There’s an outdated Yiddish expression, “Man plans and God laughs,” that appears particularly apt for retirement.

You will have saved up for that stage of life and thought by means of what you’ll do together with your newfound free time. However odds are, you’ll wind up going through what a brand new retirement examine from the monetary companies agency Edward Jones and the Age Wave analysis and consulting agency calls “cannonballs” and “curveballs.”

The trick is determining the best way to take care of them after they happen and, when doable, dodging them earlier than they occur.

“Making these course corrections actually permits you to dwell an energetic, engaged, purposeful life,” mentioned Lena Haas, head of wealth administration recommendation and options at Edward Jones, on the “Associates Discuss Cash” podcast I co-host with Terry Savage and Pam Krueger.

Resilient selections for retirement

Haas was one of many creators of that Edward Jones/Age Wave analysis report, “Resilient Selections: Commerce-offs, Changes, and Course Corrections to Thrive in Retirement.”

In a webinar discussing the report’s findings, Age Wave chief government and founder Ken Dychtwald mentioned: “The challenges are actual, however the inhabitants is fairly intelligent in considering of what they’ll do to avert these crises.”

The report relies on surveys the 2 firms carried out with greater than 12,000 folks — lots of them retirees and pre-retirees — from January by means of March 2023.

“Most of us expertise these curveballs, that are comparatively minor derailers, and cannonballs, that are main setbacks, that occur through the course of retirement or resulting in retirement,” mentioned Haas. “Retirement will not be a static journey, it’s a really dynamic journey.”

How frequent are cannonball occasions in retirement?

In actual fact, her examine discovered, 75% of retirees have skilled a cannonball occasion — girls greater than males.

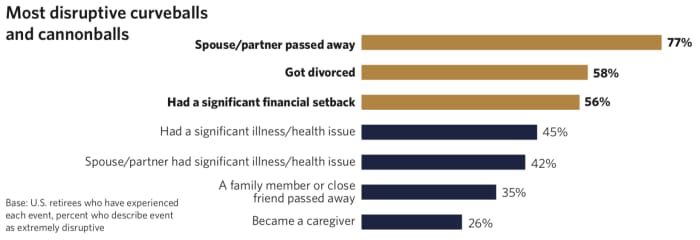

The most typical ones: demise of a member of the family or shut good friend, private well being points, dealing with a partner’s or companion’s well being points and important monetary setbacks.

Edward Jones, Age Wave

A couple of third of retirees surveyed mentioned they had been pressured to retire unexpectedly attributable to a job loss or a well being downside they or their partner or companion had.

In one other current examine, the Nationwide Council on Getting old discovered that 80% of individuals 60 and older lack the monetary assets to cowl long-term care companies or one other monetary shock. But one in seven older adults would require such take care of greater than 5 years.

Savage, a personal-finance columnist and writer, mentioned there’s one other phrase for these cannonballs and curveballs: Life.

Among the many finest methods to keep away from curveballs that may result in unhappiness in retirement, the Edward Jones/Age Wave report discovered, was to keep away from spending time in poisonous relationships.

“Spending time with these you take pleasure in will deliver you the enjoyment,” Haas mentioned.

Edward Jones, Age Wave

Retirement cannonballs with the largest impression

The retirement cannonballs with the largest impression, the Edward Jones and Age Wave researchers discovered: Widowhood and divorce.

“In our focus teams, you would simply hear the emotion about these,” mentioned Haas.

The Heart for Retirement Analysis at Boston School has concluded that divorce considerably will increase the chance of being in danger, financially, in retirement.

Krueger, CEO and founding father of the monetary adviser vetting agency Wealthramp, famous on “Associates Discuss Cash” that the pandemic was an enormous cannonball for pre-retirees and retirees.

“The purpose is: ‘How do I construct cannonballs like a depressed inventory market into my monetary planning, figuring out that these items can simply derail me? How am I going to react?’” she mentioned.

Individuals who reacted to the 2008-09 monetary disaster by pulling their cash out of the market, Krueger added, “missed the largest and strongest bull market within the historical past of the inventory market.”

Monetary course corrections that work

Haas mentioned among the best monetary course corrections retirees and pre-retirees have taken are lowering debt and decreasing bills.

“The phrase that got here up again and again was ‘frugality,’” Haas mentioned. “Prior to now, frugality had a adverse connotation, perhaps which means ‘low-cost.’ However we heard folks speaking about frugality, which means being deliberate and sensible.”

So, she suggested, look at your retirement funds and see how one can handle it successfully. Follow residing on a slimmed-down retirement funds earlier than you retire, Haas prompt.

Pre-retirees might be able to keep away from the cannonball of working out of cash in retirement by working longer and saving extra, if they’ll.

The Edward Jones/Age Wave examine cited a hypothetical pre-retiree couple, each 62, who every determined to work 5 extra years — the spouse switching to working 30 hours per week whereas persevering with to fund her 401(ok) and getting the corporate match; the husband turning into an impartial advisor. Each delayed claiming Social Safety to 67.

“The quantity of additional monetary safety for them was completely staggering,” mentioned Haas.

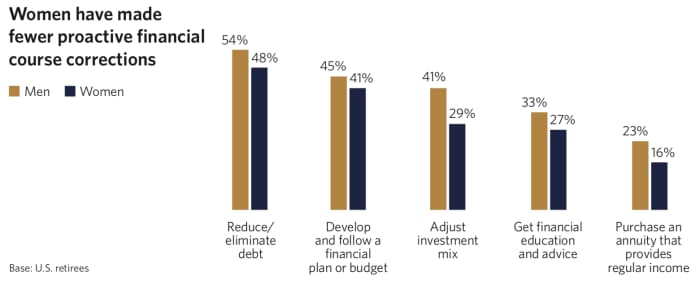

Retired girls have made fewer proactive monetary course corrections (like lowering debt, creating a monetary plan or adjusting an funding combine) than males, the Edward Jones/Age Wave survey discovered.

It’s possible you’ll need to rent, or work with, a monetary adviser to higher keep away from monetary cannonballs and curveballs in retirement or to recalibrate after they arrive, mentioned Savage.

Volunteering as a course correction

Volunteering in retirement, Haas mentioned, could be a nice course correction when you battle discovering which means and objective.

“Doing good is sweet for you,” she added. “Individuals who volunteer only a few hours per week report that they’re happier, extra resilient and more healthy.”

I’ve discovered that to be true in my unretirement. By volunteering weekends at Furnishings Help, in Springfield, N.J., I’ve grown happier. The bodily exertion from carting objects from the furnishings warehouse to folks’s vehicles and transporting items from folks’s vehicles to the warehouse has stored my coronary heart pumping, too.

One downside some retirees have, Dychtwald mentioned: Figuring out the best way to discover the precise volunteering match.

What millennials take into consideration their dad and mom’ retirement

The Edward Jones/Age Wave survey additionally had some eyebrow-raising findings when millennials had been requested concerning the retirements of their dad and mom.

Two-thirds of millennials surveyed had been involved their dad and mom or in-laws may not come up with the money for to dwell on in retirement. “That’s a reasonably staggering quantity,” mentioned Haas. And 61% of the millennials mentioned they fear their dad and mom will develop into financially depending on them.

When the grownup kids had been requested whether or not they’d desire their dad and mom have monetary safety or go away them extra inheritance, “83% mentioned, ‘By no means thoughts our inheritance. We simply need our dad and mom to have monetary safety and dwell properly,’” famous Haas.

The millennial youngsters had some recommendation for his or her dad and mom, and it was not not like what boomer and Era X dad and mom usually inform their kids: Save more cash for the longer term and keep bodily energetic. The kids additionally inspired dad and mom to attempt staying mentally sharp, check out new hobbies and actions and spend extra time with pals.

The windfalls of retirement

Not all the things that occurs in a retirement is a cannonball or a curveball, although, the Edward Jones/Age Wave researchers discovered. Removed from it.

“We noticed that over 80% of retirees additionally skilled comfortable, surprising windfalls,” mentioned Haas. These windfalls weren’t simply monetary; some had been psychic, too.

One was spending extra time with your loved ones.

“It unlocks a lot by way of emotional well-being and bodily well-being,” mentioned Haas. “One of many biggest windfalls retirees indicated to us is having grandchildren.”

Because it seems, that’s the windfall coming my method this September and I can’t wait.

from Stock Market News – My Blog https://ift.tt/0sAC1QP

via IFTTT

No comments:

Post a Comment