain lengthy my calls, perhaps “trim and path” which means promote some to guard capital and scale back threat or perhaps promote all and transfer on. As soon as the candle drops under the dotted blue line then I would contemplate promoting and shifting to a brand new commerce.

Friday was an excellent instance of value motion staying ABOVE the dotted center blue bollinger line virtually the complete day, proper up till about 3:30PM the place I circled in crimson the value motion lastly falling under the center bollinger band.

Take into consideration that for a second. Had I solely used the center bollinger band, I actually didn’t get a promote sign till proper earlier than the shut. I had a shot at a close to $5 transfer on SPY, superb!

I take advantage of these bollinger bands totally on 1 and three minute charts through the day. I usually will search for value motion to be BELOW the center bollinger band then look to purchase if we cross above that line (my sign line) after which goal 10 to twenty% or trim and path if the commerce seems to be working for some time like Friday’s chart confirmed.

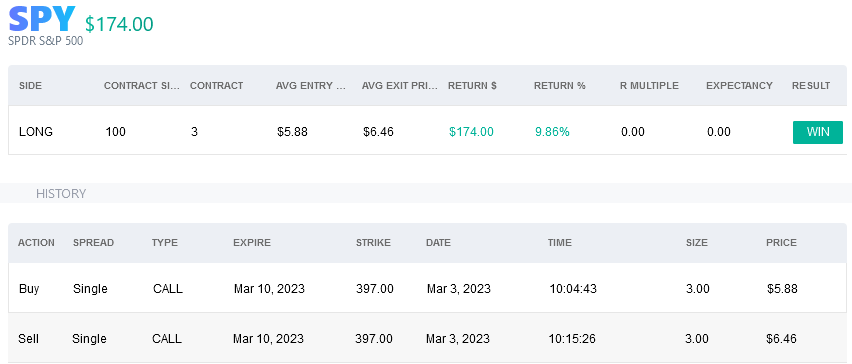

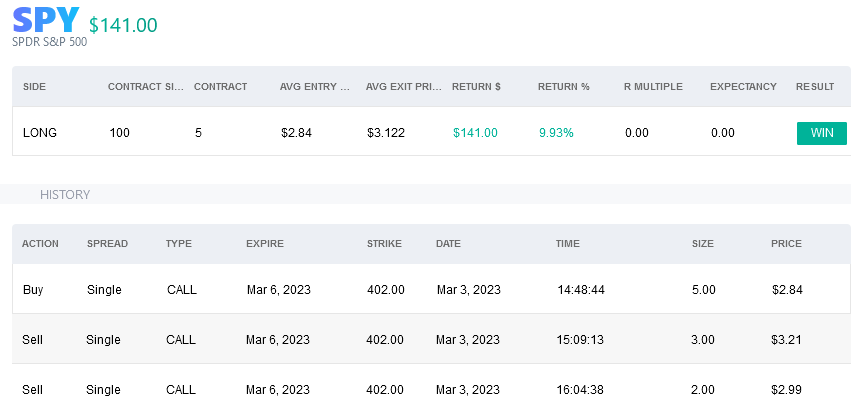

Matter of reality, I used the bollinger bands to make 2 trades on the SPY Friday. One within the morning on the dip and one within the afternoon earlier than the autumn late within the day. You possibly can line up the instances of the pictures under with the chat above and also you’ll see how I purchased the dips and offered the rips increased.

Whereas I by no means advocate utilizing simply ONE indicator nor will I say the bollinger bands assist me win each commerce, I do really feel they’re an excellent easy to make use of indicator that may certainly assist information me in making extra educated, actual time entries and exits and that’s all I can hope for.

If you want to study extra about my buying and selling methods or truly watch me commerce reside through the day, I’m providing a $1,000 financial savings proper now to my flagship service Market Navigator.

I’ve taught hundreds of merchants similar to you over the past 12 years (click on HERE for critiques) and I’m assured that I can educate you numerous about markets and the way they work (click on right here for my buying and selling file).

So…I’m hopeful you’ve realized one thing at the moment…

And for those who’d wish to study MORE, merely click on right here to see how one can pocket $1,000 now but nonetheless get a full studying expertise with me.

from NYSE Updates – My Blog https://ift.tt/Vlo2iNZ

via IFTTT

No comments:

Post a Comment