As we strategy spring 2023, the US housing market has not crashed nationally. Not even shut. Essentially the most vital drops in residence costs have been in the identical metropolitan areas that even have had the most important run-ups in worth since 2020.

In line with Newsweek, the cities with the most important drops in residence costs to date are:

- Austin, Texas

- San Francisco, California

- San Diego, California

- Phoenix, Arizona

- Denver, Colorado

- Seattle, Washington

- Tampa, Florida

Whereas residence costs in Austin are anticipated to say no by greater than 15% subsequent 12 months, in San Francisco, San Diego, Phoenix, Denver, Seattle, and Tampa, costs will drop by over 10% throughout 2023.

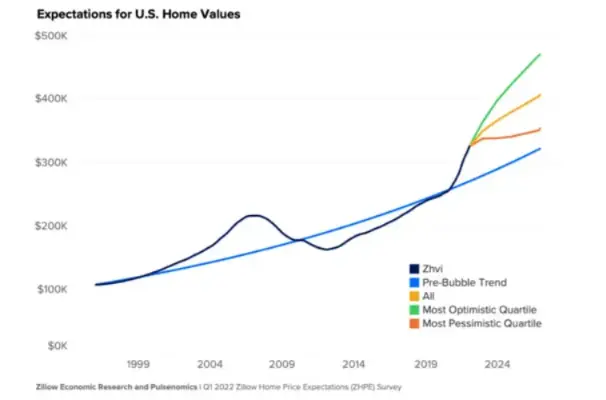

House values slipped simply 0.1% in January 2023, leaving the standard residence worth at $329,542, or 4.1% under the height worth set in July 2022, in keeping with the Zillow House Worth Index. House values are nonetheless 6.2% greater than one 12 months earlier–a quickly decelerating tempo of annual progress, down from the almost record-high 18.8% year-over-year progress measured in April. Zillow tasks typical U.S. residence values to rise 0.5% from January 2023 to January 2024 (seasonally adjusted).[1]

Whereas there may be some proof to counsel that we’re getting ready to the worst housing meltdown in latest American historical past, the present worth stats present no vital adjustments. Nevertheless, there are mounting indications that that is the beginning of one other housing despair just like the one we noticed in 2008 based mostly on the collapse of purchaser curiosity and listed residence costs being lowered prior to now few months. This text will discover the disturbing particulars of the 2023 housing crash, what’s inflicting it, and what it means for the long run.

The 2020-2022 Housing Growth

From March 2020 to June 2022, the median residence worth elevated by 43%, as measured by the Case Shiller Index. This unbelievable rise was by no means regarded as attainable. Actual property buyers and owners cashed in on hundreds of thousands on this tremendous progress period, house owners pulled out record-high fairness by HELOCs, and consumers grew determined, watching as month after month costs simply elevated. On the peak of the housing market by 2021 and 2022, homebuyers have been moving into bidding wars and even shopping for properties they’d not seen in individual. After 27 straight months of near-parabolic progress, the market lastly give up rising at a runaway tempo in June 2022. The Federal Reserve’s rising rates of interest and inflation’s financial influence on homebuyers helped cease the exponential rise in residence values in 2022.

The 2023 Housing Crash

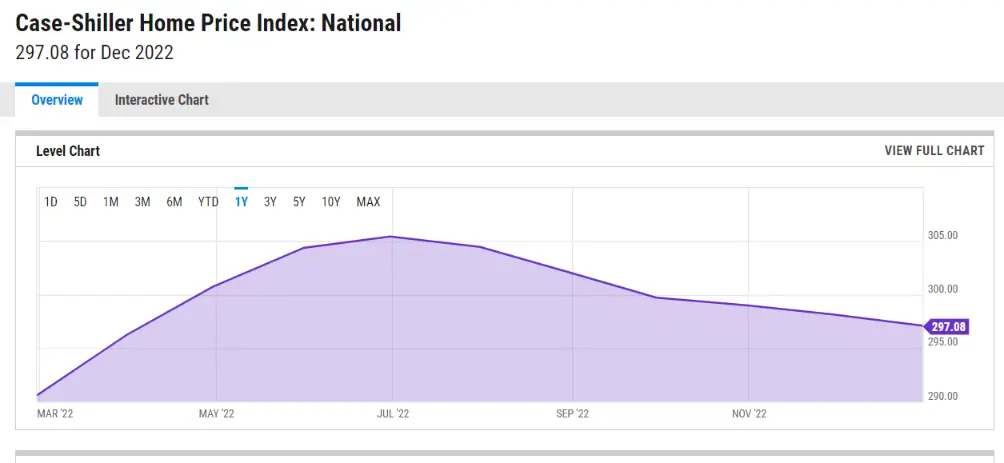

The development within the housing market is lastly beginning to change. Costs for 5 straight months have declined, falling 3.6% from the height. To many, this looks as if a slight decline in comparison with what occurred three years prior. For costs to fall to pre-pandemic ranges, the Case Shiller should drop a further 28%. Whereas a 3.6% drop is barely noticeable to consumers, there may be mounting proof that that is the beginning of one other housing market crash just like the one we noticed in 2008. The hazard comes from the markets that went up probably the most and are indifferent a lot from the elemental worth of residence costs traditionally and new residence substitute worth. Million-dollar costs in massive cities for starter properties usually are not sustainable in an economic system with runaway inflation, excessive power prices, and a price of dwelling disaster.

The Proof for the 2023 Housing Crash

The proof for the 2023 housing crash will be present in surprising new weekly knowledge. For instance, the latest Case Shiller launch revealed that costs have declined for six months. This may increasingly look like no massive deal, but when we hint the historical past, we will see that this decline hardly ever occurs. In reality, since 1986, which is the earliest studying for the Case Shiller, the market has seldom dropped greater than 3%. The one exceptions have been 2008 and this small 3.05% drop in 1990.

Chart supply

Many consultants speculate that we’re in what they name the denial part of the crash. You’ve lots of people who’re non-public sellers refusing to budge on costs and sustaining this phantasm of a market. House sellers have the cognitive bias of anchoring on previous excessive costs as a substitute of evaluating them to the worth they paid for a house. Whereas it might be irritating as a purchaser, we all know from earlier crashes that non-public sellers usually are not the primary mover residence sellers in any actual property market. They’re nearly all the time the final to promote because of the price of realtors and the price of shopping for and shifting to a brand new residence. The group that strikes costs first and probably the most within the housing markets is nearly all the time the builders. Builders have a look at the price they’ve within the land, licensing prices, value of supplies, labor, and market demand for a geographic location. They set their value for a revenue margin and never anchoring cognitive bias for what they paid. Builders wish to create and transfer stock for revenue.

The Position of Builders within the 2023 Housing Crash

The builders are multi-billion greenback firms that transfer 1000’s of items per thirty days and have complete groups devoted to setting costs. They perceive the demand and provide higher than anyone else and have a a lot greater incentive to maneuver costs down to maneuver stock. We noticed this previous quarter that nearly each single severe builder has lowered costs and included incentives like charge buy-downs to get individuals to purchase. So, whereas the Case Shiller graph appears okay to date, it’s not indicative of what’s taking place on the bottom. The newest earnings reviews from builders reveal some extreme market points.

What it Means for the Future

Whereas the consequences of those actions will take a while to maneuver into the present residence market, it’s plain that these developments within the new residence area will have an impact. Think about in the event you have been buying an present residence and a brand new one down the road all of the sudden slashed its worth by 20%, placing it on par with the present one you have been taking a look at. It’s going to nearly definitely sway your shopping for choice, as there’s all the time a premium between the present and new residence stock. New properties are all the time those that anchor costs to what they value to buy.

The proof concerning a brand new residence slowdown is fairly simple, it’s nonetheless not one thing that can all of the sudden erase all these post-2020 beneficial properties in a single day. The reality about actual property crashes is that they take a very long time to get rolling. The housing market is at a crossroads. For generations now, proudly owning a house has been a part of the American dream, and that dream is beneath menace by basic math.

Affordability of Housing

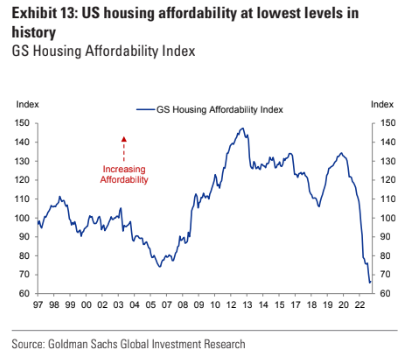

To show this reality, we will have a look at the affordability of housing. Utilizing knowledge from the US Census Bureau, the Fed, and the US Division of Housing, we will see that the American who purchased a median residence in 2022 now pays over 52% of his gross before-tax revenue on the mortgage. We are actually properly above the relative costs of 2008, and if that was the worst actual property bubble this nation has ever seen, now we have to ask ourselves what’s completely different about this one.

US housing affordability is on the lowest ranges in historical past.

One of many three variables that want to present is costs, and searching on the affordability chart, it’s straightforward to see why so many are calling for a crash. Homeownership has develop into unaffordable, though unemployment is close to document lows, and incomes have achieved very properly over the previous 5 years. With out demand from atypical on a regular basis People, it is going to be more and more tough for provide to remain low. As soon as the stock scenario unfolds, costs will lower as demand has to satisfy provide on the proper worth stage.

Conclusion

In conclusion, whereas the housing market has not but crashed, mounting proof means that we’re getting ready to the worst housing meltdown in latest American historical past. The proof will be present in surprising new knowledge being up to date each week. The builders are multi-billion greenback firms that transfer 1000’s of items per thirty days and have complete groups devoted to setting costs. They perceive the demand and provide higher than anyone else and have a a lot greater incentive to maneuver costs down to maneuver stock.

Undeniably, these developments within the new residence area will have an effect on the present residence market. The newest earnings reviews from builders reveal some severe market points. With out demand from on a regular basis People, it is going to be more and more tough for provide to remain low. Each new and present residence costs being lowered is the primary sign of accelerating provide over demand from consumers at these worth ranges. As soon as the stock scenario unfolds, we’ll see residence sellers that want to maneuver hand over. The market is at a crossroads, and we might be coming into a protracted, painful bear market that we’ll see play out within the coming 12 months.

from Trading Strategies – My Blog https://ift.tt/TmrUkb6

via IFTTT

No comments:

Post a Comment