Editor’s Word: This was despatched to subscribers of Jeff Bishop’s Bullseye Trades on Monday, April third, 2023.

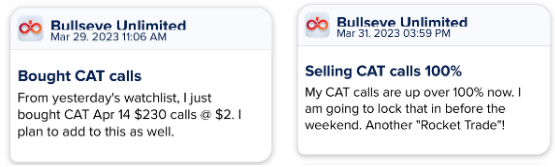

Talking of  “Rocket Trades,” final week, we noticed a number of nice ones. My favourite was the decision on CAT to the upside on Wednesday, after which it doubled by the market shut on Friday. I used to be on the airport headed house after I determined to lock within the 100% winner to finish the week.

“Rocket Trades,” final week, we noticed a number of nice ones. My favourite was the decision on CAT to the upside on Wednesday, after which it doubled by the market shut on Friday. I used to be on the airport headed house after I determined to lock within the 100% winner to finish the week.

Listed here are the copies of the alerts I despatched to members earlier than I made every commerce:

Fairly superior begin to the service in March, and I’m dialed in on making April a good higher month for trades!

On-line enrollment is open once more proper now. If you wish to improve your membership or look into any credit you might need, please attain out to Jeff Brown (jbrown@ragingbull.com) or name him at 800-585-4488, and he’ll get you taken care of immediately.

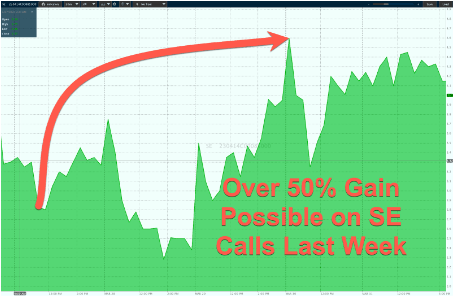

Final week with Bullseye Trades, I used to be in a position to exit my calls with a fast in a single day win (we’ll speak about that within the stay session this afternoon), after which the inventory continued to climb a lot of the week.

My remorse for the week is that I didn’t reload and purchase the dip on Wednesday. The chart was nonetheless robust, and I simply bought preoccupied with different trades, and I missed it. That might have been a 100% achieve in a single day from the lows, however there may be at all times one other one across the nook!

For this week, I nonetheless assume the market shall be uneven and proceed to frustrate the bears. Whereas I don’t count on to see any important new highs after the blowout rally final week, I don’t assume the market goes to roll over and provides again a bulk of the positive aspects we simply noticed.

The Biotech sector has been discovering some life once more after a dismal few months to begin the 12 months. I actually just like the help build up for that whole sector, and I feel we are going to see it play “catch up” with the remainder of the market quickly (IBB is down 2% whereas the QQQ is up 20% YTD thus far).

The highest canine in that ETF is certainly one of my favourite Biotech shares, and that’s what I’m specializing in this week.

The corporate is Amgen (AMGN).

There’s a lot to love concerning the chart setup proper now. When a significant inventory like this drops from $280’s to $220’s in just a few months’ time, you higher concentrate.

I feel we have now seen the lows for AMGN for fairly some time, and the bulls will take cost once more.

I’ll stroll you thru all the pieces I’m seeing with the value charts throughout my stay session @ 11am EST immediately so be sure to be part of us then!

Please be aware: There are two totally different rooms the place I shall be streaming stay immediately:

Bullseye Reside can entry the Bullseye Reside room HERE.

Bullseye Reside can entry the Bullseye Reside room HERE.

Bullseye Limitless (or

Bullseye Limitless (or  “Rocket Trades”) members, you’ll wish to be part of me in The Taking pictures Gallery, the place not solely will you will have entry to speak through the stay Bullseye session, however you’ll have the ability to catch the FULL HOUR of my Monday stay buying and selling session… PLUS, you’ll have entry to my high 3 concepts every day PLUS any new trades I make through the week LIVE.

“Rocket Trades”) members, you’ll wish to be part of me in The Taking pictures Gallery, the place not solely will you will have entry to speak through the stay Bullseye session, however you’ll have the ability to catch the FULL HOUR of my Monday stay buying and selling session… PLUS, you’ll have entry to my high 3 concepts every day PLUS any new trades I make through the week LIVE.

By the best way, it doesn’t matter what service you will have, if you’re not getting my real-time alerts when I’m able to make trades –

Get the app in your cellphone!

Get the app in your cellphone!

I at all times ship out my commerce alerts through our cell app. It’s essential that you just obtain it and allow alerts so you possibly can keep up-to-date on what’s going on with my trades.

I’m anticipating AMGN to have a slight dip immediately or tomorrow, and I plan to be there to purchase it up. I’m placing my goal value on the choices just a bit decrease than the closing value on Friday final week.

If this commerce goes towards me, I’ll look to cease out if AMGN closes below $234, which is just under the mid-point of the Keltner channel.

If issues go my means, I’m trying on the 200-day transferring common as goal #1, which is round $248.

After that, I feel AMGN may see $255 earlier than the following earnings date, which is April 26.

My Commerce Particulars:

- AMGN Apr 21 2023 $245 Name close to $2.70

from NYSE Updates – My Blog https://ift.tt/KBFyIPt

via IFTTT

No comments:

Post a Comment